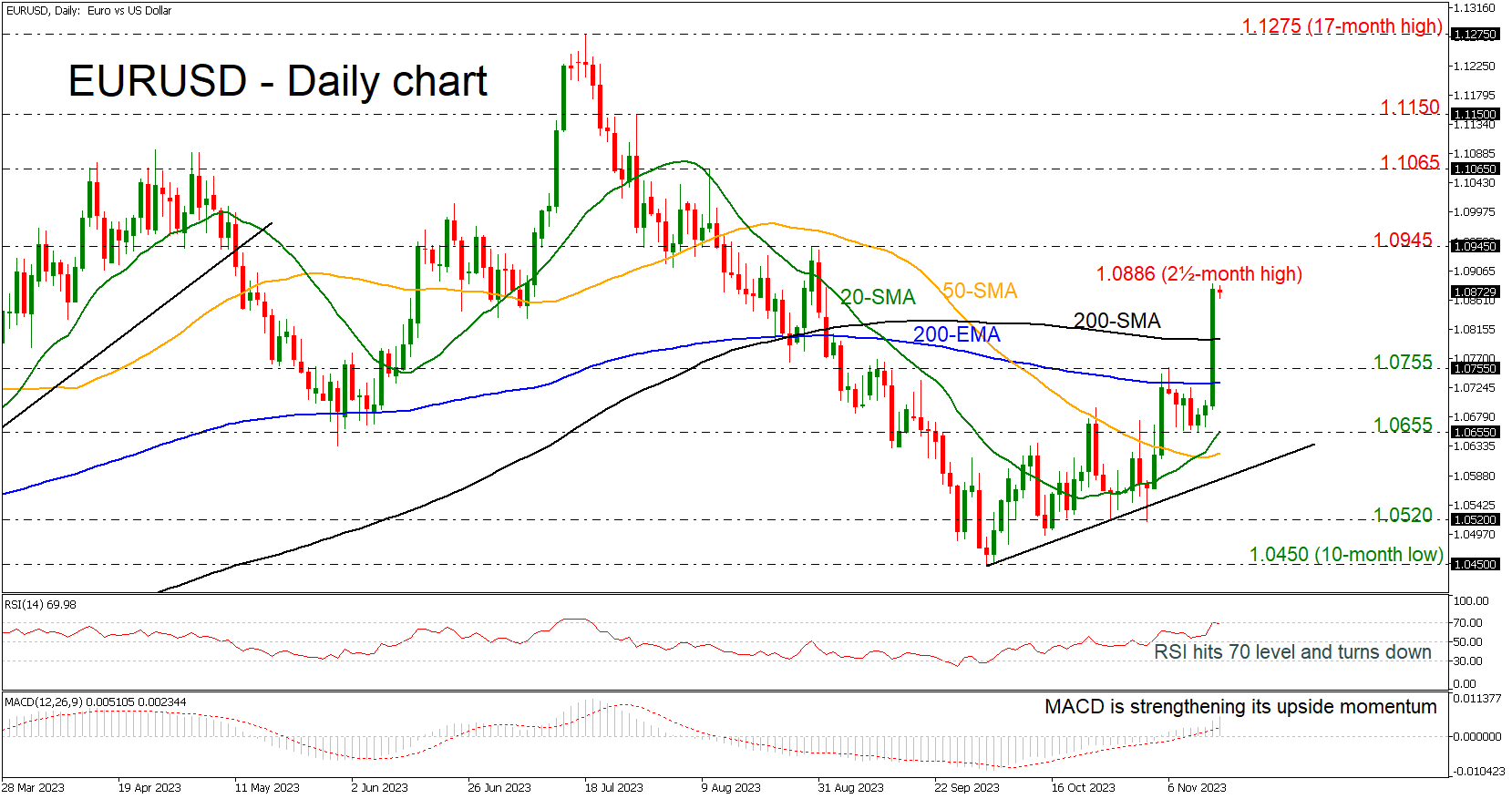

The EURUSD pair experienced a significant surge, adding nearly 200 pips and reaching a new two-and-a-half-month high of 1.0886, following the release of the US CPI data. However, this sharp rally appears to be losing steam as the pair approaches the key 1.0900 level. The Relative Strength Index (RSI), after touching the overbought zone, is showing signs of a potential negative correction, indicating that the pair's upward momentum might be waning. In contrast, the MACD oscillator continues to signal a strengthening bullish movement, suggesting that the upward trend may still have some resilience.

Notably, EURUSD has convincingly broken above significant moving average lines, including the 200-day exponential moving average (EMA) and the 200-day simple moving average (SMA), which previously acted as strong resistance levels. Additionally, the bullish crossover of the 20- and 50-day SMAs further bolsters the bullish case.

Potential Resistance and Support Levels

Should the pair resume its uptrend and surpass Tuesday's high of 1.0886, the next resistance level to watch is at 1.0945. A breach of this level could open the path to the 1.1065 mark, a notable resistance zone from August. This level represents a significant barrier that bulls would need to overcome to sustain the uptrend.

Conversely, on the downside, the 200-day SMA at 1.0800 emerges as the first crucial support level. Further down, the support at 1.0755 and the 200-day EMA at 1.0733 are key areas to monitor. A break below these levels could lead to increased selling pressure, with the next significant support lying around the 1.0655 mark, coinciding with the 20-day SMA, which could trigger heightened volatility.

Outlook and Market Watch

In summary, EURUSD is currently maintaining its upward trajectory above key moving average lines and the short-term uptrend line. To attract additional buyers and sustain its upward momentum, the pair needs to decisively break through the 1.0900 psychological barrier. However, the mixed signals from technical indicators, particularly the RSI's suggestion of a potential negative correction, imply that traders should be prepared for possible volatility and shifts in market sentiment. As the pair navigates these critical levels, close monitoring of technical indicators and market dynamics will be essential for traders looking to capitalize on the EURUSD's next move.