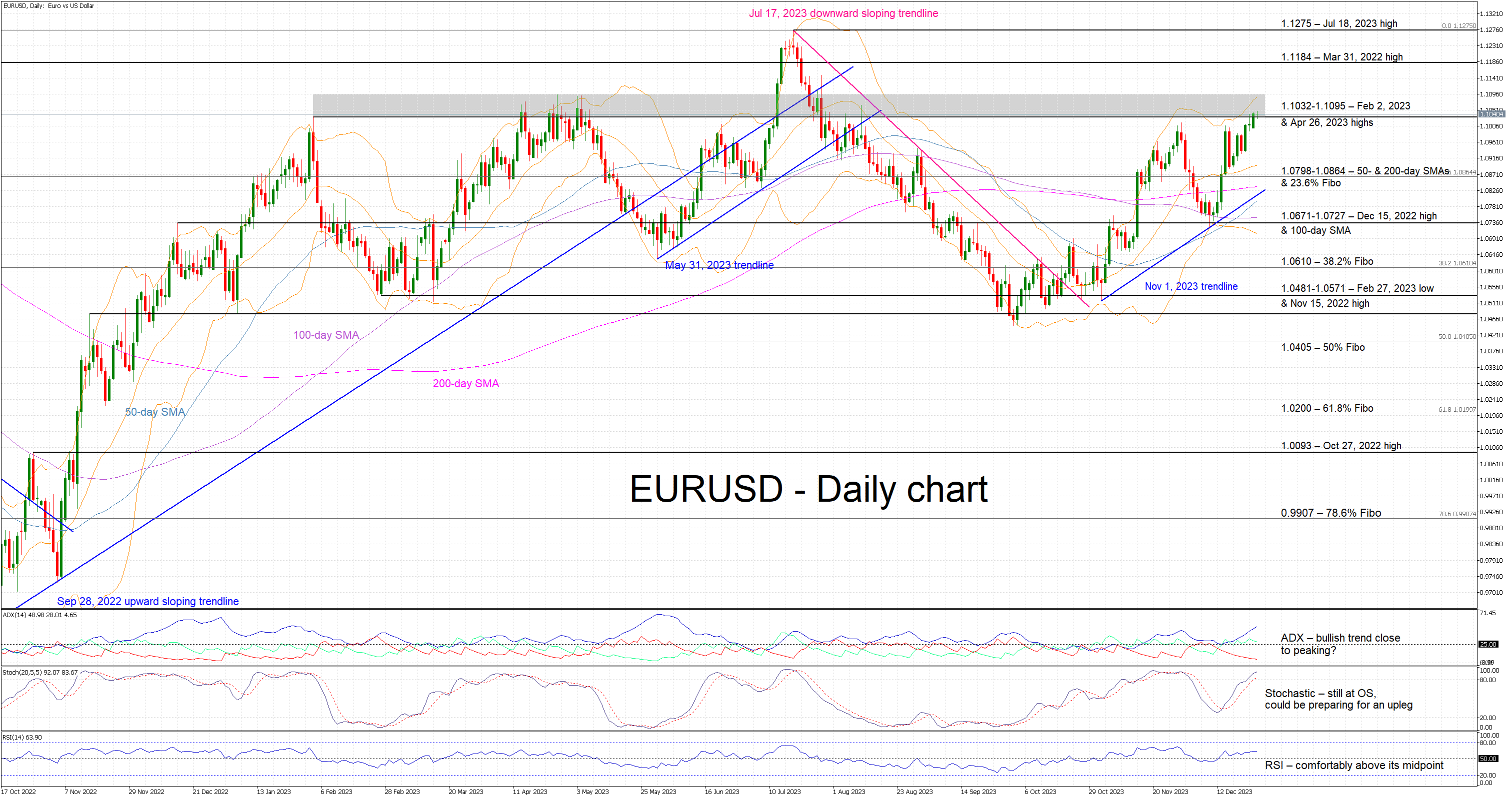

The EURUSD pair has seen a notable upward movement, extending its bullish trend and testing a significant resistance area north of 1.1032. This resistance zone has been a formidable barrier for the bulls since February 2023, with several unsuccessful breakout attempts. The currency pair's recent surge to a higher high above 1.1016 reinforces the bullish momentum that has been in play since the lows of November 2023.

Bullish Indicators and Potential Upside Targets

The bullish trend in EURUSD is further supported by key momentum indicators. The Relative Strength Index (RSI) is comfortably above the 50-threshold, suggesting sustained buying interest. Additionally, the Average Directional Movement Index (ADX) is showing an aggressive upward trend, indicating a strong market direction. The stochastic oscillator, currently in overbought territory, mirrors the EURUSD’s recent gains, signaling the potential for continued upward movement.

Should the bulls maintain their vigor, surpassing the challenging 1.1032-1.1095 area could be on the cards. A successful breach of this zone might pave the way for the pair to target previous highs at 1.1184 (March 31, 2022) and 1.1275 (July 18, 2023).

Bearish Counter and Support Levels

Conversely, bears are likely to put up a strong defense in the 1.1032-1.1095 range. A successful bearish push could see the pair retreat towards the 1.0798-1.086 zone. This area is critical as it encompasses the 50- & 200-day Simple Moving Averages (SMAs) and the 23.6% Fibonacci retracement of the uptrend from September 28, 2022, to July 18, 2023.

A further decline could see the EURUSD testing the 1.0671-1.0727 region, marked by the December 15, 2022 high and the 100-day SMA. This support zone may present a more formidable challenge for bears than currently anticipated.

Market Outlook and Key Observations

Currently, the EURUSD bulls appear to have a firm grip on the market. However, the approaching resistance zone warrants caution, as it has historically led to significant price corrections. Traders should closely monitor the pair's behavior around this key area to gauge the potential for either a continued bullish breakout or a bearish reversal.

In summary, the EURUSD pair’s current trajectory is a testament to the dynamic nature of forex markets. While the bulls seem to be in command, the looming resistance area poses a significant test. The outcome of this battle between bullish aspirations and bearish defenses will likely set the tone for the EURUSD's direction in the near term.