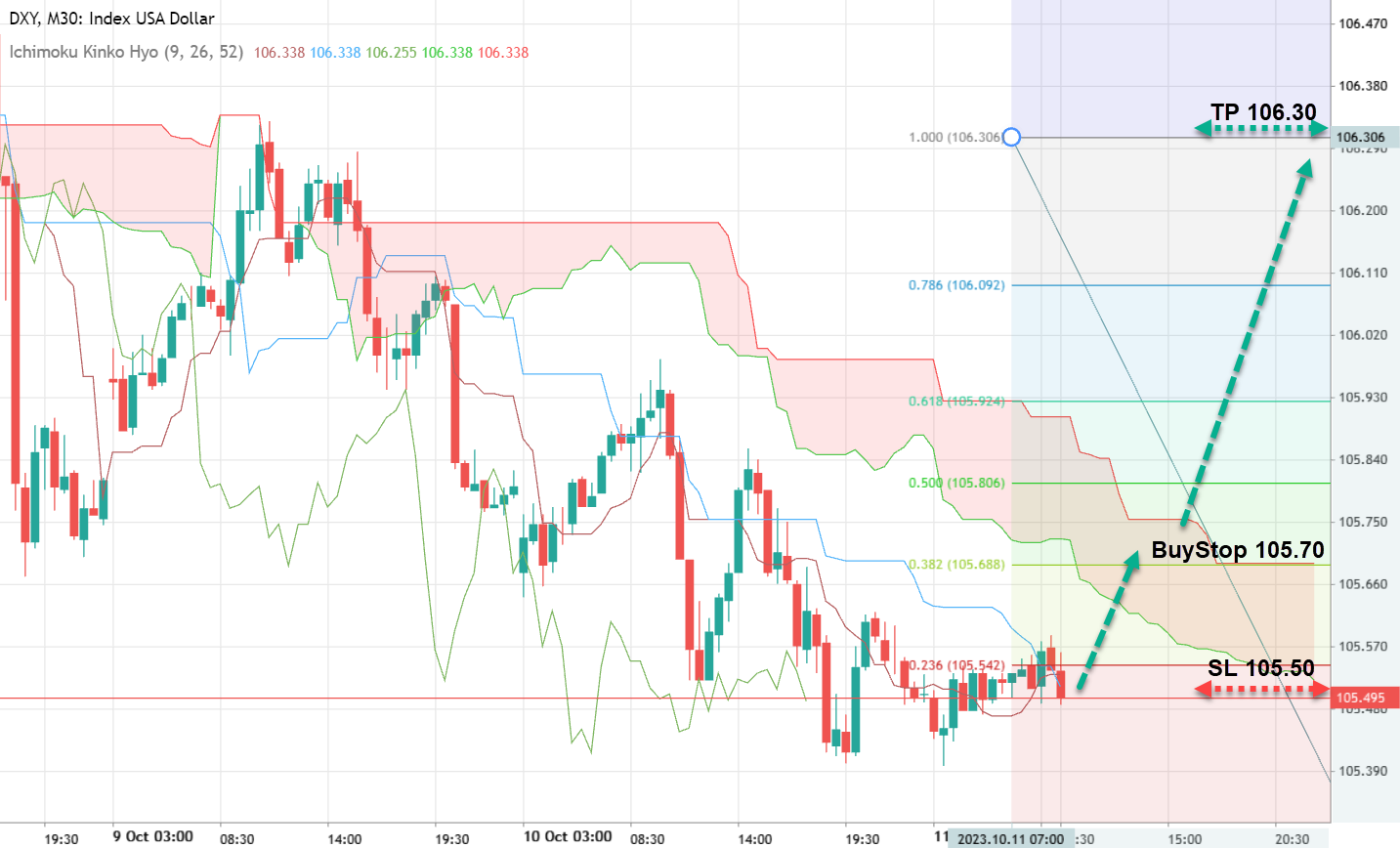

Situated around the 105.50 mark, the Dollar Index (DXY) exhibits signs of consolidation. The International Monetary Fund (IMF) has recently bolstered its growth projections for the U.S. economy. From an earlier anticipated growth rate of 1.8%, the revised estimate now stands at an optimistic 2.1%. This upbeat reassessment finds its roots in the robust consumption patterns within the U.S. domain, buoyed by a labor market that has remained resilient. On the horizon is the imminent release of U.S. industrial inflation data. If predictions hold, we might witness an annual core increase of around 2.3%. Such a figure could fortify the Federal Reserve's case for interest rate hikes, a move that would invariably prop up the dollar.

Trade Insight: BUY STOP at 105.70 with a Target Price (TP) of 106.30 and a Stop Loss (SL) of 105.50

NZD/USD - The Kiwi's Contemplation

Positioned close to the 0.6000 threshold, the NZD/USD pair seems to be in a reflective mode. As market players await the minutes from the recent Federal Reserve meeting, there's palpable anticipation regarding insights on potential rate hikes in the upcoming months. Such developments could augment the dollar's bullish undertones. Shifting focus to New Zealand, pertinent economic indicators are set for release this Friday. These encompass data pertaining to September's business activity and retail sales. Early indicators seem to signal a potential disappointment for currency buyers, casting a shadow over the Kiwi and reinforcing its susceptibility to downward pressure.

Trade Recommendation: SELL STOP at 0.6000 with a Target Price (TP) of 0.5920 and a Stop Loss (SL) of 0.6030.

BRENT - Navigating the Oil Labyrinth:

Currently anchored close to the $88 mark, Brent Crude maintains its poise. The evolving geopolitical scenario in the Middle East remains central to market deliberations. Should Iran become a more active player in the region's intricacies, the repercussions on the oil market could be profound. Such a move might trigger a bullish surge in oil prices, stemming from significant potential disruptions in supply chains. Bolstering this sentiment are the anticipations surrounding U.S. oil reserve data. With the American Petroleum Institute's report slated for release, prevailing estimates hint at dwindling oil reserves - a testament to rising demand. If these projections materialize, the $90 barrier for Brent could soon be in the rearview mirror.

Trade Proposition: BUY STOP at 88.50 with a Target Price (TP) of 91.00 and a Stop Loss (SL) of 87.80.

In Conclusion

Statistical releases and forecasts play a pivotal role in shaping currency dynamics, as evidenced by the intricate interplay of factors influencing the Dollar Index, NZD/USD, and Brent. Traders and investors alike would do well to monitor these evolving narratives closely, leveraging them to craft informed and strategic trading decisions.