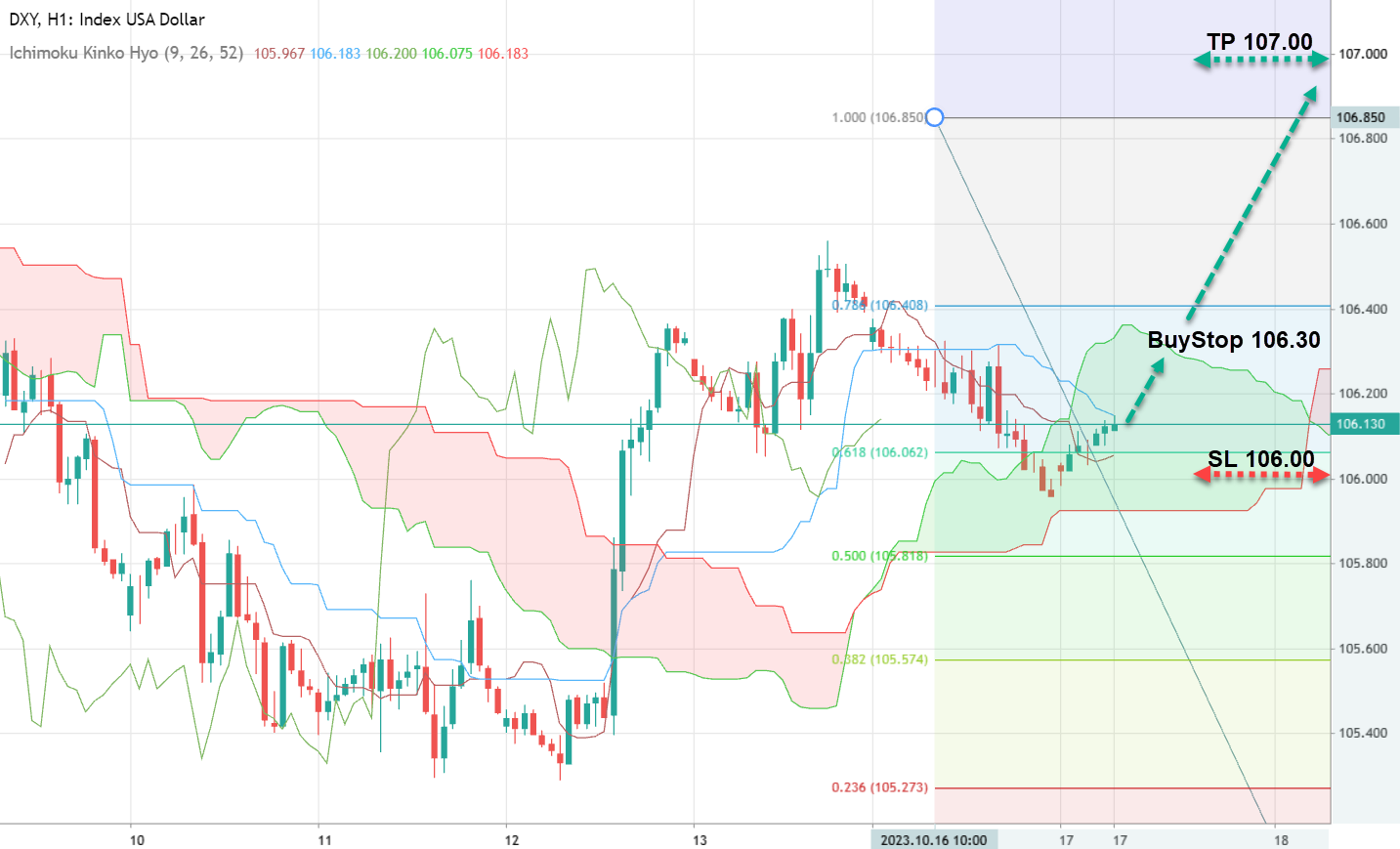

The dollar index, known as DXY, is currently stationed at a value of 106.00. As global markets oscillate, a significant focus is directed towards the remarks of key figures within the US Federal Reserve. In particular, the President of the Federal Reserve Bank (FRB) of Philadelphia, Mr. Patrick Harker, dropped hints suggesting that the Federal Reserve might hit the pause button on its monetary tightening endeavors. This assertion comes even in the backdrop of a flourishing job market and inflationary pressures.

Harker emphasizes the significance of steady interest rates in manipulating inflationary trends. Interestingly, data from the consumer price index for September doesn't seem to flash any immediate red flags concerning inflation acceleration. Echoing Harker's sentiment, the Federal Reserve Bank of Chicago's head, Austan Goolsbee, is of the view that the country's inflation deceleration isn't a mere blip but more of a sustained pattern. Nonetheless, a large faction within the Federal Reserve remains bullish about the prospect of further interest rate hikes, which could play a pivotal role in buoying the dollar.

Trade Suggestion: BUY STOP at 106.30; Target Price (TP) at 107.00; Stop Loss (SL) at 106.00.

USD/JPY Analysis

Positioned around the 149.50 mark, the USD/JPY pair seems to be holding its ground. A slew of national statistics emanating from Japan has exerted downward pressure on the yen. Notably, there's a slump in the industrial production figures in Japan, registering a 0.7% dip last month. In response to these dynamics, Japanese Deputy Finance Minister Kanda relayed assurances that necessary countermeasures would be initiated if undue pressures mount on the national currency. Kanda further illuminated that while interest rates are pivotal, they aren't the sole determinants shaping exchange rates. Given the inherent strength of the US dollar, it is plausible that before any southward journey, the pair might lock horns with the 150.00 resistance level.

Trade Suggestion: BUY STOP at 149.70; Target Price (TP) at 150.50; Stop Loss (SL) at 149.40.

USD/CAD Insights

Currently oscillating near the 1.3620 zone, the USD/CAD currency pair displays an intricate dance. The Canadian dollar finds its anchor in escalating oil prices, a primary export commodity for Canada. Additionally, Canadian real estate metrics provide further tailwinds with construction permits in August experiencing a 3.4% surge. Imminent inflation data release from Canada is on traders' radars. If projections hold true, the Canadian consumer price index on an annual scale could persist above the 4% threshold, thereby amplifying the odds of a more stringent Canadian monetary policy. A realization of this forecast could catalyze a southward movement for the pair.

Trade Suggestion: SELL STOP at 1.3600; Target Price (TP) at 1.3500; Stop Loss (SL) at 1.3630.