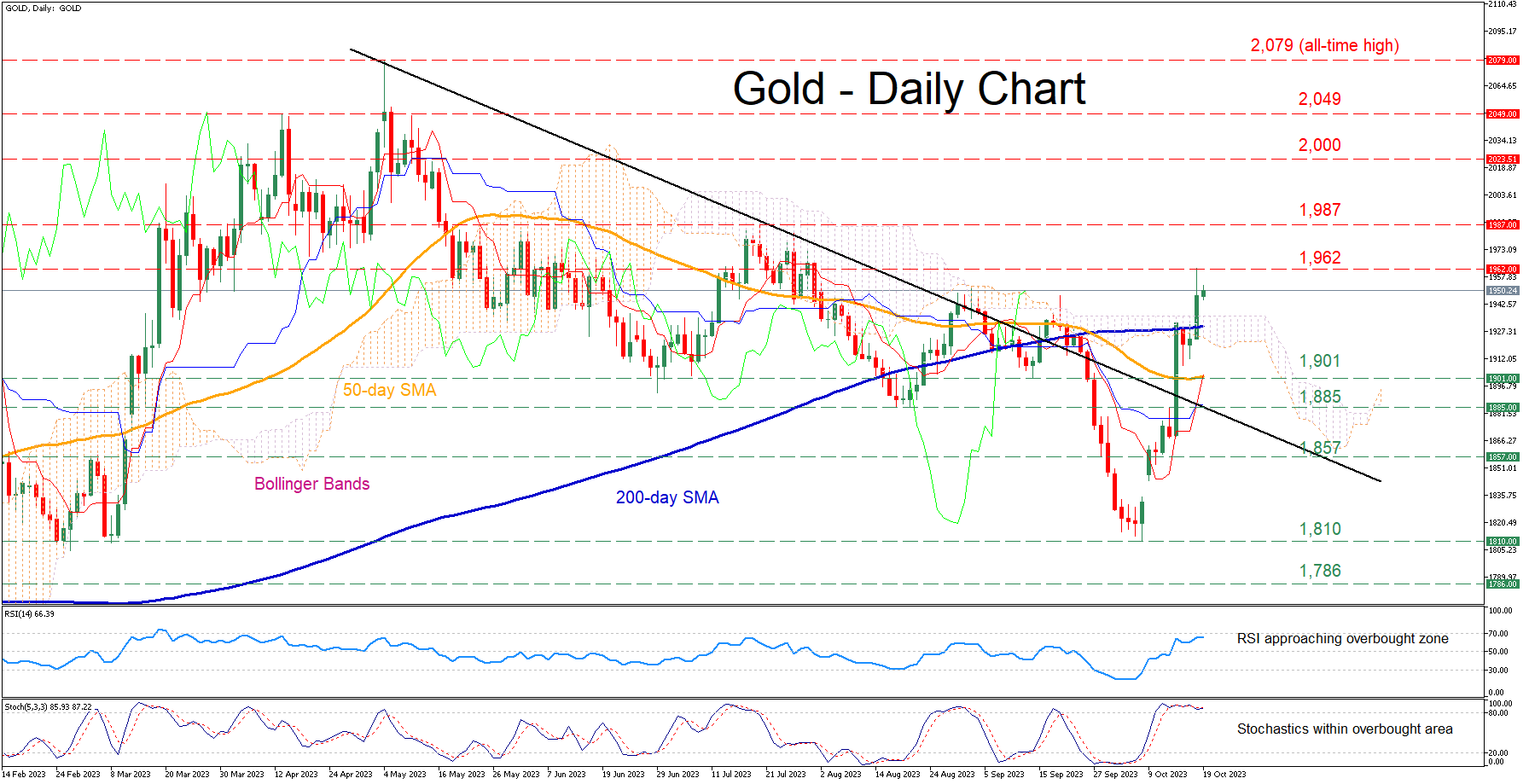

Gold, historically seen as a haven in tumultuous times, has carved an impressive rally from its October nadir. Propelled not only by inherent market dynamics but also by escalating geopolitical concerns, gold has shattered pivotal technical thresholds. It's now comfortably perched above the renowned 200-day simple moving average (SMA) and the intricate layers of the Ichimoku cloud.

Gold's Trajectory Soars Amid Global Uncertainties

While the technical architecture suggests that gold's recent rally might be moving into the overextended territory, the metal's trajectory remains undeniably robust. External pressures stemming from geopolitical hotspots might further augment this bullish momentum, hinting that the best for gold might still be yet to come.

Exploring Potential Price Movements

Gold enthusiasts are closely watching the recent two-month zenith at 1,962. If the bullish sentiment persists and this formidable resistance is vanquished, the spotlight will inevitably shift to the July pinnacle of 1,987. And if the stars align for gold, the illustrious 2,000 mark – a psychological milestone – might soon be on every trader's radar.

In a scenario where profit-booking or bearish sentiments prevail, gold might be nudged towards the September fortress of 1,901, which interestingly coincides with the 50-day SMA. If this support crumbles under pressure, the subsequent floor might be the August trough of 1,885. Moreover, if gold retraces its steps further, the September 2022 resistance of 1,857, which in the peculiar world of trading could morph into support, might come into play.

Gold's current narrative is undeniably tinted with optimism, as it brushes against overbought thresholds. The intertwined dynamics of technicals, fundamentals, and geopolitics suggest a gripping chapter ahead. While the metal enjoys its upward spree, market aficionados are left pondering: Will the bears mount a resurgence or will the gold rally continue unabated? Only time will unveil this precious story.