In a remarkable show of resilience and investor optimism, Bitcoin (BTC) soared past its preceding year's peak of $35,500, escalating to a freshly minted high of $36,000. This surge in value transpired in the wake of the Federal Reserve's strategic decision to halt interest rate hikes, marking a departure from its previous monetary tightening course. The culmination of a 16-month trajectory, this milestone underscores the cryptocurrency's defiance of the previous ceiling, signaling a potent upward momentum within the digital asset domain.

A Convergence of Favorable Market Catalysts

A comprehensive market research analysis reveals that Bitcoin's robust performance is underpinned by a confluence of market-enhancing developments. The infusion of buoyancy within the sector is attributed to the debut of a new spot Bitcoin Exchange-Traded Fund (ETF), the Invesco & Galaxy Spot BTC ETF, joining the DTCC's catalog of financial products. This follows the lead of BlackRock and Ark's similar ETF offerings, fostering a growing sentiment that regulatory approvals for multiple spot BTC ETFs may be imminent.

In a concurrent strategic maneuver, business intelligence behemoth MicroStrategy disclosed the acquisition of an additional 155 BTC, at a value of $5.3 million, in October. This acquisition bolsters its already substantial Bitcoin treasury to 158,400 BTC, underscoring the firm's unwavering confidence in the cryptocurrency's enduring value proposition.

Cryptocurrency Investment Trends: A Resurgence of Inflows

A telling indicator of the burgeoning interest in cryptocurrency investments is the substantial inflow of capital into crypto funds, which experienced a notable rebound. Digital asset investment vehicles attracted an impressive $326 million, representing the largest influx of funds within a single week since July 2022. A staggering 90% of these inflows were channeled into Bitcoin, propelled by the heightened anticipation of a spot ETF endorsement. In the realm of altcoins, Solana (SOL) distinguished itself with the most significant inflow of capital, amassing $24 million.

The altcoin sector, energized by the relentless uptrend in a multitude of coins, sparked a Fear of Missing Out (FOMO) among retail traders. This psychological momentum was mirrored by an incremental rise in funding rates midweek. Yet, the ensuing pullback illustrated the market's inability to sustain such rapid price appreciations, as numerous coins retreated from their yearly zeniths.

Market Leverage: A Balanced Perspective

Interestingly, the retracement was not exacerbated by exorbitant liquidations, as might be expected during such volatile episodes. With liquidations remaining modest, approximately $100 million in both directions, it suggests that market leverage has remained comparatively restrained, implying that the mid-week retraction was more a symptom of a market momentarily overheating than any underlying systemic issue.

Amid the heights of market optimism, the cryptocurrency exchange FTX was observed transferring a tranche of digital assets, valued around $200 million, for liquidation purposes.

Although the quantum of assets sold was not significantly large enough to alter market dynamics profoundly, it nonetheless sent ripples through the trading community, prompting a section of traders to initiate sell-offs or open short positions, thereby inducing a market correction.

Sustaining the Uptrend: A Closer Look at BTC's Market Mechanics

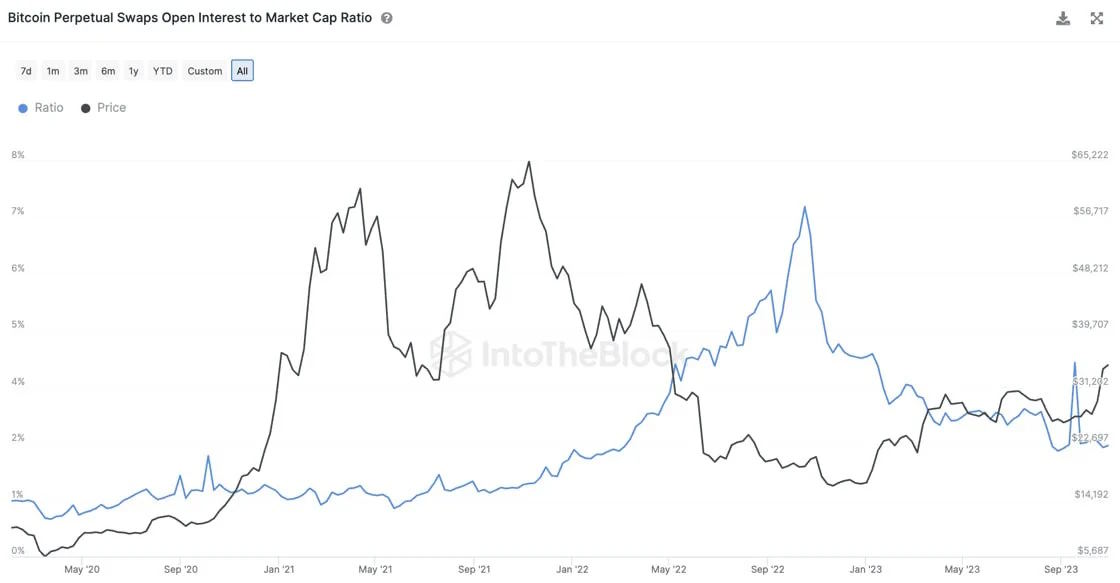

To discern whether the current upswing in Bitcoin's value is attributable to leveraged speculation or genuine spot market activity, analysts often examine the ratio of Bitcoin's open interest to its market cap (OI/MC). Remarkably, even as Bitcoin's price swelled by over 10% in the preceding week, this ratio has remained anchored near yearly low levels. This detachment of OI growth from market cap amplification suggests that the rally is predominantly spot-driven, inferring a more durable potential for growth.

As Bitcoin momentarily stabilizes, the altcoin sector is basking in the limelight, with rotational trading dynamics offering abundant opportunities.

With profits from Bitcoin's ascent being reallocated into large-cap altcoins, there is a palpable sense of vibrancy and speculative energy. Among the standout performers are RUNE, SOL, and NEAR, while DeFi stalwarts like UNI, SUSHI, and CAKE have resurfaced, signaling a return to form after a prolonged period of underperformance.

The Emergence of Ethereum: Poised for a Rally?

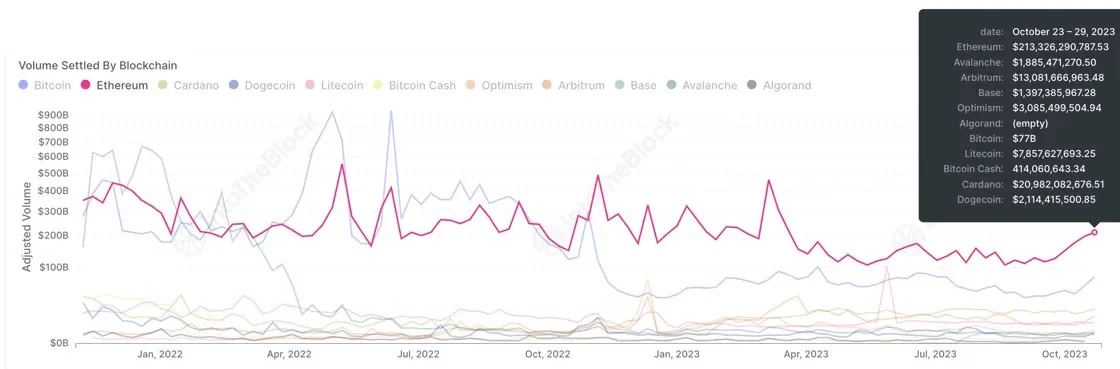

Ethereum (ETH), often regarded as the sovereign of altcoins, has been somewhat overshadowed in this rally, lagging behind its counterparts in percentage gains. Nevertheless, there is a burgeoning sense that Ethereum is on the cusp of a rebound. The on-chain metrics are indicating robust activity, with the Ethereum network settling over $213 billion in transactions, complemented by an additional $10 billion from the Layer-2 ecosystem. With the increasing integration of staking solutions and the Merge approaching, investors are closely monitoring for signals that could herald Ethereum's resurgence.

The Road Ahead: A Balanced Narrative

The juxtaposition of Bitcoin's steady price action and the altcoin market's volatility paints a nuanced picture of the current cryptocurrency landscape. While the path ahead is fraught with potential regulatory hurdles and macroeconomic uncertainties, the present state of affairs offers a testament to the inherent dynamism and maturation of the digital asset ecosystem. Whether this phase culminates in sustained growth or retracement, it remains a subject of keen speculation among market participants.

As the digital currency space continues to evolve, stakeholders and investors alike are advised to maintain a balanced perspective, cognizant of both the opportunities and risks inherent in this burgeoning asset class.