The financial markets this week have been abuzz with speculation and analysis following a notable shift in the Federal Reserve's stance. Market participants are keenly assessing the implications of Fed Chair Jerome Powell's recent dovish remarks, particularly in relation to interest rate trajectories and their impact on key assets like gold and the Nasdaq.

Jerome Powell's latest press conference marked a discernible change in tone, leaning more towards dovishness. This shift was reflected in the movement of 30-year treasury bond yields, which retreated from their highs to settle below 5%. This change in narrative is critical, as it suggests a possible easing in the Fed's aggressive interest rate hike policy. The market is now pricing in a lower likelihood of further rate hikes in 2024, with most traders anticipating a modest rate decrease by September next year, according to the Fed’s watch tool.

The equity markets, particularly the Nasdaq and S&P 500, experienced a mixed reaction to these developments. Initial rallies were interrupted by further hawkish comments from Powell, leading to a correction during Thursday's session. This volatile response highlights the market's sensitivity to Fed communications and suggests that the upward trajectory for stocks may face challenges in the short term, given the current excessive optimism.

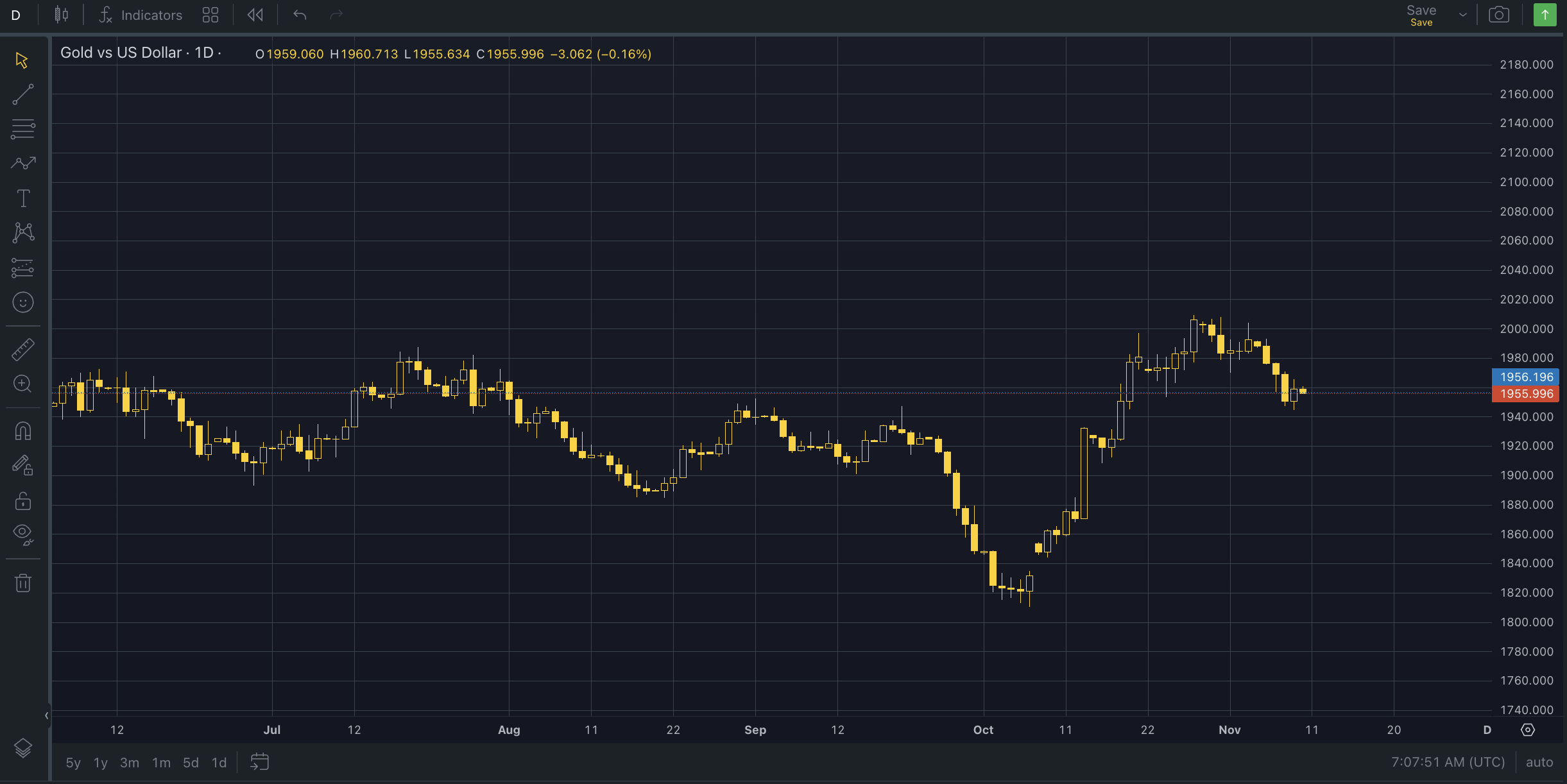

Gold's Position: A Potential Rebound

Gold, in contrast, presents an intriguing case. Currently deemed oversold, especially considering its previous strong uptrend, gold has found technical support in the 1940-1950 range. This positioning might set the stage for a rebound, with the precious metal drawing support from the weakening yields of US bonds and the Fed's softened stance. Gold's price dynamics, including a retest of the previous low from October 24, indicate that the bullish trend may resume, particularly if market conditions continue to favor risk-off assets.

The upcoming Consumer Price Index (CPI) publication on November 14, along with the core inflation rate, is eagerly awaited by the markets. The core inflation rate is expected to remain around 4.1%, but there's potential for a slight dip, influenced by the weaker non-farm payroll (NFP) numbers earlier in the month. These data points will be crucial in shaping market expectations and the Fed's policy outlook.

Nasdaq's Technical Outlook

Turning to the Nasdaq, as the earnings season wraps up, its growth potential appears to be tapering off. The index recently encountered a significant resistance level at 15200 and is now showing technical weaknesses above this threshold. These weaknesses are further compounded by the Fed's recent hawkish statements, suggesting that a pullback for the Nasdaq to below 15000 is a distinct possibility.

Conclusion: Market Dynamics in a State of Flux

In summary, the Federal Reserve's shift to a more dovish narrative has set the stage for a complex interplay of market forces. While equity markets, particularly the Nasdaq and S&P 500, navigate through a period of uncertainty and potential corrections, gold emerges as a potential beneficiary of this shift. Investors and traders alike are closely monitoring upcoming economic data releases, which will further inform market direction in this evolving landscape. The key takeaway is that market dynamics are in a state of flux, with the Fed's policy direction serving as a critical pivot point for both risk and safe-haven assets.