The financial markets have recently experienced a divergence in performance, with stocks soaring to all-time highs on the back of a dovish Federal Reserve (Fed) stance, while cryptocurrencies endured a significant retreat. This report explores the key events that contributed to these contrasting trends and offers insights into what lies ahead for both asset classes.

Cryptocurrency prices witnessed one of the most substantial dips of the year, triggered by a sudden drop in Bitcoin's (BTC) price. This decline occurred alongside a slightly hotter-than-expected Consumer Price Index (CPI) release, which raised concerns among short-term crypto investors. The combination of year-end considerations and the looming Fed meeting further fueled uncertainty in the market.

During the week, borrowing activity among altcoins surged as airdrop enthusiasts on popular DeFi protocols aggressively borrowed funds to short the market. Their goal was to generate trading volume and accumulate points for future airdrop rewards. This wave of borrowing triggered a broad correction in the altcoin market, particularly for assets like AVAX and SOL, which had experienced substantial overvaluation.

Market Reset Ahead of Fed Meeting

The market-wide correction played a crucial role in resetting open interest and funding rates to neutral levels, just in time for the Fed meeting. As expected, the Fed decided to maintain interest rates, but what really bolstered risky assets was Fed Chief Jerome Powell's announcement. Powell indicated that with inflation falling faster than anticipated, the Fed had room for additional rate cuts in the coming year. Most officials are now anticipating three rate cuts in 2024, as they aim for inflation to approach a 2% target. FED Governor Christopher Waller even suggested that rate cuts could commence in the spring if inflation performs well, encouraging investors to accumulate long positions.

Following the Fed meeting, cryptocurrencies experienced a robust rebound, with BTC briefly touching $43,000. Altcoins also joined the rally, many of which completely recovered their losses from earlier in the week. AVAX and INJ emerged as top performers, surpassing their previous price highs. However, the inability of BTC and most altcoins to establish new highs signaled potential exhaustion in the two-month-long rally.

Long-Term Whale Accumulation vs. Short-Term Profit-Taking

While leveraged long positions were liquidated, and short-term traders booked profits, long-term whale investors continued to accumulate BTC. These whales displayed confidence in the long-term price trajectory of BTC, with approximately 150,000 BTC acquired over the week, marking one of the most substantial weekly accumulations in BTC's history.

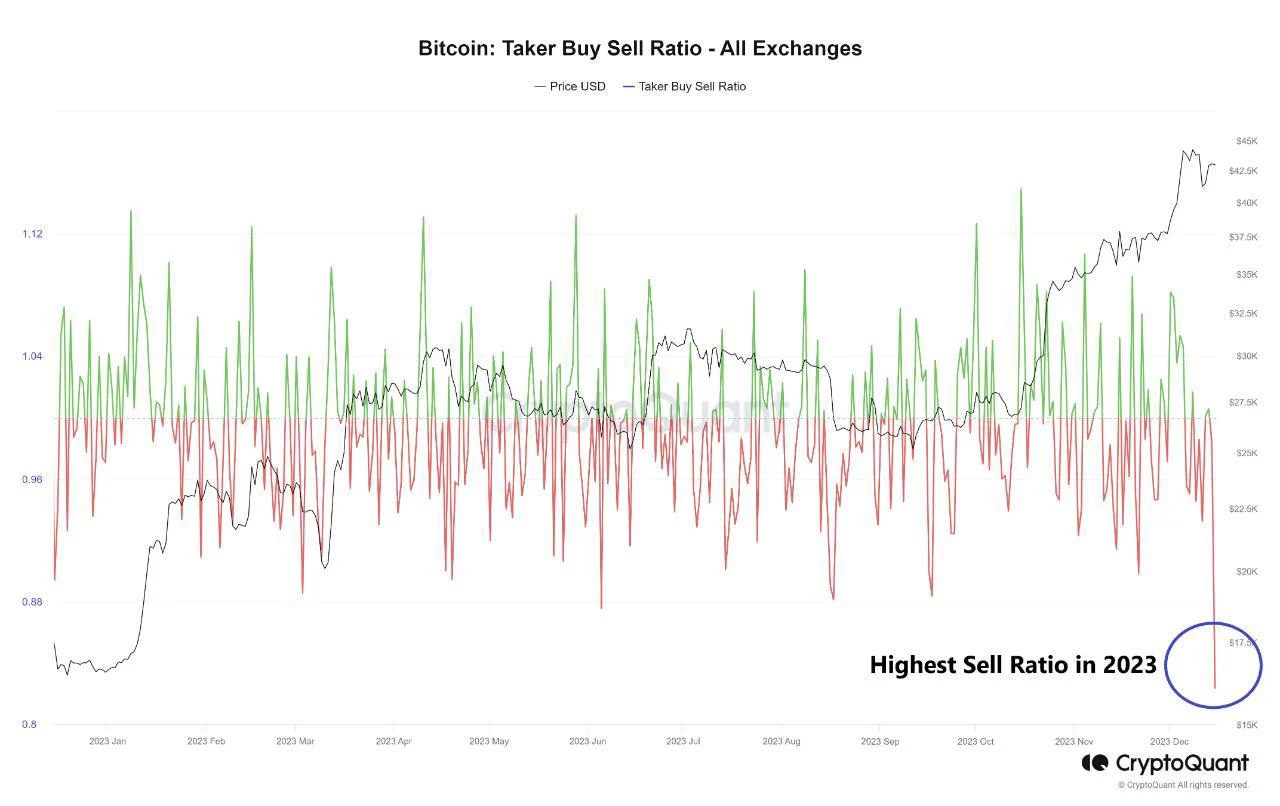

As the year-end holiday season approached, increased selling pressure emerged as traders naturally took profits and reduced their trading activities. Notably, a high sell ratio was observed following the Fed meeting spike, limiting BTC's price from breaking the $45,000 mark. Concerns arose about the CME gap at around $38,900, with some investors anticipating that this gap needed to be closed for the ongoing uptrend to continue. The fear of this gap closure potentially contributed to BTC's inability to rally further, even as stocks surged to record highs.

Altcoins and Year-End Profit-Taking

Altcoins faced profit-taking as well, with retracements of 10-50% observed in coins that had experienced substantial gains over the past two months. This profit-taking is expected to persist into the final weeks of the year, with occasional pockets of pump-and-dump activity driven by declining trading volumes. Traders employing leverage should exercise caution due to the heightened price volatility expected in this environment.

Asia has seen increased crypto trading activity over the past couple of years, driven by greater regulatory clarity and high inflation in the region. The early Asian trading session recorded significant price growth in 4Q23, primarily driven by purchases. While the US trading session consistently showed strong demand over the past year, this trend may continue as prospects for BTC spot ETFs improve.

In contrast to the crypto market's volatility, US stocks continued to rally, reaching new all-time highs. Slightly higher-than-expected CPI numbers did not deter the stock market, as traders anticipated a dovish Fed. Their expectations were met, as the Fed maintained interest rates and signaled a minimum of three rate cuts in the coming year due to rapidly falling inflation. The Dow Jones Industrial Average breached 37,000 for the first time, reflecting strong investor sentiment.

Impact on Yields and the Dollar

Following the Fed's dovish stance, US yields declined, with the 10-year Treasury falling below 4%, leading to a significant dollar sell-off. The Bank of England and the European Central Bank also kept rates unchanged, contributing to a further decline in the dollar, which lost over 2% by the week's end.

Gold experienced a 0.73% gain due to the weaker dollar, while Silver edged up by approximately 0.5%. Oil prices also rebounded, marking the first week of gains after seven consecutive weeks of losses, thanks to an upward revision in demand outlook by the Energy Information Administration (EIA).

Looking ahead, the US economic calendar is relatively quiet, with the final 4Q GDP figure being the primary release. Central bank meetings, including the Bank of Japan's last meeting of the year, will shape the market landscape as traders wind down for the holiday season. Many anticipate that traders have already booked profits for the year and are unlikely to increase risk until after the new year.

In conclusion, the markets are set for an eventful year-end period, with cryptocurrencies facing volatility and profit-taking while US stocks reach record highs amid a dovish Fed. Traders must navigate these trends carefully and remain vigilant as they approach the new year.