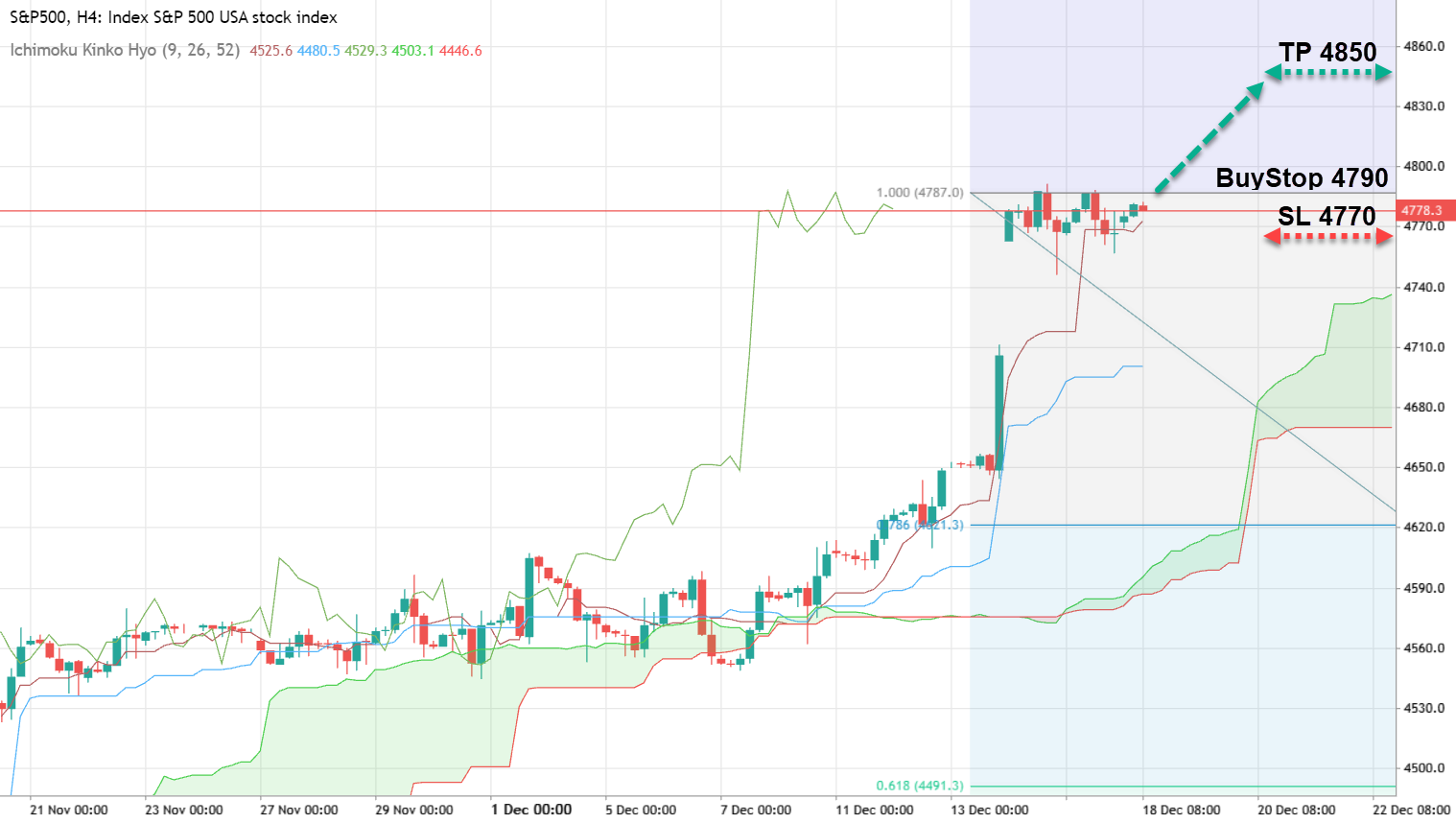

The American stock market remains perched near historical highs, with the S&P 500 index currently trading at 4780. Several factors are contributing to this sustained growth, instilling confidence in investors. These factors include expectations of a more accommodative US monetary policy, declining US bond yields, and a deceleration in inflation. This combination of factors is increasing the likelihood of a swift rebound in consumer activity, which holds great significance for the US corporate sector.

Investors are increasingly convinced that the Federal Reserve (Fed) may initiate interest rate cuts as early as March next year. This prospect has bolstered the overall bullish sentiment in the stock market, with expectations that the rally will persist.

Trade Recommendation:

- Buy Stop: 4790

- Take Profit: 4850

- Stop Loss: 4770

USD/JPY

The USD/JPY pair is presently consolidating around the 142.20 level. However, the pair is facing downward pressure due to the weakening US dollar, a consequence of the Federal Reserve (Fed) meeting outcomes. The Fed decided to maintain interest rates at their current levels and hinted at the possibility of implementing monetary policy easing early in the upcoming year. The Fed officials' median rate forecast for the end of 2024 suggests a potential rate cut of 75 basis points, which has contributed to the dollar's decline.

On the other hand, the yen is finding support from positive Japanese economic data. Japan's services sector exhibited an increase in activity last month, rising from 50.8 to 52, while industrial production grew by 1.1%, surpassing the previous month's 1% growth rate. Given these circumstances, the USD/JPY pair is susceptible to further declines.

Trade Recommendation:

- Sell Stop: 142.00

- Take Profit: 141.00

- Stop Loss: 142.40

GBP/USD

The GBP/USD pair is holding steady around the 1.2700 level. Despite a decline in the UK manufacturing business activity index from 47.2 to 46.4 points in November, the services sector indicator surged from 50.9 to 52.7 points. This exceeded the anticipated 51.0 points and led to a correction in the composite value from 50.7 to 51.7 points, surpassing the forecasted 50.9 points. These positive dynamics persist despite elevated inflation rates and interest rates set by the Bank of England, signaling a reduced risk of an economic recession in the UK.

The pound received further support from the Bank of England's meeting results, which indicated the possibility of another rate hike. This combination of factors suggests a favorable outlook for the GBP/USD pair.

Trade Recommendation:

- Buy Stop: 1.2700

- Take Profit: 1.2850

- Stop Loss: 1.2650