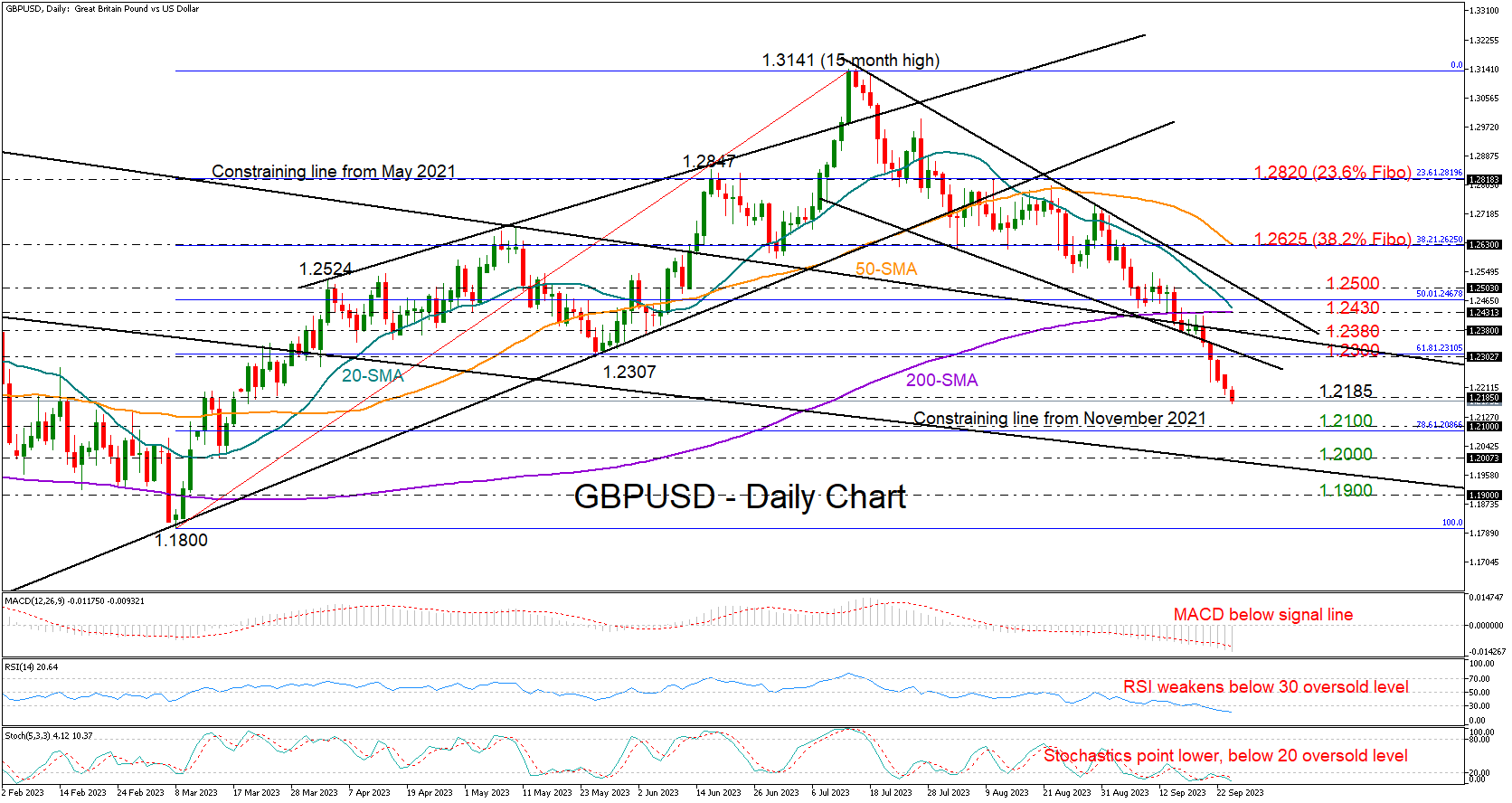

As September 2023 draws to a close, the GBPUSD pair finds itself in a precarious position, poised to mark its worst month of the year. This sharp downturn comes after the pair had reached a 15-month high of 1.3141 in mid-July, signaling a significant shift in sentiment and market dynamics. With the clock ticking down on the month, GBPUSD has posted losses in nearly every trading week since its peak.

The cumulative effect has seen the pair plummet by a substantial 4.0% throughout September, making it the bleakest month of 2023 thus far. The current trading levels hover near a six-month low, resting at 1.2173. This has fueled speculation that the bearish trend may soon exhaust itself, but caution is warranted.

Bearish Sentiment Persists, Oversold Conditions Arise

The Relative Strength Index (RSI) and the Stochastic oscillator, though dipping into oversold territory, fail to signal an imminent shift in market sentiment. This suggests that sellers may maintain their dominance for a bit longer before contemplating a retreat. As GBPUSD continues its descent, the crucial 1.2100 level looms on the horizon. A breach of this floor could lead the pair to seek refuge near the psychological barrier at 1.2000. A further downward slide might result in a pause around the 1.1900 area before testing the lows of 2023 at 1.1800.

Potential for an Upside Correction

Alternatively, a corrective rebound may shift the focus to the 1.2300-1.2380 trendline zone. Here, the 61.8% Fibonacci retracement level from the previous uptrend awaits. Slightly higher, the pair may encounter a more formidable obstacle within the 1.2430-1.2500 range. This region gains significance from the presence of the 20- and 200-day Simple Moving Averages (SMAs), the 50% Fibonacci marker, and the resistance trendline stemming from mid-July.

A successful breakthrough here could trigger fresh buying interest, propelling GBPUSD towards the 38.2% Fibonacci level at 1.2625 and the 50-day SMA.

Navigating Uncertainty

In summary, GBPUSD remains in the throes of a short-term bearish bias, although the relentless decline could potentially pave the way for an upside reversal as critical support levels draw near. Traders and investors must exercise caution and closely monitor key levels as they navigate the challenging landscape of September 2023. The evolving dynamics of this currency pair continue to provide opportunities and challenges alike in the ever-fluctuating world of forex trading.