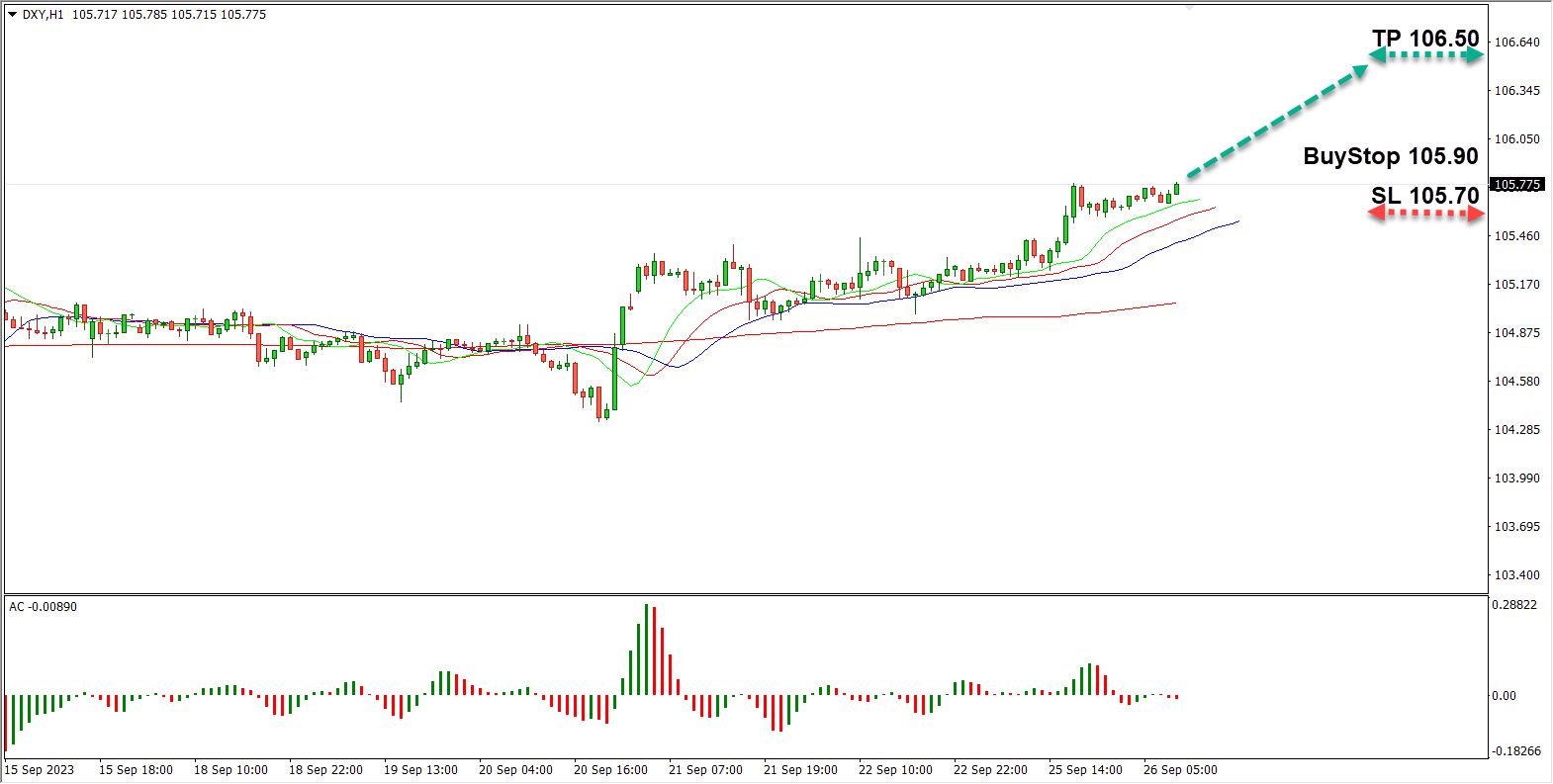

The US dollar index (DXY) is inching closer to resistance at the 106.00 level. This ascent is underpinned by robust data indicating strength in both the US manufacturing and services sectors, a report released on Friday. Traders are now anticipating another 25 basis point hike in the key interest rate, with a potential decision looming in November. Adding to the mix, the current budget law that funds the US government is set to expire at the end of September. Up to this point, politicians have failed to secure a new agreement for government spending by year-end, with this week marking the final stretch for negotiations. Against this backdrop, the dollar is poised for further growth.

Trade Idea: Buy Stop at 105.90 / Take Profit at 106.50 / Stop Loss at 105.70

Moving to the USD/JPY pair, it continues to hover around the 149.00 level. In the absence of significant economic releases, currency movements are largely influenced by external factors. Bank of Japan Governor Kazuo Ueda emphasized the importance of a stable exchange rate aligned with fundamental economic indicators. He confirmed that the central bank is closely monitoring yen dynamics, suggesting that it could intervene in foreign exchange markets if the yen weakens. However, traders speculate that the Bank of Japan may hold off until the pair surpasses the psychological barrier of 150.00. Considering these factors, it is advisable to maintain long positions.

Trade Idea: Buy Limit at 149.00 / Take Profit at 150.00 / Stop Loss at 148.60

Turning to Brent crude oil, it is currently trading around $91.50 per barrel. Recent pressure on prices stems from Russia's decision to temporarily lift the ban on gasoline and diesel exports to stabilize domestic prices. This move has raised concerns among investors about potential fuel shortages in the market, especially during the winter when demand is at its peak. Additionally, the strengthening US dollar is exerting local downward pressure on oil quotes. Market participants are also eagerly awaiting Wednesday's release of US oil reserve data. Until then, oil prices may test support around $90 per barrel.

Trade Idea: Sell Stop at 91.00 / Take Profit at 89.00 / Stop Loss at 91.70

In conclusion, the US dollar is poised for continued growth, supported by strong economic data and expectations of an upcoming interest rate hike. In the currency markets, USD/JPY remains stable, with the potential for intervention from the Bank of Japan if certain conditions are met. Meanwhile, Brent crude oil faces headwinds from easing export restrictions and a strengthening dollar, with a key focus on US oil reserve data in the near term.