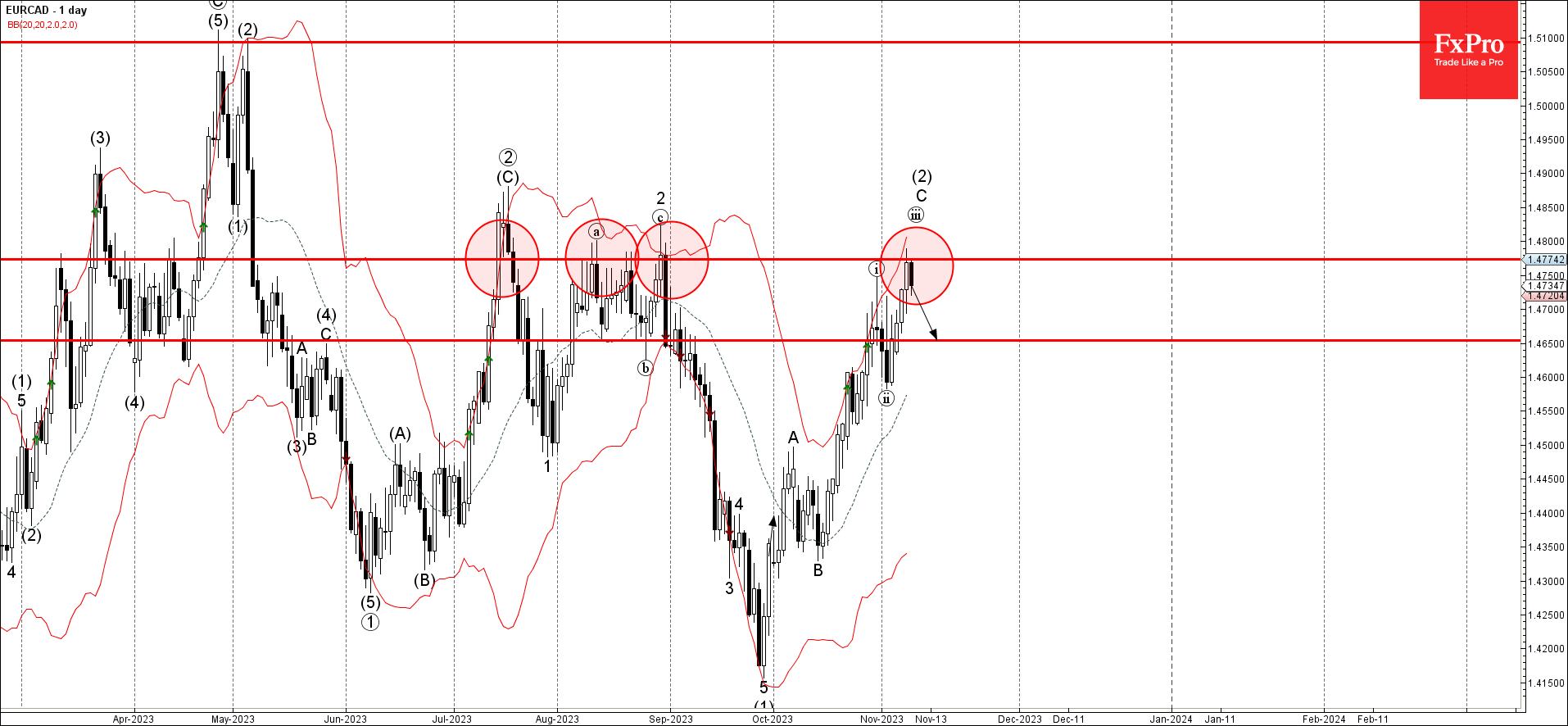

EURCAD has recently experienced a significant reversal, marking a downturn from the pivotal resistance level at 1.4775. This particular level has played a crucial role in influencing the pair's direction since the beginning of July. The recent downward shift has not only thwarted the ongoing medium-term ABC correction (2) but also underscores the formidable nature of the resistance at 1.4775.

The reversal from the resistance level at 1.4775 suggests a strong bearish sentiment, further intensified by the prevailing negative sentiment surrounding the euro in the broader foreign exchange (FX) markets. This reinforces the likelihood of EURCAD extending its downward trajectory in the near term.

Medium-Term Correction Disrupted

The reversal not only halted the prior medium-term ABC correction (2) but also implies a potential change in the overall trend dynamics. This interruption in the correction pattern underscores the significance of the resistance level and signals a shift in the balance of power between buyers and sellers.

Anticipated Movement: Downward to 1.4650 Support

Considering the robust resistance at 1.4775 and the prevailing bearish sentiment towards the euro, it is reasonable to anticipate a continued decline in EURCAD towards the next significant support level at 1.4650. This support level, if breached, could open the door for further downward movement, potentially setting the stage for a more prolonged bearish trend.

Risk Management and Trading Strategy

Traders and investors should exercise caution and implement effective risk management strategies, considering the heightened volatility associated with trend reversals. Setting stop-loss orders and closely monitoring developments in the FX market, particularly those impacting the euro, will be crucial in navigating potential fluctuations in EURCAD.

In summary, the reversal from the pivotal resistance level at 1.4775 signifies a notable shift in EURCAD's trajectory. The bearish sentiment, coupled with the disruption of the medium-term correction, points towards a potential downward continuation. Traders are advised to stay vigilant, adapt to evolving market conditions, and incorporate risk management measures to navigate the current dynamics in the EURCAD pair.