The US Dollar Index (DXY) is currently trading at 104.30, reflecting significant movements influenced by recent labor market data and Federal Reserve commentary. The latest weekly report revealed an unexpected increase in initial jobless claims to 231,000, surpassing the forecast of 220,000. This increase points towards a deteriorating situation in the American labor market, potentially signaling a shift in economic conditions that could contribute to a reduction in inflation in the United States. Such labor market trends are critical in shaping monetary policy and investor sentiment.

Adding complexity to the dollar's outlook are comments from Federal Reserve representative Loretta Meister, who highlighted the need for the Fed to draw appropriate conclusions from the weakening inflationary pressures. These remarks are interpreted by traders as an indication of a possible shift in the Fed's stance, potentially moving away from its current tight monetary policy. This perceived shift, coupled with the labor market data, sets a backdrop for a potential continued decline in the dollar.

As for trading strategies, a SELL STOP at 104.20 with a target price (TP) of 103.60 and a stop loss (SL) at 104.50 is suggested.

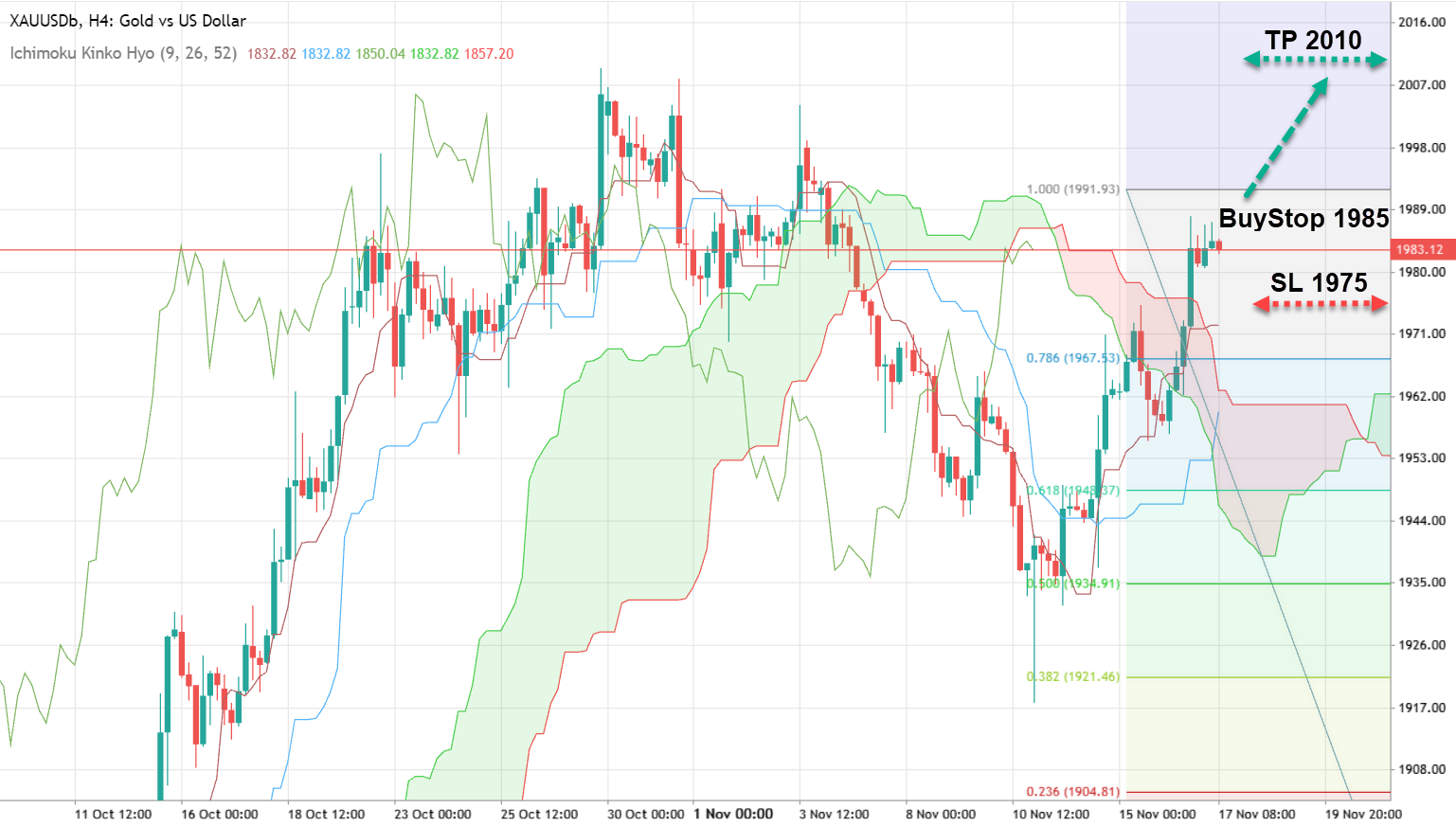

In the gold market, XAU/USD is witnessing a bullish trend, currently trading at around $1,985. Gold's strength is largely supported by the weakening dollar, particularly in light of recent U.S. inflation data. Market sentiment analysis reveals a notable trend: a significant majority of traders (75%) are short on gold, while a minority (25%) are holding long positions.

Historically, markets tend to move against the prevailing sentiment of the majority, suggesting that gold's bullish trajectory might continue, potentially testing the psychological resistance level of $2,000 per ounce. In this context, maintaining long positions is recommended, with a BUY STOP at 1985, a TP at 2010, and a SL at 1975.

Turning to the GBP/USD pair, it is trading at 1.24, influenced by external factors in the absence of significant economic releases. Recent comments from Bank of England board member Megan Green have been pivotal. Green labeled the slowdown in October inflation to 4.8% as "good news" but cautioned against premature interest rate cuts. She also noted the potential inflationary pressure from the rapid wage increase (7.9% as per the latest data), which could further strain the economy. Given these mixed signals, a corrective sentiment is expected to persist in the market until the end of the week. A SELL STOP at 1.2370, with a TP at 1.2250 and an SL at 1.2410, is advisable.

In summary, the financial markets are currently navigating through a complex interplay of economic data, central bank policies, and trader sentiments. The weakening dollar is creating a favorable environment for gold bulls, while mixed signals in the GBP/USD pair point towards potential corrective movements. These dynamics offer unique trading opportunities, but they also require careful analysis and strategic positioning.