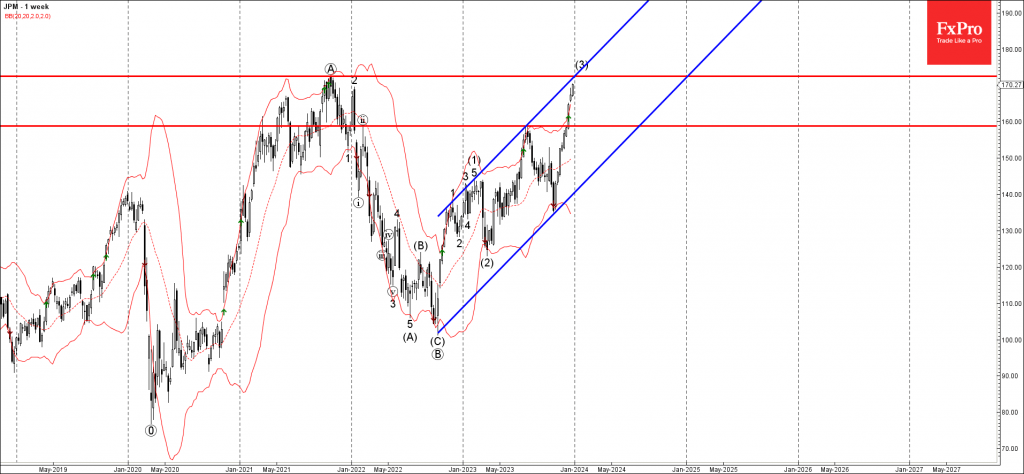

JPMorgan Chase's Ascend in Weekly Impulse Wave and Its Trajectory: JPMorgan Chase, a pivotal player in the financial sector, is currently experiencing a robust upward trend, encapsulated within the medium-term impulse wave. This wave signifies a significant phase in the stock's momentum, having successfully breached the key resistance level of 160.00. This breakout is a notable development, illustrating the stock's strength and potential for further gains.

Analyzing the Structure and Progression of Impulse Wave

The ongoing impulse wave is a critical component of JPMorgan Chase's broader weekly upward impulse sequence labeled as C, which commenced at the end of the previous year. The progression of this wave is integral to understanding the stock's current bullish sentiment and its potential future direction. The wave's formation and movement provide valuable insights into the stock's dynamics and investor sentiment.

Projected Movement Towards Resistance Level 172.60

Considering the current uptrend and the momentum within impulse wave, JPMorgan Chase is expected to continue its ascent. The next significant milestone for the stock is the resistance level of 172.60, a level that previously marked a multiyear high in 2021. Reaching this resistance level would not only signify a continuation of the current bullish trend but also potentially set the stage for new highs, depending on market conditions and investor reactions.

Contextualizing JPMorgan Chase's Performance in the Financial Sector

JPMorgan Chase's performance should be viewed within the broader context of the financial sector and global economic conditions. Factors such as interest rate policies, economic indicators, and market sentiment play a crucial role in influencing the stock's trajectory. As one of the leading financial institutions, JPMorgan Chase's stock movement is often reflective of wider trends in the banking industry and the economy as a whole.

Conclusion: Strategic Considerations for Investors and Traders

Investors and traders monitoring JPMorgan Chase should consider the implications of impulse wave (3) and the stock's approach to the 172.60 resistance level. While the current trend indicates potential for growth, market dynamics are subject to change, and a prudent approach involves staying informed about economic developments and sector-specific news. The journey towards the resistance level offers both opportunities and challenges, necessitating a balanced and informed investment strategy.