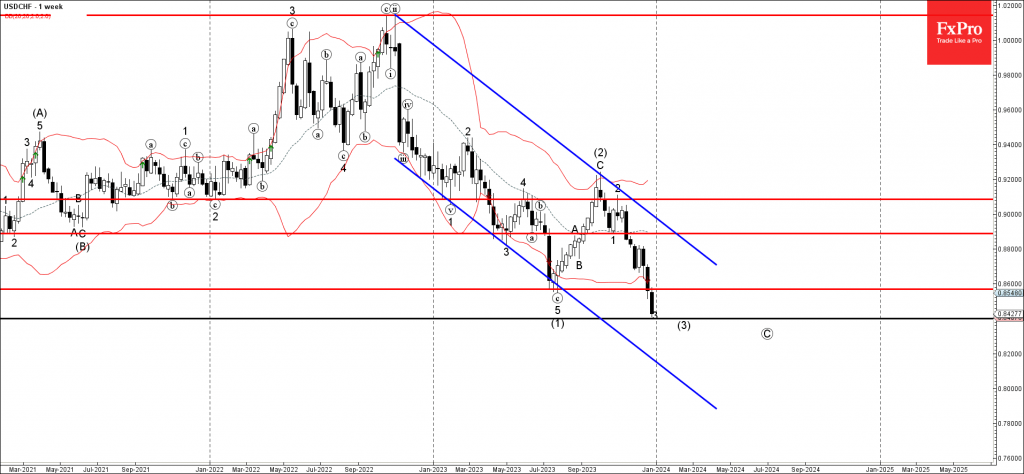

USDCHF Experiences a Notable Break Below Critical Support, Indicating a Bearish Trend. The USDCHF currency pair, an important barometer in the forex market, has recently undergone a significant shift in its trading pattern. The pair broke through the key support level at 0.8570, a level that previously represented a multi-month low established in July. This breach is not just a minor fluctuation but a notable shift in market dynamics, indicating a potential trend change.

The Impact of the Breakout on Current Market Waves

The break below the 0.8570 support level has had a pronounced effect on the existing market waves. Specifically, it has accelerated the momentum of both the active impulse waves 3 and (3), which are part of the Elliott Wave Theory framework used by many traders to analyze market cycles and forecast trends. This acceleration suggests an increase in bearish sentiment, further supporting the likelihood of a continued downward trend.

Analyzing the Broader Market Context and Swiss Franc Sentiment

The current market scenario is not solely about technical levels. It's essential to consider the broader context, including the overall daily downtrend of the USDCHF pair and the prevailing sentiment towards the Swiss Franc. The Swiss Franc, often viewed as a safe-haven currency, has been exhibiting strong bullish sentiment. This strength, juxtaposed with the bearish pressure on the USDCHF pair, creates a conducive environment for further depreciation in the pair's value.

Anticipating a Move Towards the Next Support Level

Given these factors, the USDCHF pair is likely to continue its descent towards the next significant support level, which is identified at 0.8400. This level is not just a random point but is strategically significant as it is projected to be the target for the completion of the active impulse wave 3. Reaching this level would represent a continuation of the current bearish trend and could serve as a crucial juncture for future market movements.

Extended Analysis: Beyond Immediate Support Levels

While the focus is currently on the 0.8400 support level, a comprehensive analysis would also consider what lies beyond this point. Should the pair breach this level, it could open the path to even lower levels, further cementing the bearish trend. Conversely, any unexpected shift in market sentiment, perhaps influenced by geopolitical events, economic data, or central bank policies, could potentially reverse the current trend, necessitating a reevaluation of the market outlook.

Conclusion: A Dynamic Forex Market Requires Vigilance

In summary, the recent break below the key support level in the USDCHF pair signals a strong bearish trend, with the potential to reach the 0.8400 support level. However, given the dynamic nature of the forex market, traders and investors must remain alert to changes in market sentiment and economic conditions. Staying informed and flexible is crucial for navigating these complex market waters.