The crypto market cap rose 1.75% over the past 24 hours to $1.19 trillion, outperforming Bitcoin and Ethereum’s 1.5% growth over the same period. Among the top altcoins, Solana (+5.7%), BNB (+6%) and Polygon (+9.4%) are outperforming the market. Tron (-0.2%) and Dogecoin (+1.2%) underperform the market. According to CoinShares, investments in crypto funds rose by $136 million last week, marking the third consecutive week of inflows totalling $470 million, with bitcoin investments up $133 million and Ethereum up $3 million.

However, trading volumes slowed to $1 billion for the week, compared to an average of $2.5 billion in the previous two weeks, CoinShares noted.

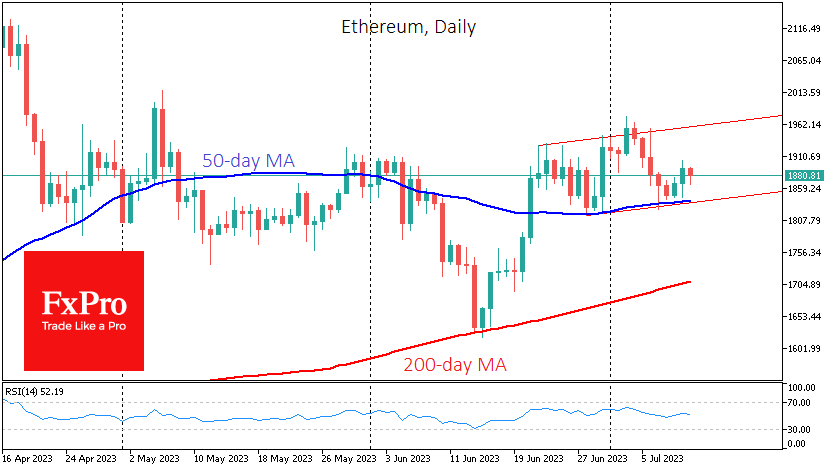

Ethereum reversed to the upside at the end of last week, pulling back from its 50-day moving average. This is the second such reversal in the past two weeks, suggesting that the market is looking to reassert the dominance of the uptrend. If this proves to be the case, Ethereum is headed for a renewal of local highs near $1960 from the current $1880.

News background

According to Standard Chartered Bank, Bitcoin could reach $50K this year and $120K by the end of 2024. "The increased profitability of miners per BTC mined means they can sell less while maintaining cash inflows, reducing the net supply of the asset and driving up its price," said analyst Geoff Kendrick.

SEC lawyers accused Coinbase of intentionally violating securities laws. The court will consider the parties' arguments and decide whether to hear the case in the coming days. Coinbase's shares rose more than 50% following the SEC's lawsuit in early June.

According to a report by venture capital firm Electric Capital, the number of cryptocurrency developers has nearly doubled in three years. Bitcoin trades at a discount of more than $2K on the Binance.US exchange. Binance.US users lost the ability to deposit dollars the day before, prompting selling by those looking to withdraw funds in fiat.