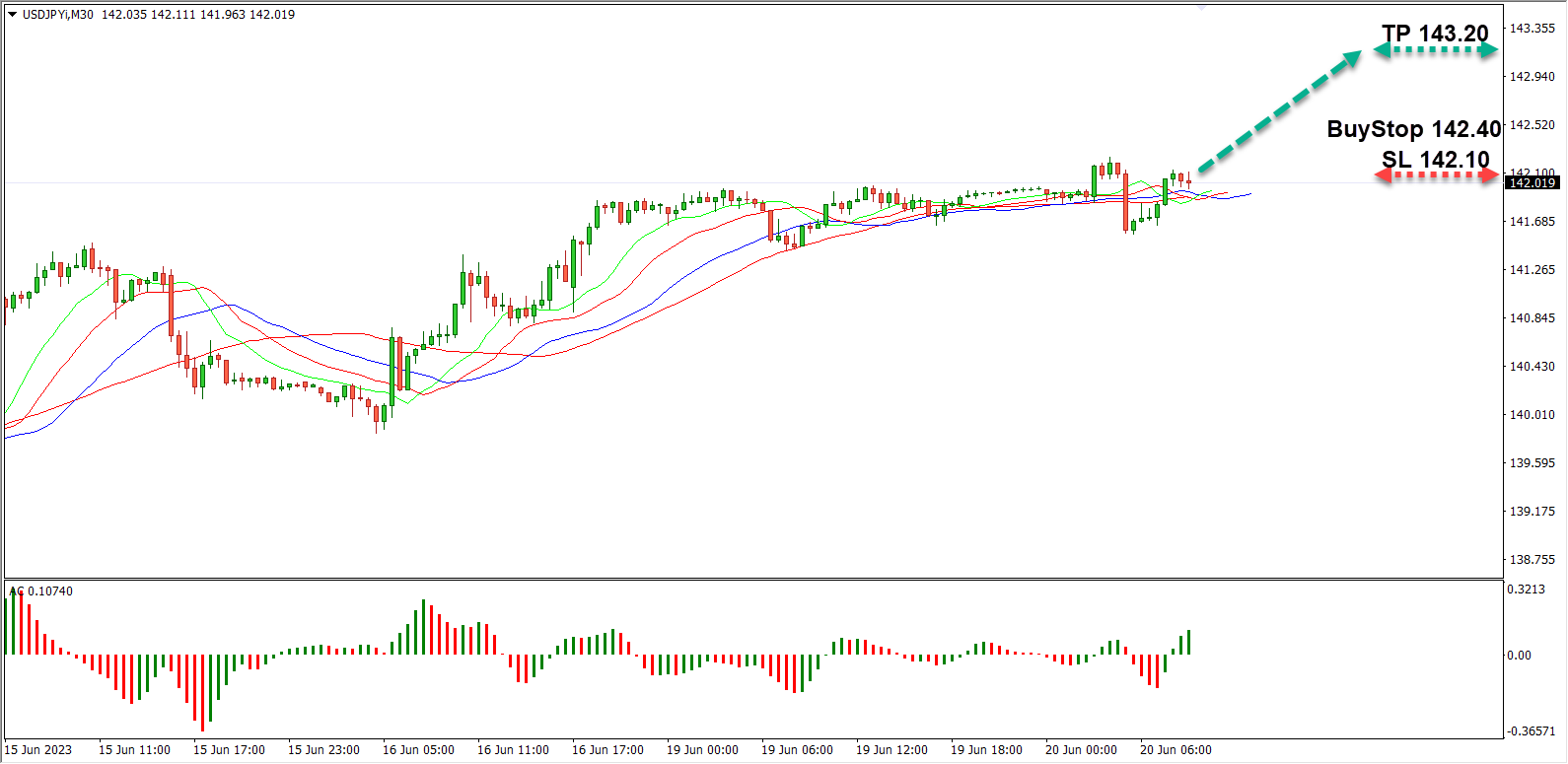

The USD/JPY is trading near its last November high at 142.00. The pressure on the yen continues to be exerted by the policy of the Bank of Japan. Last Friday, the Japanese regulator kept the interest rate unchanged at -0.10%. According to the bank’s management, inflation in the country is not yet high enough to tighten the national monetary policy. The annual inflation rate is now 3.5%, while the base is 3.4%.

Today a report on Japan’s industrial production will be released. According to forecasts, industrial production has decreased by 0.4%, the same as in March. If the expectations come true and the statistics disappoint again, the Bank of Japan will get another argument to maintain its ultra-easy monetary policy. Against this backdrop, the growth of the pair may continue.

BUY STOP 142.40/TP 143.20/SL 142.10

GBP/USD

The GBP/USD pair is trading near 1.28. Tomorrow, data on the UK consumer price index in May will be published. The indicator may slow down from 8.7% to 8.5% year-on-year. In addition, the Bank of England will meet on Thursday. The regulator is ready for another increase in interest rates by 25 basis points to 4.75%. It is expected that seven members of the regulator’s board will vote for the decision to tighten monetary policy. If these expectations are confirmed, the pound may hit local highs. Pound buyers are also supported by the potential for a decline in the dollar as the Fed left its rates steady last Wednesday.

BUY STOP 1.2800/TP 1.2900/SL 1.2770

BRENT

Brent oil is testing the resistance of $76. Prices are supported by the latest report of the International Energy Agency (IEA), according to which the oil demand this year will grow by 2.45 million barrels per day compared to the previous estimate of 2.20 million barrels. Growth in demand will be supported by the recovery of China’s economy. Additional support for prices may come from a report on oil inventories in the US, which will be released on Wednesday. Also, Saudi Arabia’s intention to cut oil production by 1 million from July remains a positive factor for quotes. Against this backdrop, prices will continue to rise.

BUY STOP 76.00/TP 78.00/SL 75.40