The Bank of Japan (BoJ) is set to convene, but expectations are muted as the central bank is anticipated to maintain its current interest rates and yield curve control. While the world has witnessed other major central banks alter their monetary policies, the BoJ has remained a stalwart with negative interest rates. Let's delve into the dynamics surrounding the upcoming meeting and its potential impact on the Japanese yen.

Despite Japan experiencing inflation above the 2% target for an extended period, the BoJ has refrained from swift policy changes. At its December meeting, the central bank underlined its commitment to maintaining loose monetary conditions until wage growth and inflation stabilize at desired levels.

Recent data trends have aligned with the BoJ's cautious stance. In the absence of external shocks like the 2022 energy crisis, inflationary pressures appear to be easing. December's Tokyo Consumer Price Index (CPI), often a precursor to national CPI figures, demonstrated a notable slowdown in both headline and core consumer prices.

CPI Data Crucial

The spotlight now turns to the forthcoming CPI report due on Friday. Forecasts suggest a deceleration in core inflation from 2.5% to 2.3% year-on-year in December. Such an outcome could further validate the BoJ's prudent approach to policy normalization and place additional pressure on the Japanese yen.

Wage Negotiations as a Turning Point

Governor Ueda has repeatedly emphasized that the BoJ is open to tightening policy, but this hinges on substantial wage growth. The upcoming spring wage negotiations are pivotal, as they could serve as a catalyst for the BoJ to exit negative interest rates. Market expectations currently point to wage increases outpacing last year's 3.58%, driven by robust corporate profits and tight labor market conditions. The BoJ's requirement of positive real wages before considering rate hikes has led to speculation that positive results in annual wage talks might prompt action as early as the April meeting, contrary to market pricing, which indicates a rate increase in June.

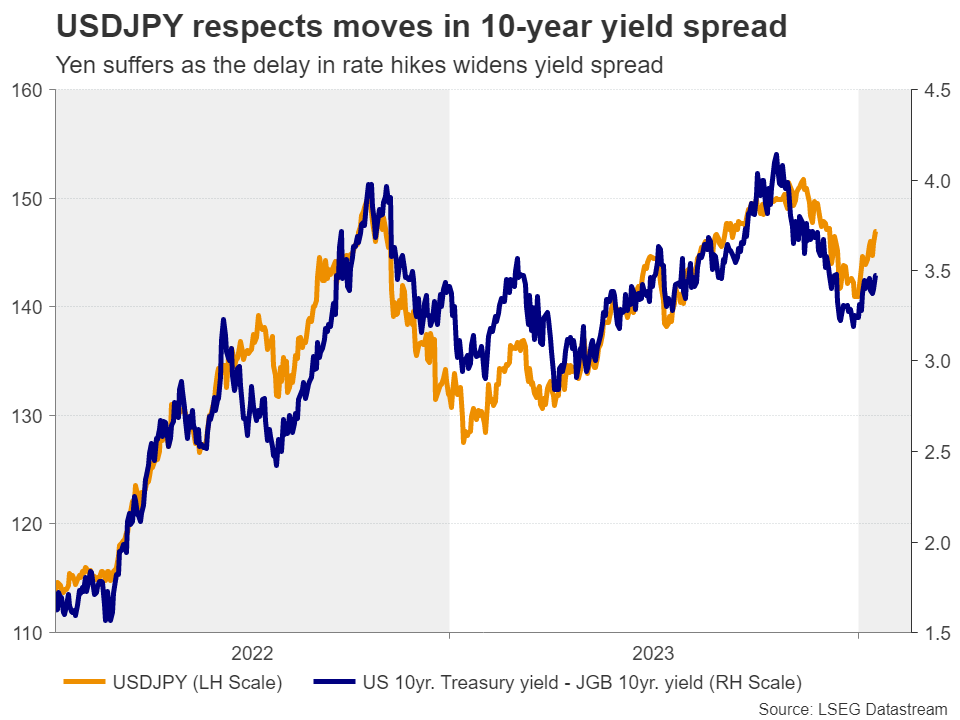

Yield Curve Control and Yen's Vulnerability

While the yen initially strengthened on rate hike speculations, it has retreated following the BoJ's dovish commentary in December. With rate hikes off the table for now, any further easing in the yield curve control policy could offer temporary relief to the Japanese currency. However, the upcoming BoJ meeting is not expected to bring such policy adjustments, potentially leaving the yen exposed to further selling pressure in the short term. Concerns about dollar/yen reaching intervention levels loom, especially if the Federal Reserve implements quicker-than-anticipated rate cuts, presenting a significant downside risk.

Key Levels to Monitor

From a technical perspective, dollar/yen appears poised to recover its recent pullback, contingent on macroeconomic developments. The outcome of the BoJ meeting may determine whether the pair revisits intervention threshold levels. To the upside, should the recent rebound persist, the pair might challenge the 32-year high at 151.92. Conversely, a hawkish BoJ meeting could place the December low of 140.24 within the scope of scrutiny.

In conclusion, the Bank of Japan's upcoming meeting is unlikely to bring about significant policy changes, maintaining the status quo in monetary policy. The Japanese yen's trajectory will depend on the central bank's comments and future economic developments, with potential implications for dollar/yen levels.