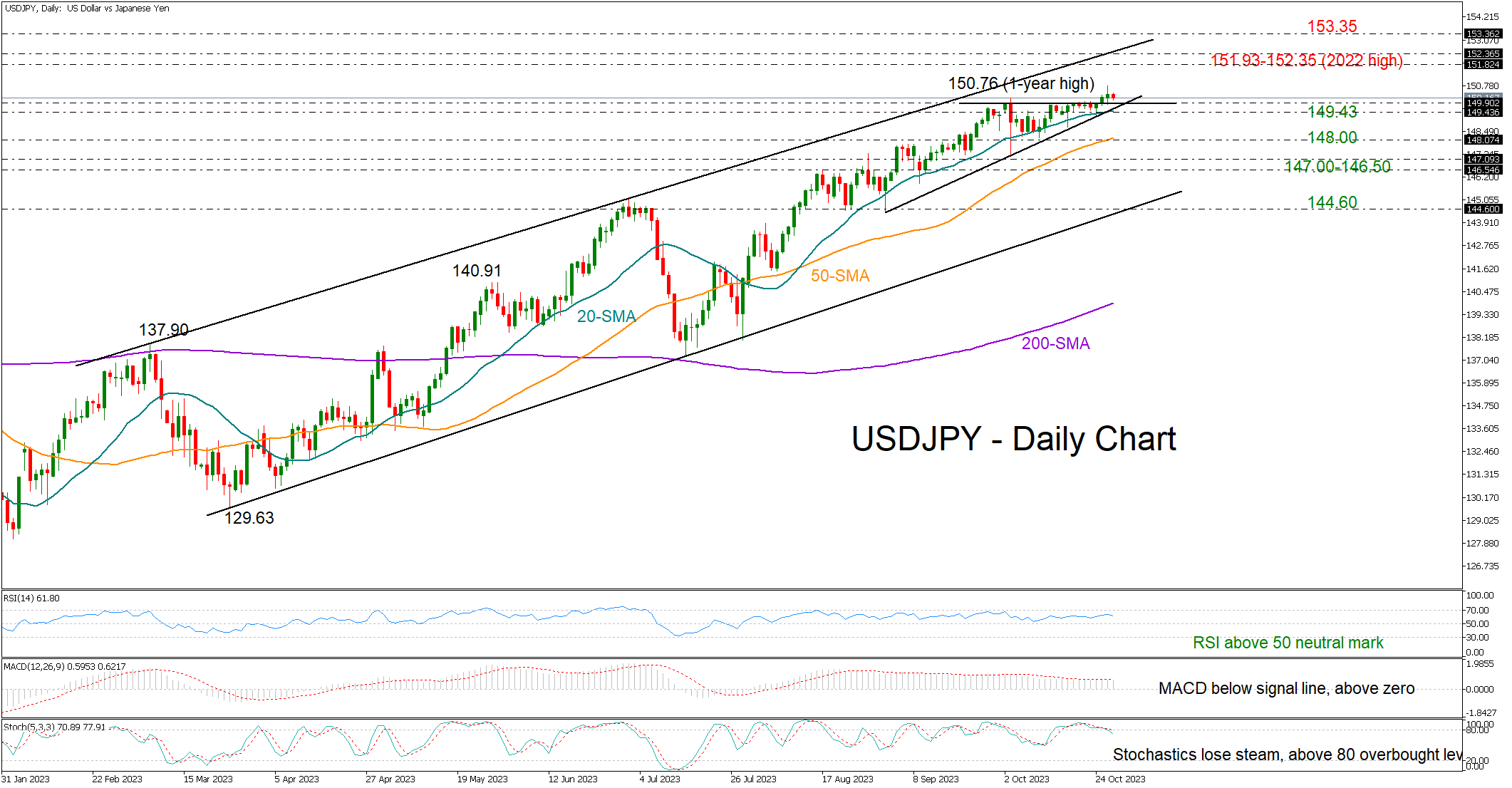

In recent trading sessions, USDJPY has notably edged past the 150 mark, marking a significant one-year high of 150.76. Notably, this achievement comes even amidst lingering concerns and potential market interventions. On Thursday, the currency pair managed to sidestep any significant FX interventions and cemented its position just above the 150 threshold for two consecutive sessions.

From a technical standpoint, there's an apparent breach of an ascending triangle to the upside for the USDJPY. This pattern has typically been indicative of a potential bullish trend, further accentuated by the upcoming US core PCE inflation data. However, a word of caution arises from Thursday’s relatively diminutive candlestick situated at the zenith of the prevailing uptrend. The divergence in technical indicators does sow seeds of doubt and is reflective of the market's current hesitance.

Looking forward, bullish traders will be setting their sights on the 151.93-152.35 range, an area defined by the peak of 2022 and the upper echelons of the overarching bullish channel. Going back in time, historical data reveals that the 153.35 zone had served as a considerable barrier in 1990. Further up, the 155.35-156.60 bracket had similarly acted as a formidable hurdle during the same period, thus potentially laying out the roadmap for future bullish targets.

Conversely, a downward trend that sees the pair dip beneath the aforementioned triangle and the 20-day simple moving average (SMA) at 149.43 might bring the 50-day SMA into play, positioned at 148.00. If the downward pressure persists and the 50-day SMA threshold is breached, we might witness a temporary stabilization around the 146.50-147.00 region. Any continued decline could potentially snowball, targeting the lower confines of the bullish channel at 144.60.

In conclusion, the USDJPY's trajectory in 2023 has been largely upward-reaching, achieving fresh highs. Yet, the present momentum doesn't exude the robustness one might expect. This has given rise to speculations regarding a possible waning in buying interest. Nevertheless, the predominant market sentiment is anticipated to tilt towards the bullish side unless the pair takes a downturn below 149.43.