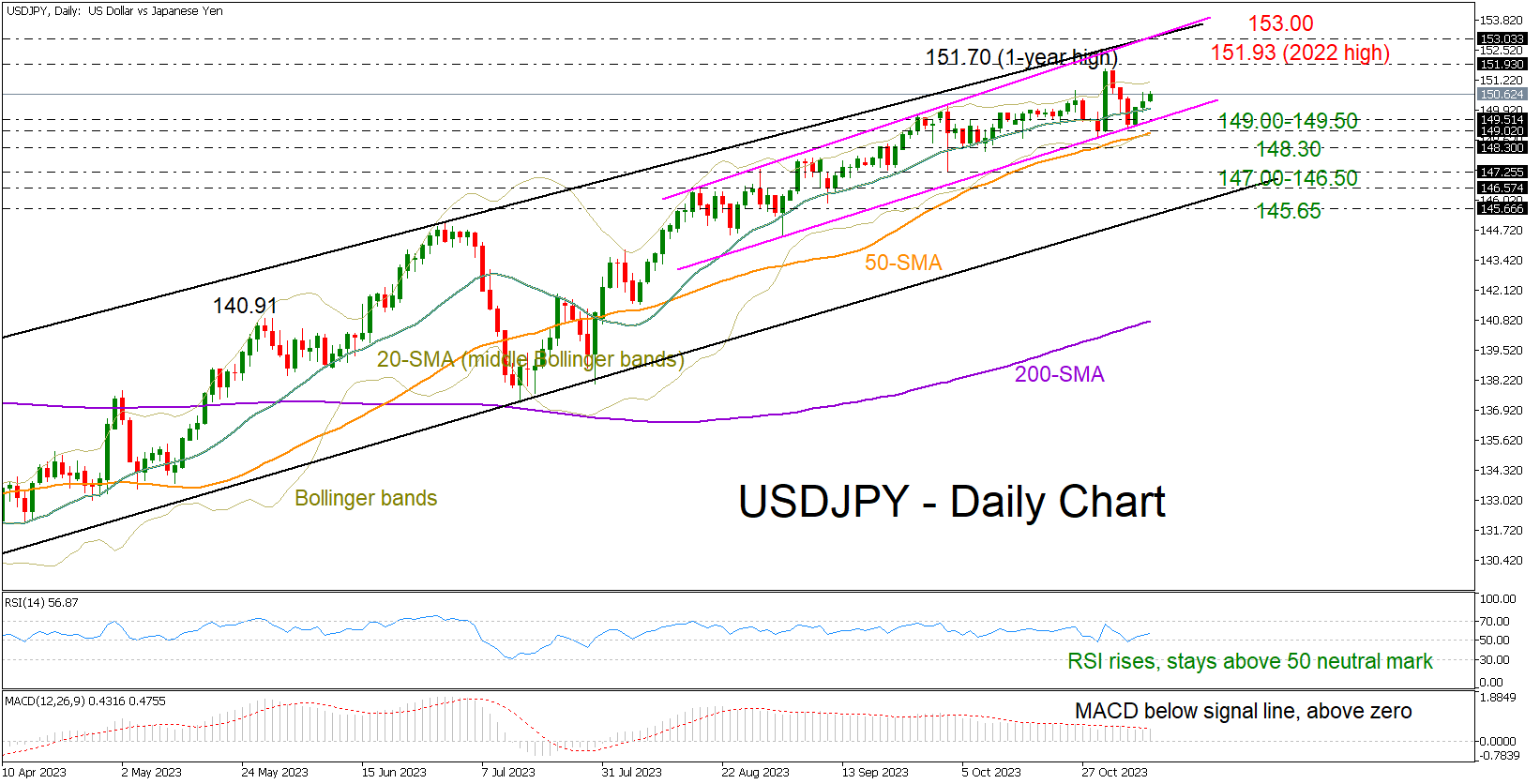

The USDJPY currency pair has recently shown signs of reclaiming its upward momentum, a move that has caught the eye of market observers and traders alike. The pair's thrust into the 150 price zone is a notable development, signaling that the bullish run that characterized much of 2023 remains firmly in place. Nonetheless, the path ahead is fraught with both technical and fundamental challenges.

The Push for Higher Ground

Entering the week with a gentle pivot from the 149.30 support level, USDJPY has positioned itself for a potential continuation of the prevailing uptrend. The market's focus is now fixated on the Federal Reserve Chairman Jerome Powell's forthcoming speech, which may provide fresh directional impetus.

For the bullish narrative to gain additional traction, the pair needs to convincingly breach the resistance at 151.65, clearing the path toward the pinnacle of the 2022 peak at 151.93. Achieving this feat could inject further vigor into the rally, propelling USDJPY toward the pivotal 153.00 resistance trendline. A break above this zone could open the gates to the 155.40-156.60 resistance corridor, a historical region of interest dating back to the early 1990s.

A Mixture of Technical Perspectives

Despite the recent gains, technical indicators present a mosaic of signals that suggest a cautious approach. The converging Bollinger Bands signal a buildup of market tension, hinting at an imminent breakout that could set the tone for the pair's next significant move. However, the trajectory remains ambiguous.

The Relative Strength Index (RSI) has managed to stave off a dip below the neutral 50 threshold, an encouraging sign for the bulls. In contrast, the Moving Average Convergence Divergence (MACD) indicator exhibits a lack of upward momentum, lingering beneath its signal line and casting doubt on the sustainability of the current trend.

The Downside Scenario

While the possibility of a resumption in bullish activity exists, a corrective phase cannot be ruled out. A retreat below the critical support range of 149.00-149.50, demarcated by the recent ascending trendline and the 50-day SMA, might trigger a pullback toward the 148.30 level. Should selling pressure intensify, a further descent into the 146.55-147.30 support bracket is conceivable. It is only with a decisive closure beneath the lower band of the overarching bullish channel at 145.65 that medium-term bullish sentiment would suffer a serious setback.

The Path Ahead

As it stands, USDJPY retains a positive outlook for the week, yet it has not fully dispelled the specter of potential downside risks. To solidify market confidence, it is imperative for the pair to not only breach the 151.93 barrier but also to establish a foothold above the 153.00 mark, cementing its bullish structure.

Investors should remain mindful, however, that a pronounced depreciation of the yen, especially in rapid succession, could provoke a response from Japanese monetary authorities in the form of foreign exchange intervention. This potential counteraction could serve as a moderating force against any unchecked appreciation of the USDJPY.

In conclusion, while the uptrend in USDJPY is clear, traders may want to stay vigilant and look out for signals in Jerome Powell’s speech, as well as any indication of policy shifts from Japan, which could dramatically alter the pair's trajectory in the short to medium term.