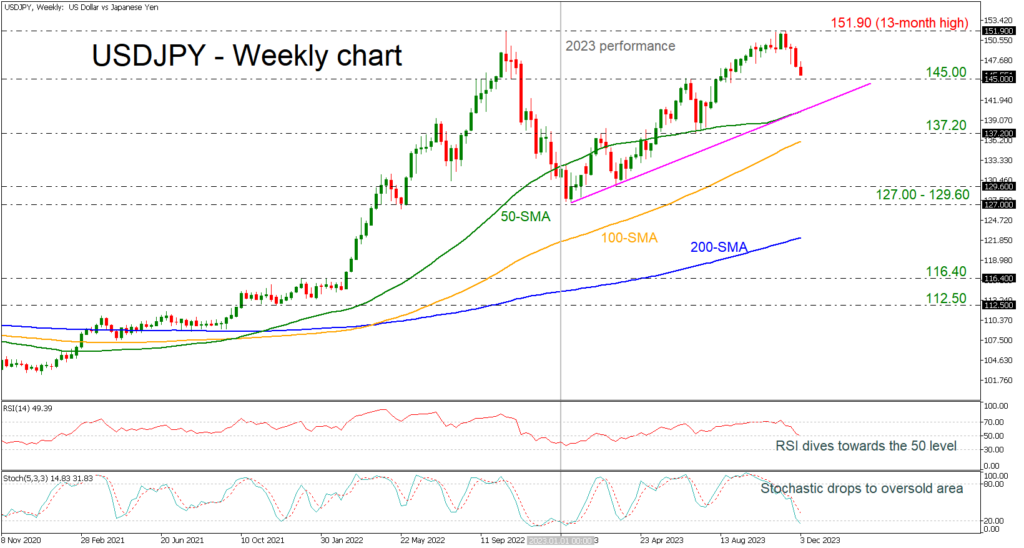

The USDJPY currency pair has been exhibiting a noteworthy performance in the year 2023, indicating a positive trajectory overall. Nevertheless, recent developments suggest that a bearish correction might be on the horizon, as technical indicators signal caution amid a backdrop of a sustained upward trend.

Sustained Ascendancy in 2023

USDJPY has experienced an upward journey since the onset of 2023, showcasing resilience and potential. However, it's crucial to note that the currency pair has now recorded its fourth consecutive week in the red, following a retreat from its 13-month high at 151.90.

Technically, while the bullish sentiment might still be in play, there are signs pointing towards a potential bearish correction. Notably, the market remains above a long-term uptrend line, a positive signal for bullish traders. However, technical indicators, specifically the Relative Strength Index (RSI) and the stochastic oscillator, are exhibiting behavior indicative of a forthcoming negative move. The RSI is on a downward trajectory, nearing the neutral threshold of 50, while the stochastic oscillator is approaching oversold territory.

Potential Scenarios

In the event that the USDJPY price maintains resilience above the crucial 145.00 handle, this could embolden the bulls to aim for a close above the 13-month peak of 151.90. Achieving such a feat would likely redirect market attention to the April 1990 peak at 160.70. To reach this milestone, however, the market must successfully surpass psychological resistance levels at 152.00 and 155.00.

Conversely, if the downside pressure persists, selling forces could intensify, targeting the critical 145.00 support level. Further declines from this point might lead to a retest of the uptrend line, coinciding with the 50-day simple moving average (SMA) at approximately 140.00. A move south of this hurdle could pave the way for a more pronounced bearish structure, potentially extending the downturn until 137.20.

Summing Up the Outlook

In summary, USDJPY has exhibited a positive performance throughout 2023, with its upward trajectory intact. However, it's essential to exercise caution as technical indicators hint at the possibility of a bearish correction. While the potential for continued support remains, the scope for further improvement may be limited until the next bearish phase unfolds, particularly if it breaches the crucial uptrend line. Traders and investors should remain vigilant and adaptable in light of these dynamics shaping the USDJPY market.