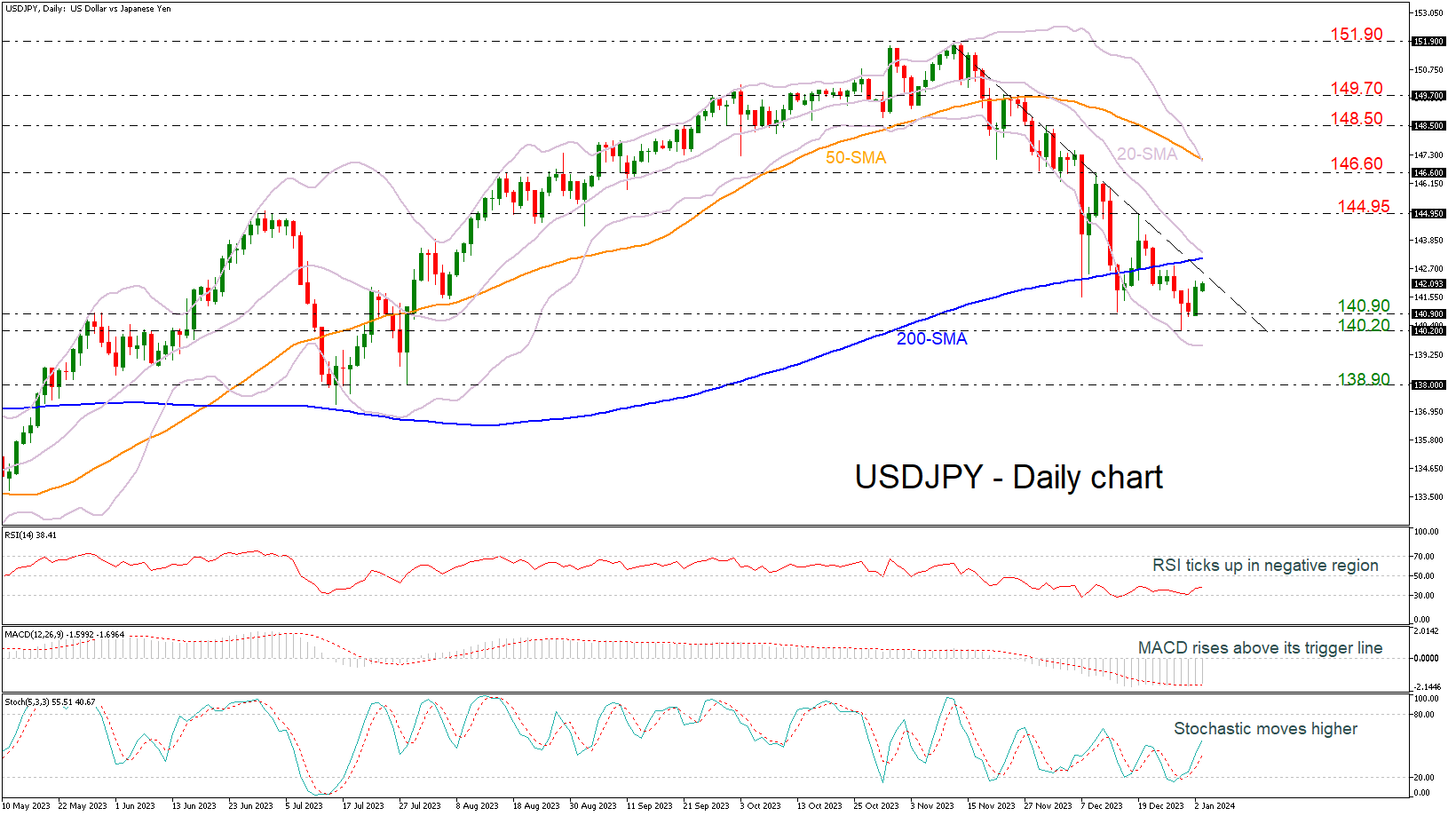

As the new year unfolds, USDJPY buyers demonstrate robustness, signaling a potential shift in momentum for the currency pair. With the year's commencement, USDJPY has shown commendable progress, rebounding from the critical support level at 140.90. This rebound is particularly noteworthy as it challenges the formidable resistance imposed by a steep descending trend line that has been a defining factor in the pair's recent price action.

Technical Indicators Signal a Bullish Undercurrent

Key technical indicators lend credence to the strength of the buyers. The Relative Strength Index (RSI), while still trailing below the 50 neutral benchmark, is on an upward trajectory, hinting at a strengthening bullish sentiment. The Moving Average Convergence Divergence (MACD) maintains its position above the signal line, despite lingering in negative territory. This suggests that the bullish momentum, albeit in its nascency, has a foothold. Concurrently, the stochastic oscillator flirts with the prospect of an upside reversal, raising the question of whether there is ample bullish vigor to propel the currency pair toward the lofty November peak of 151.90.

A Rally Towards Key Resistance Levels

Should the uptrend find fresh impetus, overcoming the immediate resistance delineated by the descending trend line at 142.60, the subsequent hurdles lie at the 200-day simple moving average (SMA) at 143.15 and the median of the Bollinger Bands at 143.40. Breaching these could see the bulls pausing at the 144.95 resistance level, gathering strength for a possible surge towards the 146.60 mark. A decisive breakthrough could further pave the way to the 50-day SMA, conveniently aligning with the upper boundary of the Bollinger Bands at 147.00, which would signify a notable bullish conquest.

Defensive Layers to Thwart the Bears

On the flip side, the currency pair is buttressed by significant support levels that have staunchly defended against bearish assaults over the last three weeks. The supports at 140.90 and 140.20 are particularly critical, having proven their mettle in forestalling downward trajectories. If the bears were to regain dominance, we might witness the pair's descent towards the support echelon at 138.90, a stronghold established back on July 28.

A Crossroad for USDJPY Buyers

In essence, USDJPY buyers are seemingly gearing up to seize the reins. However, for the currency pair to decisively shed its bearish skin and don a bullish mantle in the short-term landscape, a substantial influx of buying pressure is requisite. The technical indicators, while leaning towards optimism, still necessitate a vigilant watch to confirm if the budding bullish narrative will indeed take root and flourish as 2024 marches on.