Tick volumes are one of the simplest options for VSA analysis Most forex traders are familiar with technical and fundamental analysis. There are several ways to use these two methods to study the forex market. In a nutshell, the fundamental analysis explores the causes of market movement, while technical analysis finds out when a movement will occur.

But a different approach to analyzing prices in the stock and currency markets is also possible. In theory, the methodology should combine the main of two options in order to solve the "why" and "when simultaneously". This is what VSA in forex is all about volume variance analysis.

What is VSA?

VSA (Volume Spread Analysis) is a proprietary market analysis method that looks at the relationship between the opening/closing price range and trading volume. VSA can also be referred to as comparing the distance between the high and low of a bar/candle to the total trading volume in the forex market.

Thus, a trader tries to find out the difference between supply and demand created by the major players in the market (professional traders, institutions, banks, and other market makers). If you know how to interpret their actions accurately, it will give you good signals to enter the market.

A Brief History of the Method

The VSA is an evolutionary extension of the work of Richard D. Wyckoff, who began trading stocks in 1888 at the age of 15. In the 1910s, Wyckoff published his work in a financial weekly that sold 200,000 copies and made the concept public domain. In the late twentieth century, Tom Williams improved on Wyckoff's research and developed his own methodology. In his book "Market Masters" he mentioned the importance of price differences (spreads) related to volumes and closing prices.

Tick volumes are one of the simplest options for VSA analysis. There are a total of three landmark figures in the development of VSA:

- Jesse Lauriston Livermore;

- Richard Demille Wyckoff;

- Tom Williams.

Livermore was the first to use volume data to analyze the mood of bulls and bears to find entry points. But he was not the creator of this trading method as such. The main contribution was made by another — Wyckoff. He was distinguished by his academic approach to trading. He was fond of education and used any source of ideas to develop his trading methods. In particular, he personally met with leading traders and interviewed them. One such interviewee was Livermore with his thoughts on volumes, from which Wyckoff would later derive the basic tenets of the VSA concept.

But neither Livermore nor Wyckoff used a combination of Volume Spread Analysis. It was Williams who coined the term for methods based on Wyckoff's work. Williams' books and computer software helped to promote VSA as a powerful tool for analyzing market volumes among Forex traders and made the concept an alternative to the classic analysis variants.

What the VSA Shows

To determine the balance between supply and demand, the VSA examines the interaction of three variables on a forex chart to determine the supply/demand balance and identify the likely short-term direction of the market.

These variables are:

- Candle/price bar volume;

- Total price change for the session (highs and lows);

- Сlosing price.

Using these three pieces of information, a skilled trader will find the best entry points into forex. The significance and importance of volume seem to be poorly understood by most novice traders, but it is a very important component of technical chart analysis. Wall Street likes to compare a price chart without volume to a gas tank without gasoline. The volume gives half the information and the other half is found by studying the price difference.

How VSA Works

Every market (forex is no exception) moves according to the supply and demand created by professional players. If demand is greater than supply, the market rises. If supply is higher than demand, the market goes down. Seems simple, but in practice, financial markets are not easy to calculate. Supply and demand work differently in financial markets.

The VSA teaches that all market strength can be read in a bearish candle, conversely, market weakness can be read in a bullish candle. Professional and institutional investors trade forex often and in large volumes.

Their purchases and sales are represented on the chart by bullish and bearish candles with a large range. By comparing the closing price, overall price range, and trading volume, traders determine if the bulls/bears have succeeded in breaking through the support/resistance lines and if this momentum has enough power to reverse the trend.

Where You Can Use VSA

The VSA focuses on price and volume and tends to track the actions of professionals. Consequently, in any market where there are good turnover and market makers, the VSA trading concept remains valid. Almost all financial markets (stocks, futures, forex) nominally meet these requirements. However, in the forex market, volume is a complex quantity. Traders argue a lot about whether VSA can be used in the forex market.

The reason is that the foreign exchange market is decentralized, unlike the stock market. As a result, actual volumes are not available. But we can simply analyze the volumes of each bar and candlestick. It works quite well in forex trading.

Concepts of VSA

In broad terms, volume allocation analysis is a school of trading thought that insists on the crucial role of volumes in understanding price movements in financial markets.

Thus, five basic concepts of VSA emerge:

- Technical analysis is not self-sufficient. The argument in favor of technical analysis is the postulate that price already discounts everything. However, reading the market solely by price is not enough. Markets depend primarily on supply and demand, hence on the psychology of their final participants. Therefore, volume analysis is a good way to understand how supply and demand affect prices.

- It's all about perceived rather than real value. The fundamental analysis says we can always understand the real value of an asset by examining the intrinsic value of a financial instrument - stocks, currencies, commodities, etc. Volume traders say that to fully understand what is happening in the markets we have to start from perceived value. Not the actual value, but how the bulls and bears see it at the moment. Because traders are constantly valuing companies above their book value, taking into account other types of analysis besides fundamental analysis.

- Price and volume are interrelated. Past prices are an important aspect of understanding movements in financial markets. However, price analysis is not enough. Proponents of VSA say it is more important to understand exactly where the money is now and where it will be at the moment we need it. Volume determines the "hunger" or "saturation" of the market, which affects the strength and direction of price impulses.

- Volume is the cause of any movement. We have already dismissed fundamental and technical analysis as the only explanation for movements in financial markets. VSA suggests looking at price movement in relation to volume as the main factor. For example, no matter how good the performance of the market or an individual issuer may seem, if the trading volumes have been at a peak for a long time, we can expect an impending slack or reversal.

- Different traders have different roles in forex. The basic idea of the concept is that different types of traders carry different types of information. We can base our trading strategy on this idea.

VSA defines three different types of traders:

- Retail;

- Commercial;

- Professional.

Retail traders are those who have small accounts and trade casually. Commercial traders are investment banks whose function is to place orders in the market to meet customer needs. Professional traders are qualified investors who seek to win and almost always try to stay slightly behind the market in order to go in a steady trend. By calculating which type is making the weather now, a trader is more accurate in predicting future price movements in forex.

Advantages and Disadvantages of VSA

Advantages of VSA for forex trading:

- Versatility. VSA is suitable for all markets: commodity, stock, forex, etc.

- Efficiency. This approach is really unique in behavioral research. It helps to bypass the limitations of classical fundamental and technical analysis.

- Accuracy. Volumes give an idea not only about the direction but also about the strength of the future trend. This is very useful.

Disadvantages of VSA for forex trading:

- Lack of clarity. There are no clearly defined rules in theory. There is a concept of market strength and weakness, but everything is quite vague. This is an obvious disadvantage for beginners. It takes a long time to sweat over a demo account to master everything.

- Bad for high-frequency trading. In short time frames, classic technical analysis is much more effective.

Signals for VSA Trading

Upthrust reversal pattern

The Upthrust pattern is the canon of using the concept. An uptrend pattern can appear on the candlestick chart as a large uptrend candlestick on super high volume with a further downward movement. Such anomalous candlesticks are not uncommon in forex and are associated with the manifestation of aggressive trading. In particular, these situations often occur after the broadcasting of important news.

The appearance of the pattern of upward movement sends a signal to many traders about the beginning of a reversal movement.

Shakeout

The term Shakeout consists of two words — Shake and Out. The term requires no explanation. It reflects what happens behind the candlestick formations. The big forex players often use the Shakeout to drive the weaker players out of the promising bull market. When trading on margin with leverage, their skinny deposits simply can't withstand the drawdown from the resulting ripples.

Shakeouts can be found on any type of chart, across different time frames and markets. The classic VSA pays a lot of attention to shakeouts.

Level Attack

On a price chart, a pattern is represented by powerful candles or bars with high volume, which "break" the current price patterns. For example, observing this during a sideways movement, you can say that the consolidation period is coming to an end. The main point: the candle should break out at a really strong level. The levels should be fully formed.

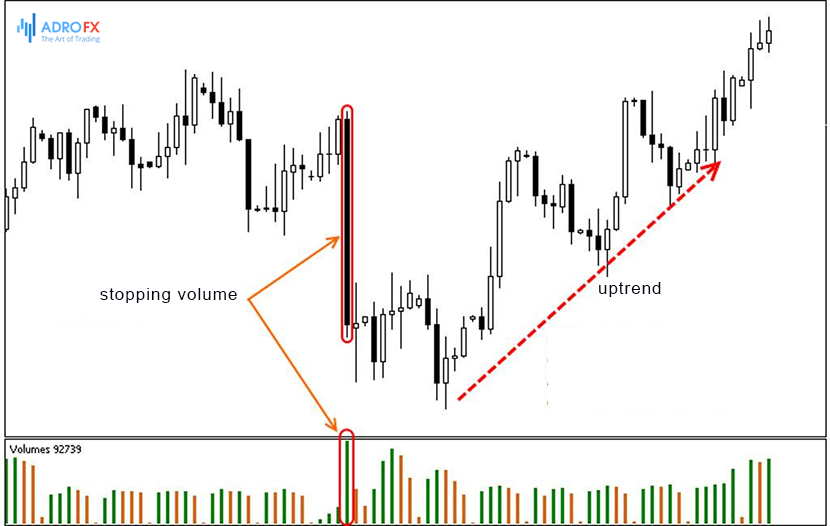

Stopping Volume

The harbinger of the end of the imminent change of the trend on the forex market. Often there is a sharp increase in liquidity against the background of rapid growth, which is quickly followed by a state of uncertainty and a decline in volumes.

It is important for forecasting. The main mistake beginners make is to see a mistaken continuation of the trend, mistaking a reversal for a consolidation. Big players can manipulate the market with such a trick, knocking down stop-losses en masse and changing the trading volume. Be careful.

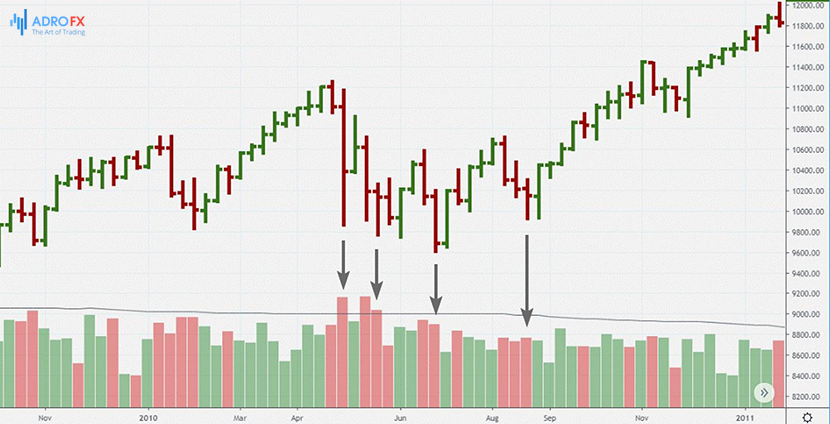

Demand/Supply Testing

It can be found on any trading instruments and time frames. It is a fairly reliable indicator that shows the current state of affairs in forex. In such cases, we can see how the uptrend bumps into a hidden resistance level, to which many sell orders were most likely attached. A simple "squeeze" does not work, so the market moves to the accumulation stage.

Tips for Using VSA

The peculiarities of VSA analysis are related to the fact that one cannot get the exact data on volumes in forex. Still, we can give you a few tips on this:

- Compare price readings from several brokers. They should not deviate below the average for the forex market. Ideally, if the broker does not draw quotes, but only acts as an intermediary.

- Treat VSA with caution during average volumes. During consolidation periods, the accuracy is less than during the peaks.

- Always expect a clear confirmation. Analyze forex volumes separately from price.

- Also, VSA will be more accurate in the stock market and less certain in the currency market. Therefore, the same strategies may work differently on different instruments.

Conclusion

Although the concept was invented almost 200 years ago, volumes are still a valuable indicator of any market (forex included). They offer an alternative methodology for measuring the market for analysis. Volume is also dangerous because it can be confusing to those who don't know about them.

So follow the proverb that advises measuring twice, and cutting once. Study the concept of VSA and use it wisely in your forex trading. As soon as you understand the role of volumes in price formation, you will start to progress. But it won't happen overnight.