Remember old stock market players who had no charts and therefore had to read the ticker tape and place buy or sell orders with a broker only via phone? Trading stocks is totally different nowadays: everything is done online in a few clicks of the mouse. But the necessity to pick a reliable broker who doesn’t charge exorbitant commissions is as burning a question now as it was decades ago. The variety of software, commission options, margin rates, and trading accounts can be overwhelming for those who break the ground on stock investment. One shouldn’t underestimate the importance of picking the best stockbroker because this choice determines an overall experience from trading and the success of efforts to establish a continuously growing income stream.

Pick Your Broker Wisely! The List of the Best International Brokers for Trading Stocks

To assist our readers in the matter of choosing the most suitable intermediary for profitable stock speculations, we have compiled this comprehensive list of top brokers with the untainted reputation that offer the combination of low commissions, state-of-the-art trading tools, access to a wide range of international stock markets, insightful education sections on respective websites, and helpful customer service. We have awarded each of these ten brokers scores on these criteria to facilitate the choice. .

Interactive Brokers

Our list of top international stock brokers begins with Interactive Brokers, also known as IBKR, the top-of-the-line brokerage firm that began to take root in the industry in 1993, after Interactive Brokers Inc. had obtained the license of a broker-dealer that offers access to international markets to its U.S. customers through the extensive international network of Timber Hill, the original market-making firm established by Interactive Broker’s founder, Thomas Peterffy, in 1982.

Our list of top international stock brokers begins with Interactive Brokers, also known as IBKR, the top-of-the-line brokerage firm that began to take root in the industry in 1993, after Interactive Brokers Inc. had obtained the license of a broker-dealer that offers access to international markets to its U.S. customers through the extensive international network of Timber Hill, the original market-making firm established by Interactive Broker’s founder, Thomas Peterffy, in 1982.

Over the years, the firm has been continuously progressing towards becoming the biggest international online platform for trading stocks and other financial instruments like forex, indices, mutual funds, warrants, options, futures, and bonds. This top stock broker currently opens the gateway to 135 markets in 33 countries, with 23 currencies available for account funding and asset purchasing, ranging from US Dollar (USD) to Israeli Shekel (ILS).

- In the Americas, Interactive Brokers provides means for trading stocks and ETFs with Arca (NYSE), the Toronto Stock Exchange, and the Mexican Stock Exchange.

- In Europe, it’s the London Stock Exchange, BATS Europe, Euronext, and CHI-X Europe.

- The markets in the Asia Pacific region can be entered through the Australian Stock Exchange (ASX), the Hong Kong Stock Exchange (SEHK), the National Stock Exchange of India (NSE), the Tokyo Stock Exchange, and the Singapore Exchange, among others.

This is only a short list of major stock trading platforms accessible through Interactive Brokers; in total, there are over 80 market centers across these regions where speculations can be done. The firm offers two account types, namely IBKR Lite and IBKR Pro.

The first one is designed specifically for retail stock traders, including independent traders and those who manage retirement or trust accounts, and financial advisors that carry out financial operations on the platform on behalf of their customers. However, those advisors must conduct business in the United States and have no more than 15% of their client accounts and client equity located outside of the U.S.

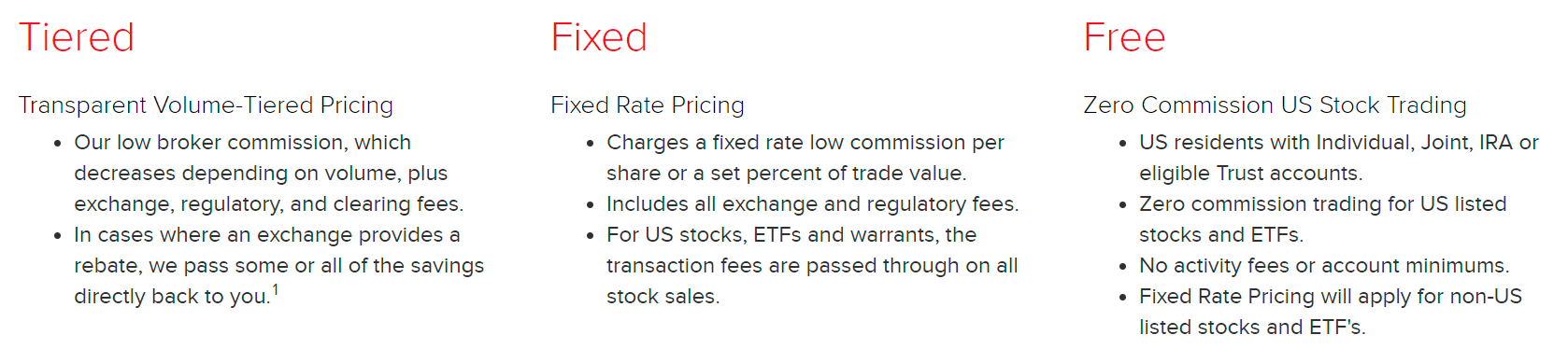

Interactive Brokers Commissions

Opting for IBKR Lite allows trading stocks and ETFs that are listed on U.S. exchanges free of commission. There is a fixed pricing on trading stocks on international markets - it implies that the broker charges a fixed sum per share, which encompasses IB commission, as well as regulatory and transaction fees. The fixed fee amounts to $0.005 per share for U.S. stocks, including pink sheet stocks, with the minimum fee per order being $1 and the maximum - 1% of trade value. For the Canadian markets, the fee is $0.008 per share or 0.5% of trade value; for the Mexican ones, it stands at 0.1% of trade value.

Moreover, IBKR Lite ensures that there are no account minimums, and it also doesn’t charge any inactivity fees. The users of the IBKR Pro plan are charged the commission that goes from $0.0005 to $0.0035, but with it comes access to IB SmartRouting, the proprietary mechanism for continuous scanning of competing markets that is capable of detecting the price improvement of up to $0.47 per share. The system then re-routes a fraction or an entire order to a more profitable avenue and then executes the said order electronically. The firm also offers arguably the lowest margin loan rates for stock traders that don’t exceed 1.57% in USD.

For seamless stock trading experience, Interactive Brokers offers four trading platforms: Client Portal, Trader Workstation, IBKR Mobile, and IBKR APIs, with advanced analysis features like two levels of market data, advanced market scanners, market signals, streaming news services, and alerts. Those who use the IBKR Pro account and trade stocks via Trader Workstation can utilize more than 100 order types and trading algorithms that can be adapted to any trading strategy. Lastly, this top stockbroker has a very useful feature called “fractional shares” or “fractional trading” that is superb for low cash balances since it allows one to supplement the portfolio with shares of expensive stocks like Amazon (AMZN), priced at $3,461 per share, or Google (GOOG) at $2,600 per share, without buying the whole stock. The fees associated with fractional trading are the same as the ones charged for the regular stock trading on IBRK Lite and IBRK Pro.

Pros:

- Interactive Brokers offers one of the lowest commission and fees on stock trading;

- There is a very good selection of feature-packed trading platforms and supported products, with stock trading supported across all platforms;

- Apart from stocks, Interactive Brokers provides a wide spectrum of investment options;

- Trade execution and margin rates are among the best in the industry;

- The broker also provides an extensive selection of education resources, useful for both nascent and experienced stock investors;

- The broker offers a free trial period.

Cons:

- All trading platforms are quite sophisticated, which might not be suitable for novice traders;

- The multi-tiered pricing plans could also be confusing for beginners;

- No option for backtesting of trading strategies;

- The SmartRouter function is available only for IBKR Pro, which puts the users of IBKR Lite at a disadvantage.

Our verdict

- Overall rating - 4,5 out of 5. Interactive Brokers is without a doubt a top-notch provider of stockbroking and other trading and investment services across numerous international markets. The customers of International Brokers can count on getting seamless trade execution, along with access to an array of trading tools. Low margin interest rates is also a significant factor that earned Interactive Brokers a top score and our recommendation.

- Commission rating - 4 out of 5. When compared to other top stockbrokers, Interactive Brokers impose commission and fees that are among the lowest on the market. However, in our opinion, its volume-tiered pricing could be complicated for newcomers. US residents can get zero commission on US stock trading.

- Education rating - 4.5 out of 5. Interactive Brokers provides access to a vast selection of educational materials and platforms, including Trader’s Academy, Student Trading Lab, as well as a solid selection of webinars, glossaries, and blog posts.

- Service rating - 3 out of 5. We think that this is probably the Achilles heel of Interactive Brokers as many customers have been complaining about slow response from the support team, the sub par user interface and navigation, along with some software bugs.

AJ Bell

AJ Bell is a Manchester-based publicly owned investment company that was established in 1995 by Andy Bell, a veteran investor and mathematician who currently acts as the Chief Executive Officer, and Nickolas Littlefair, a now-retired financial guru who served a number of years as the non-executive director at AJ Bell. A small firm with a starting capital of £10,000 has grown into one of the UK's biggest online investment platforms with nearly £73 billion of assets under management (AUM) and a revenue of £126.7 million as of 2020.

AJ Bell is a Manchester-based publicly owned investment company that was established in 1995 by Andy Bell, a veteran investor and mathematician who currently acts as the Chief Executive Officer, and Nickolas Littlefair, a now-retired financial guru who served a number of years as the non-executive director at AJ Bell. A small firm with a starting capital of £10,000 has grown into one of the UK's biggest online investment platforms with nearly £73 billion of assets under management (AUM) and a revenue of £126.7 million as of 2020.

The broker features several account types, namely SIPP, ISA, Lifetime ISA, a dealing account, and Junior accounts for customers' children - investment in stocks is available through all accounts, though the dealing account is the best option for frequent trading. However, investment through the Lifetime ISA account will make UK residents eligible for a £1,000 government bonus.

As for the commissions and fees, trading stocks on international markets with AJ Bell will cost you £9.95 ($13.43) per deal if you do it online and as much as £29.95 ($40.43) per deal if done via phone. There is also an extra foreign exchange charge that goes from 1% for the first £10,000 in trading volume and then gradually goes down to 0.25% when the volume exceeds £30,000. AJ Bell provides access to 24 international stock markets, encompassing all European, American, and major Asian markets.

Pros:

- AJ Bells is a competitively priced stockbroker, though it's definitely not the cheapest one since a trader would have to pay both a dealing charge and an additional foreign exchange charge.

- Suitable for beginner and intermediate stock traders who are managing small and mid-sized portfolios.

- AJ Bell offers several account options for minors, which is a good way for family people to secure the financial future of their children through opening a joint account.

- The broker has a special compensation fund to ensure that the customers won't be left high and dry in case the company goes under.

- The broker doesn't charge anything for opening an account, as well as making deposits or withdrawals. There is also no minimum deposit requirement, which makes AJ Bell accessible to all traders and investors.

- The customer service is competent and responsive.

- Both desktop and mobile trading applications are user-friendly and bug-free.

Cons:

- Handling a big portfolio through AJ Bell could be more expensive in comparison to other stockbrokers that impose fixed trading fees.

- The range of tools for technical analysis and research could be improved. Besides, most of them are from third-party providers.

- The broker doesn't offer a demo account.

- Customer support isn't available around the clock.

Our verdict

- Overall rating - 4.5 out of 5.In our opinion, AJ Bells is one of the finest stockbrokers that operates in numerous international stock markets. We reckon that it's technologically advanced and diverse enough to heed the needs of all stock traders and investors, but not without some minor flaws.

- Commission rating - 3 out of 5.AJ Bells is definitely not the cheapest stockbroker to trade with - penny pinchers might even find its commission of over $10 per deal to be too steep - but we are convinced that it's still one of the most affordable brokers around.

- Education rating - 3,5 out of 5.AJ Bell doesn't offer a proprietary educational program for stock traders and investors like Interactive Brokers does, which is certainly a shortcoming. It only trains new employees through the Company Awareness Program.

- Service rating - 4.5 out of 5.AJ Bell is definitely a top-tier international stockbroker with competitive fees, a wide choice of investment options, and a nice selection of account types. Their customer service is close to being impeccable, though it doesn't operate around the clock.

Degiro

When compared to other top stockbrokers on the list, Degiro is a new kid on the block since this financial services intermediary entered the industry in 2013. Despite its relatively young age, this German-Dutch broker already has a customer base that is larger than that of many older firms - the platform boasts over 1,000,000 active accounts. It was named the Best Broker for Stock Trading and the Best Discount Broker by several rating agencies.

When compared to other top stockbrokers on the list, Degiro is a new kid on the block since this financial services intermediary entered the industry in 2013. Despite its relatively young age, this German-Dutch broker already has a customer base that is larger than that of many older firms - the platform boasts over 1,000,000 active accounts. It was named the Best Broker for Stock Trading and the Best Discount Broker by several rating agencies.

Degiro offers a free online account (Basic) which can be improved to Custody, Trader, Day Trader, and Active. We reckon that the Basic account would be enough to satisfy most stock trading and investment needs, though it doesn’t provide access to leverage.

The Custody account deals with dividend payments and is associated with additional fees. The broker provides access to all major European, North American, and Asian markets, such as the London Stock Exchange, NASDAQ, NYSE, and Hong Kong Stock Exchange, using the Direct-to-Market order routing and a Smart Order Router, or prime brokers like Morgan Stanley or Clearing Bank.

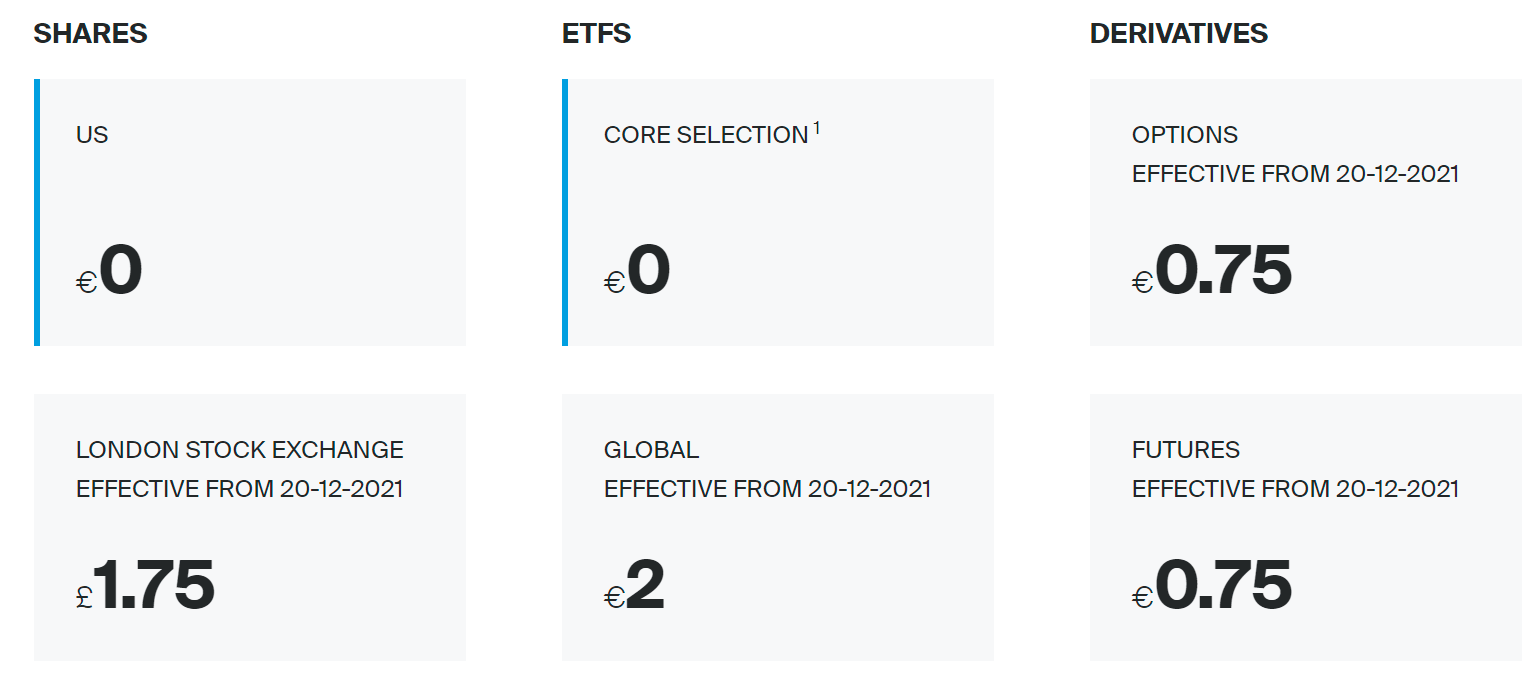

Degiro Commissions

Speaking of fees, Degiro positions itself as the broker with “incredibly low fees,” which are up to 99% lower than stock trading fees applied by other top financial brokers like Hargreaves & Lansdown, Barclays, and Halifax. For instance, an investment in Testa at the threshold of $6,800 would cost the investor as little as $0.61 per share, while Halifax would charge you a stiff $17 for the same purchase. To be more specific, traders and investors would have to pay £1.75 + 0.014% per share for operations with UK stocks, with the fee being capped at £5. Trading US stocks will cost €0.5 + $0.004 per share; European stocks, except for those originating from the Czech Republic, Greece, and Hungary (€10 + 0.16%), are subject to a charge of €4 + 0.05%. Asian markets (Australia, Hong Kong, Japan, Singapore) can be speculated on with a fee of €10 + 0.06%.

Pros:

- Degiro’s main advantage is that this broker charges one of the lowest fees across the entire industry.

- The broker offers access to a very wide range of international stock exchanges.

- Degiro doesn’t charge any deposit or withdrawal fees; it also costs pennies to open an account.

- The trading platform is easy to comprehend and navigate, with seamless order execution. Available in both desktop and mobile versions.

- Boasts a fast-growing user base.

- Regulated by two reputable financial authorities.

Cons:

- The absence of a demo account.

- Traders on international stock markets are subject to connection market fees.

- The platform charges an extra annual fee for displaying live stock prices.

- No US customers allowed.

- Deposits are made only via bank transfers.

Our verdict

- Overall rating - 4,5 out of 5. We can conclude that Degiro is an all-around good stock broker that offers very competitive fees, as well as access to all popular markets and a variety of trading instruments. Its main flaw is that Degiro doesn’t allow card deposits and charges extra for displaying live prices.

- Commission rating - 5 out of 5. Low commissions on stock trading are definitely Degiro’s main selling point. Other brokers might offer even lower fees, though there’s only a handful of them, though Degiro’s overall value proposition is definitely much better.

- Education rating - 4 out of 5. Degiro has an extensive knowledge base that includes a very helpful Investor’s Academy, along with exhaustive information on available instruments, trading strategies, markets, and exchanges.

- Service rating - 4,5 out of 5. In our experience, Degiro has a highly responsive customer service team that deals with any submitted tickets within 24 hours. This, combined with all the above-mentioned factors, put Degiro on par with elite stockbrokers.

eToro

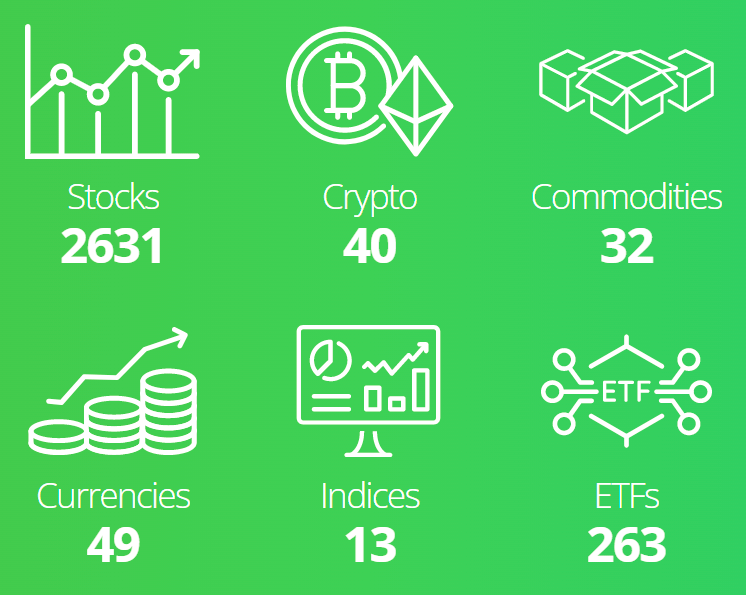

eToro is a globally renowned multi-asset brokerage company known primarily for being one of the best copy trading platforms in the industry. It affords access to an extensive number of top financial markets, more specifically, 49 Forex, 40 crypto, and 32 commodities markets; 13 indices, 256 ETFs, and - what interests us the most - as many as 2592 stock markets.

eToro is a globally renowned multi-asset brokerage company known primarily for being one of the best copy trading platforms in the industry. It affords access to an extensive number of top financial markets, more specifically, 49 Forex, 40 crypto, and 32 commodities markets; 13 indices, 256 ETFs, and - what interests us the most - as many as 2592 stock markets.

This clearly shows that eToro is a stock-centered broker that has amassed over 17 million registered users since the year of its establishment, which is 2007. eToro’s brokerage services are regulated by the Cyprus Securities & Exchange Commission (CySEC), the Financial Conduct Authority (FCA), and an Australian Financial Securities & Investments Commission (ASIC), with corresponding licenses being obtained from all these regulatory bodies, which allows us to conclude that eToro is an absolutely safe stockbroker.

Traders and investors who want to get involved with eToro can open either free retail or a professional account. However, the minimum deposit on eToro is $200 (commission-free) or higher, though the deposit is available via credit card and many other payment outlets. The broker has a fixed withdrawal fee of $5.

eToro Tradeable Assets

Retail traders are able to use the entire spectrum of trading tools and markets, including stocks, though the platform restricts their ability to trade with leverage. However, retail customers are subject to negative balance protection, margin closeout restrictions, and under certain conditions, their losses could be covered by the Investor Compensation Fund. Professional clients are allowed to trade with much higher leverage and get equity loss compensation. eToro also offers five types of VIP accounts (Silver to Platinum+) for customers with balances greater than $5,000. All eligible clients, except cryptocurrency traders, receive free insurance of up to $1 million, which covers all positions in stock markets.

eToro prides itself on charging 0% commission on stock trading, regardless of the produced trading volume; the broker also doesn’t impose any management, ticketing, rollover, and administration fees, as well as relieves traders from stamp duty and financial transaction taxes. However, this norm doesn’t apply to customers from the United States and CFD investors. The platform makes its profit from bid/ask spreads.

Pros:

- Highly regulated.

- Very attractive fee structure.

- A huge number of stock markets to profit from.

- Availability of social trading.

- Offers a demo account with $10,000 in virtual money.

Cons:

- The minimum deposit is a bit high.

- Non-trading fees could take their toll on the account.

Our verdict

- Overall rating - 5 out of 5. We are certain that eToro is one of the fastest-growing stock brokers with the customer-first approach to service provision. Zero commissions and copy trading give it an edge over competitors.

- Commission rating - 5 out of 5. In our experience, eToro has probably one of the most lucrative fee structures among other top brokers. It does apply non-trading fees, but all in all, the commissions here are far from being predatory.

- Education rating - 3.5 out of 5. The broker offers a wide range of educational content, including a variety of articles, the Trading School program, and a YouTube channel, though it isn’t the most extensive library of all brokers presented here.

- Service rating - 4.5 out of 5. eToro’s support team can be slow at times, but they always answer our inquiry and get issues solved. Customers may also experience withdrawal delays. Other than that, eToro offers top-notch brokerage services.

FinecoBank

FinecoBank is an Italian brokerage firm (and a bank) that used to operate under the wing of UniCredit, a Milan-based transnational banking group, but got free from its influence in 2019, five years after it had conducted the IPO, got listed on Borsa Italiana and also became a part of Euro Stoxx 600 Index. In 2020, the broker expanded its reach to the United Kingdom; it currently offers its services mainly to customers from those two countries, which, as we think, is this broker’s significant drawdown. Apart from stocks, registered customers from these two jurisdictions can trade Forex, indices, futures, CFDs, options, bonds, ETFs, and commodities.

FinecoBank is an Italian brokerage firm (and a bank) that used to operate under the wing of UniCredit, a Milan-based transnational banking group, but got free from its influence in 2019, five years after it had conducted the IPO, got listed on Borsa Italiana and also became a part of Euro Stoxx 600 Index. In 2020, the broker expanded its reach to the United Kingdom; it currently offers its services mainly to customers from those two countries, which, as we think, is this broker’s significant drawdown. Apart from stocks, registered customers from these two jurisdictions can trade Forex, indices, futures, CFDs, options, bonds, ETFs, and commodities.

The broker is regulated by the following financial authorities: the national bank and the National Commission for Companies and Stock Exchange (CONSOB) in Italy, and Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) in the United Kingdom, which, we reckon, is enough to put FinecoBank is the “safe broker” category.

FinecoBank offers two types of trading accounts. The first one, “One Stop Solution,” is a universal account that affords means for dealing with 20 different foreign currencies. The universality of this particular account is that its owner also becomes eligible for FinecoBank’s professional money management and banking services. The second one is called “ISA” - intended for stock traders and investors from the United Kingdom; it’s a gateway to the biggest European and American stock markets, including NYSE, LSE, Borsa Italiana, and Euronext. This account offers good perks, fee-wise, but the owners will be charged a 0.25% annual service fee. Holders of both account types are allowed to trade with a leverage of up to 100:1. Unlike eToro, FinecoBank is known for imposing very low non-trading fees, doesn’t take a cut from withdrawals, and doesn’t charge inactivity fees.

But contrary to the previously reviewed stockbroker, its Italian counterpart has a fixed commission on stock trading: $3.95 per trade for US shares, £2.95 for UK shares, and €3.95 for EU shares. Spanish and Swiss markets are subject to a 0.19% fee. Although FinecoBank doesn’t impose any deposit barriers, it only accepts deposits via bank transfer, which, in our opinion, makes this stockbroker far less inclusive.

Pros:

- Excellent reputation.

- Relatively low fees with regard to stock trading.

- Availability of additional banking services.

Cons:

- Bank transfer is the only available deposit option.

- Charting tools as subpar.

- Operates only in two jurisdictions.

Our verdict

- Overall rating - 3.5 out of 5. We think that FinecoBank is a very good stockbroker in many departments, though we did lower its grade due to the fact that it serves a limited circle of customers. Its fees and investment solutions are on the level with other top brokers.

- Commission rating - 4 out of 5. The fees here are low but definitely not the lowest in the industry. Commission on non-stock trading, like Forex and options, are, in fact, quite steep.

- Education rating - 2 out of 5. We believe that FinecoBank has one of the poorest education sections among other stockbrokers under review. It certainly lacks content, and most of it isn’t insightful enough.

- Service rating - 4 out of 5. In our experience, FinecoBank has a competent support team, while its other financial services are also at the highest level. However, its limitation to bank transfers for deposits has bitten a big chunk off the broker’s rating.

Hargreaves Lansdown

Next on our list is a Bristol-based stockbroker with a solid reputation and an extensive selection of investment options. It was founded in 1981 by Peter Hargreaves and Stephen Lansdown and, over these past three decades, developed into one of the biggest and the most reliable stockbrokers in the United Kingdom and beyond that is regulated by the Financial Conduct Authority (FCA).

Next on our list is a Bristol-based stockbroker with a solid reputation and an extensive selection of investment options. It was founded in 1981 by Peter Hargreaves and Stephen Lansdown and, over these past three decades, developed into one of the biggest and the most reliable stockbrokers in the United Kingdom and beyond that is regulated by the Financial Conduct Authority (FCA).

Hargreaves Lansdown has a decent selection of stock markets as it affords access to 21 international stock exchanges, including London Stock Exchange, NASDAQ, NYSE, and Canadian Venture Exchange, which is considerably more than, for instance, Interactive Brokers is capable of providing. However, before trading on US markets, one would be obliged to complete the W-8BEN tax form and renew it every three years, which might seem like too much hassle for someone.

To buy/sell international stocks, a user would have to open either a Fund and Share dealing account or a Stocks and Shares ISA account. The former costs only £1 to launch, imposes no investment limits, and doesn't charge anything for holding shares. The latter has an entry barrier of £100, along with a £20,000 investment threshold and a 0.45% annual fee for holding shares (capped at £45). Stock trading fees can hardly be called low - dealing with the UK or US shares will cost you from £5.95 to £11.95 per trade. Also, the currency conversion fee applies since Hargreaves Lansdown's has only one base currency - GBP, which is its main flaw. The broker doesn't charge any deposit or withdrawal fees.

Pros:

- Secure broker with an established reputation.

- Wide selection of stock markets.

Cons:

- Stock trading fees aren't among the lowest.

- No demo account.

Our verdict

- Overall rating - 4 of 5. We deem Hargreaves Lansdown to be a trustworthy broker that is most suitable for investors from the United Kingdom who aren't too worried about stock trading fees.

- Commission rating - 3 of 5. This broker isn't the most altruistic of the bunch, so mind the commissions when trading stocks.

- Education rating - 5 of 5. Definitely one of the most educative brokers that, apart from publishing regular articles and releasing tutorial videos, conducts webinars and live seminars.

- Overall service - 5 of 5. In our opinion, Hargreaves Lansdown has superb customer service and trading platforms that work without a hitch, thus ensuring a great user experience.

IG

IG is yet another UK-based stockbroker that belongs to a slightly older generation of brokers since it was established in 1974. Over these decades, IG gathered a sizable client base of over 300,000 satisfied investors and traders who are seeking investment opportunities in more than 17,000 markets. The broker is licensed under the Bermuda Monetary Authority and operates under the regulatory umbrella of FCA and BaFin. It was awarded “The Best Multi-Platform Provider” in 2020.

IG is yet another UK-based stockbroker that belongs to a slightly older generation of brokers since it was established in 1974. Over these decades, IG gathered a sizable client base of over 300,000 satisfied investors and traders who are seeking investment opportunities in more than 17,000 markets. The broker is licensed under the Bermuda Monetary Authority and operates under the regulatory umbrella of FCA and BaFin. It was awarded “The Best Multi-Platform Provider” in 2020.

IG offers a single free trading account, the confirmation of which, however, could take up to a couple of days. There is a minimum deposit threshold of $300, which puts IG at a disadvantage in comparison with other brokers on this list, though this threshold is nullified if the deposit is made via bank transfer.

The broker doesn’t apply its own spread on operations that involve shares CFD trading but charges a relatively low commission. Those who work with Australian markets will have to pay 0.08% per side; trading US stocks will cost $0.02 per share; Euro markets can be traded at a 0.1% fee while playing Asian markets costs 0.18%.

Pros:

- Offers a plethora of deposit and withdrawal gateways.

- The inactivity fee doesn’t apply for two years.

- Well-designed trading platform.

Cons:

- Stock CFD fees are on the higher side.

Our verdict

- Overall rating - 4.5 of 5. We conclude that IG is a very reliable stockbroker that meets the needs of both rookie and veteran investors.

- Commission rating - 4 of 5. IG’s fees aren’t the lowest, but they also wouldn’t make a dent in your account. Affordable to those who are willing to pay for superior service.

- Education rating - 5 of 5. IG has enough educational tools to start a stock trading academy. From news and trade ideas trading psychology podcasts, IG offers every bit of information a stock speculator might need.

- Overall services - 3 of 5. Customer service isn’t IG’s strong suit - it’s not available around the clock and could be unreachable even during business hours. But all in all, IG is a great broker that is worth opening an account with.

Interactive Investor

Interactive Investor is a stockbroker that has been operating since 1995 from its headquarters in Manchester, UK. After its acquisition by Abrdn from JC Flowers & Co in 2016, Interactive Investor has quickly risen to the status of the second-largest investment platform in the United Kingdom. It’s currently regulated by the Financial Conduct Authority. In 2021, Interactive Investor was awarded “The Best Stock Broker for International Dealing” and “The Best Low-Cost Stockbroker” by ADVFN.

Interactive Investor is a stockbroker that has been operating since 1995 from its headquarters in Manchester, UK. After its acquisition by Abrdn from JC Flowers & Co in 2016, Interactive Investor has quickly risen to the status of the second-largest investment platform in the United Kingdom. It’s currently regulated by the Financial Conduct Authority. In 2021, Interactive Investor was awarded “The Best Stock Broker for International Dealing” and “The Best Low-Cost Stockbroker” by ADVFN.

To begin trading on more than 40.000 international stock markets, you would have to open a Trading Account, which is free at the registration phase, but then you’d have to pay a monthly fee of £9.99, which also applies to Stocks and Shares ISA and Junior ISA accounts.

Some might deem it inappropriate, especially since other stockbrokers on our list refrain from imposing such a commission. But that fee makes sense if you intend to hold onto your investment for more than 30 years. In that case, having a Trading Account could save up to £40,000 in comparison to Hargreaves Lansdown or AJ Bell. Interactive Broker’s fees on trading US and UK stocks amount to $11.2 while trading German markets would cost $28.

Pros:

- Supports 9 base currencies.

- No commission on regular investments.

Cons:

- Charges a flat monthly account fee.

Our verdict

- Overall rating - 3.5 of 5. Even though we do consider Interactive Investor to be a good all-around stockbroker, its mandatory monthly account fee might discourage some investors from opening an account with this provider.

- Commission rating - 3.5 of 5. Once again, the monthly fee forces us to reduce the overall rank, though stock trading commissions there aren’t too high.

- Education rating - 4.5 of 5. Interactive Investors has everything that a learning trader needs, including a demo account, an extensive tutorial, and a wide selection of educational videos.

- Overall service - 3.5 of 5. The customer service reacts promptly via phone but tends to be too slow when being addressed online. But the overall user experience allows Interactive Investor to live up to the standard of the top broker.

Saxo Markets

Saxo Market is the Singapore-based international stockbroker that entered the industry in 2006 as a licensed subsidiary of one of Denmark’s largest investment banks, Saxo Bank A/S. It’s a multi-regulated broker with official authorization to operate in 15 jurisdictions, though the main oversight is done by the FSA. Although Saxo Markets allows access to a multitude of stock markets and rightfully holds its place among top stockbrokers, it’s far more accoladed as a Forex broker.

Saxo Market is the Singapore-based international stockbroker that entered the industry in 2006 as a licensed subsidiary of one of Denmark’s largest investment banks, Saxo Bank A/S. It’s a multi-regulated broker with official authorization to operate in 15 jurisdictions, though the main oversight is done by the FSA. Although Saxo Markets allows access to a multitude of stock markets and rightfully holds its place among top stockbrokers, it’s far more accoladed as a Forex broker.

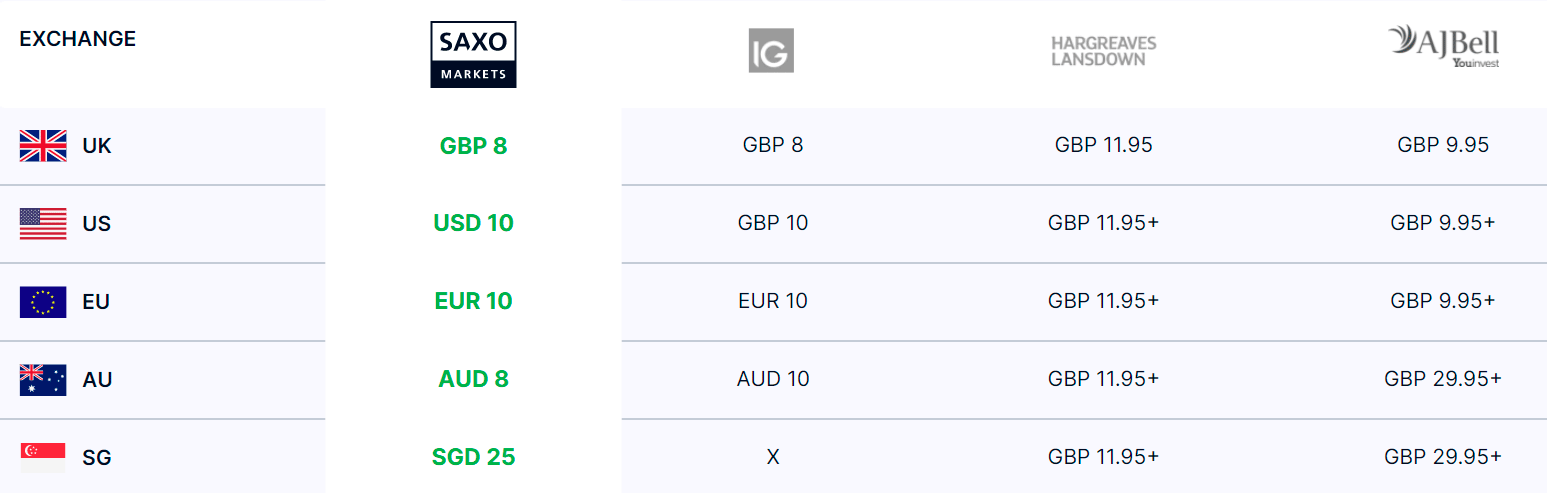

This broker provides means for trading across 60 international stock exchanges, including the Chinese Stock Exchange, that accommodate more than 30,000 stocks, along with 5,500 ETFs, the feat that is achieved only by the best brokers. Saxo Capital offers three account types: Classic (minimum deposit - $2,200), Platinum ($222,500), and VIP ($1,200,000). As you can see, the barrier here is quite high, though Saxo Markets is said to be one of the most technologically advanced stock trading platforms. Speaking of fees, this broker charges 4 USD per share for US stocks, 5 SGD for Singaporean stocks, 8 AUD for Australian stocks, and 1500 for trading on Japanese markets.

Saxo Markets' Commissions Comparison

Pros:

- Affords access to a very broad list of international stock exchanges.

- Very competitive fees.

- Good range of research tools.

Cons:

- High initial deposit requirements.

Our verdict

- Overall rating - 4 of 5. Saxo Capital grants access to a remarkable range of markets and services, but, to our mind, its inactivity fee and high investment barrier make it unattractive for many retail traders.

- Commission rating - 4 of 5. Not the lowest commission we’ve seen among stockbrokers, but they are low enough for us to put Saxo Markets among the finest firms in the industry.

- Education rating - 4 of 5. Having a demo account and a selection of educational videos is great, but the absence of insightful articles deserves the grade reduction.

- Overall service - 4 of 5. Frankly, Saxo Markets could have been named the best all-around stockbroker if not for two downsides: subpar customer service and high deposit requirements.

TradeStation

TradeStation is a long-established stockbroker that has been around since 1982. It’s based in the United States (Plantation, Florida) and falls on the regulatory radar of the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). It provides means for trading a variety of financial products, including stocks, options, ETFs, futures, cryptocurrencies, bonds, and mutual funds. As you might have noticed, Forex trading isn’t available through TradeStation, which is a shortcoming on the part of this broker as a whole, though this fact doesn’t affect our evaluation of its stock brokering services.

TradeStation is a long-established stockbroker that has been around since 1982. It’s based in the United States (Plantation, Florida) and falls on the regulatory radar of the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). It provides means for trading a variety of financial products, including stocks, options, ETFs, futures, cryptocurrencies, bonds, and mutual funds. As you might have noticed, Forex trading isn’t available through TradeStation, which is a shortcoming on the part of this broker as a whole, though this fact doesn’t affect our evaluation of its stock brokering services.

Obviously, TradeStation opens doors to all major US stock exchanges and a decent number of international markets. For this purpose, TradeStation offers TS Select and TS Go accounts with no minimum deposit requirements that can be supplemented with nine base currencies.

The broker doesn’t charge the deposit fee, though the deposits can’t be made via bank card or electronic wallet. When it comes to commissions, TradeStation used to charge a small commission for trading stocks, but it changed the model to zero-commission, with a small $0.6 fee applicable for stock options.

Pros:

- Good trading platform.

- Zero stock trading fees.

- Excellent education section.

Cons:

- Deposits/withdrawal might get complicated.

Our verdict

- Overall rating - 4 of 5. In our opinion, TradeStation combines a nicely designed trading platform with below-standard customer service, as well as low stock trading fees with complicated deposit and withdrawal processes, which probably makes it the most ambiguous top stockbroker on our list.

- Commission rating - 5 out of 5. TradeStation is now a zero-fee broker, which is a good enough reason even for the stingiest traders to use this broker.

- Education rating - 5 of 5. All educational materials provided by TradeStation are of top quality and of enough quantity to satisfy even the most inquisitive trading mind.

- Overall service - 3.5 of 5. We have slashed down the grade considerably because TradeStation doesn’t offer 24/7 support, which is a must of the top stockbroker, though their live chat support is satisfactory.

Bottom line

This completes the list of the best international stockbrokers with regard to the size of trading commissions, reliability, the broadness of available markets, user experience, and the quality of service. They weren’t placed in a strict order, so we wouldn’t appear biased because almost every broker has its unique pros and cons, but all of them are excellent for assisting in your stock trading journey.

However, our scores allow us to highlight the stockbrokers that fit a particular need. For instance, if you want to educate yourself about stock trading, TradeStation, IG, and Hargreaves Lansdown would be the best option.

Those who care about the commission size should opt for eToro or Degiro. And if the service level is of particular importance to you, Saxo Markets, Hargreaves Lansdown, and AJ Bell would definitely fit the bill. But all in all, the choice of broker should depend on your financial capabilities, individual trading style, and preferences concerning the complexity of trading software.