New investors are always advised to do ample research and “due diligence” when selecting which assets to invest in or trade. By using comprehensive analysis, making decisions about which to invest in and how to get the most return on investment will become a lot easier and lead to more consistent success. Read the following guide to learn more about how to analyze crypto using a variety of methods.

Introduction To Cryptocurrency Analysis

Learning how to analyze crypto before trading is highly recommended, and can potentially save an investor substantial losses by preventing poor decision making and steering one in the right direction when it comes to financial decisions. For example, crypto analysis can help investors avoid bear markets, and know when an asset is about to turn bullish again. It can also help to predict major fluctuations across the market.

Crypto Markets Analysis Vs. Stock Markets Analysis: Key Differences And Similarities

The methods used to analyze crypto versus the stock market are both the same and extremely different, depending on which method is used. For example, technical analysis works about the same no matter the asset class, as price action responds to indicators and setups in a similar manner. However, because crypto assets are speculative, they are highly sensitive to sentiment changes that stocks do not deal with.

Stocks and other traditional financial assets are also easier to work with when using fundamental analysis, as crypto fundamentals mainly focus on things like whitepapers and blockchain data. As we dive into what each area of crypto analysis entails, the differences and similarities will become even more clear.

3 Methods for Analyzing Cryptocurrency And How To Combine Them

There are three primary methods to analyze digital currency and digital assets: technical analysis, fundamental analysis, and sentimental analysis. Technical analysis refers to chart signals using patterns, trend lines, indicators, and candlesticks. Fundamental analysis relies on qualitative and quantitative data, such as blockchain transactions or project whitepapers.

Sentimental analysis is something different entirely, and looks at what the market participants are thinking and feeling at any given moment. Combining them can lead to far greater and more frequently success by having the best possible read on a market and related conditions.

Technical Analysis

Due to the speculative nature of cryptocurrencies, technical analysis works especially well across the asset class. Cryptocurrency technical analysis works a lot like stock market or forex technical analysis.

- Reading And Gaining Basic Information From Candlestick Charts. Technical analysis starts with opening a crypto price chart, like Bitcoin or Ethereum trading against the dollar. Candlestick charts are the most commonly used, because they provide basic data such as each trading session open, high, low, and close.

- Using Trend Lines. Using trend lines is among the most basic analysis techniques. It allows the investor or trader to discover chart patterns that can help to predict market movements. It also increases the probability of successfully following a growing or declining trend.

Understanding Indicators

Technical indicators and oscillators are a set of analysis tools that turn data sets into visual tools that layer into price action using charting software. Some of the most popular tools in this field are the MACD, Relative Strength Index, Ichimoku, Bollinger Bands, and much more.

- Support And Resistance. Support and resistance is one of the more important pieces of technical analysis. It tells investors or traders where the best place to place orders is located at. The strategy often advised is to sell or short at resistance and buy or long at support. When this stops working, the trading range has broken.

- Fundamental Analysis. Although technical analysis between digital and traditional assets is very similar, cryptocurrency fundamental analysis is completely different. There aren’t any company profits or losses or quarterly revenue reports to speak of that could impact pricing, for example. Instead, cryptocurrency fundamental analysis focuses on things like blockchain wallet data, and how active a network is.

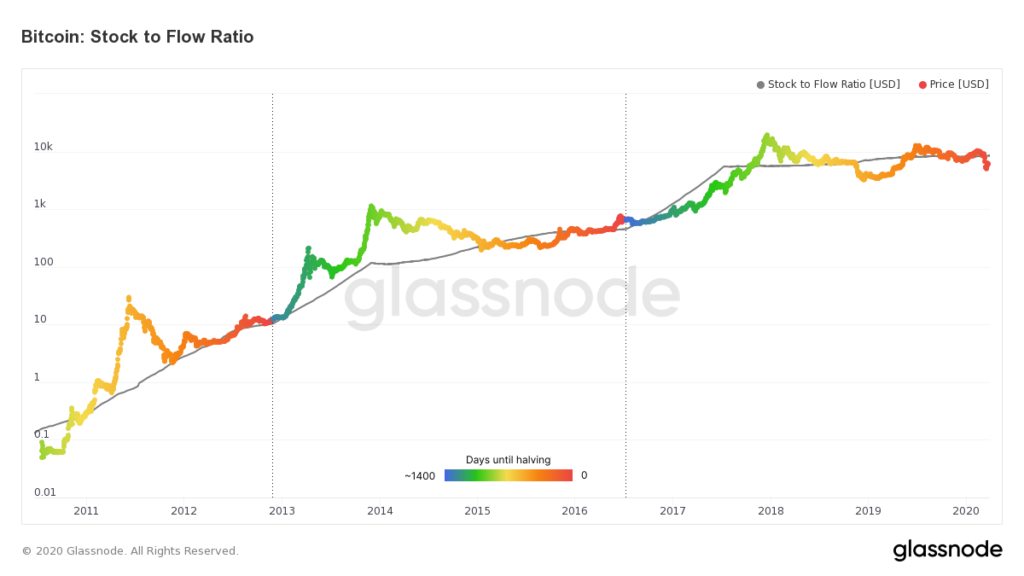

- On-Chain Analysis. Using on-chain data, investors can see how much value is being transacted across a blockchain network, how many coins are being held by wallets, how many coins are stored on a crypto exchange, and much more. There has been an explosion of on-chain analysts in recent years as new tools have been developed by companies like CryptoQuant, and Glassnode. These tools provide vital information about the health of a blockchain network and give insight into where coins are moving and at what amount.

- Read The Whitepaper. Staring with a project’s whitepaper will allow anyone to get a full understanding of what a project is capable of and its potential use cases directly from the creator or team behind the project. This best represents the ultimate goal of the speculative asset.

- Find Out More About The Team. Not every cryptocurrency project has a team, which is a major factor in how crypto differs from something like stocks. There is no company performance to review. However, many projects do have founders, CEOs, CTOs, and more, and if they do, be certain to dig into their credentials, character, and career.

- Competitive Analysis. Competitive analysis looks at how one coin stacks up to another. For example, what is the coin ranked according to its crypto market capitalization? An asset higher up the list, especially in the top ten, is more likely to succeed.

- Determine Whether The Token Has Real Utility. A lot of fundamental analysis especially in the qualitative category is going with your gut based on the available facts. It is up to the investor’s opinion in this case, to decide whether or not a token has real utility and will be utilized by its intended audience. One person’s trash is another person’s treasure, so there is a lot of wiggle room in this area.

- Regulation. Regulation speaks to the legality issues that surround certain cryptocurrencies. For example, the SEC stating that XRP was a security was a key factor in its recent market troubles. Regulation is also why the initial coin offering, also called the ICO, fell out of favor. Sudden sweeping regulation in the currently unregulated crypto market could be widely damaging. Singling out one specific project is even more dangerous.

Sentiment Analysis

Sentiment analysis is yet another method of analyzing the market to get a read on potential future price action. Because cryptocurrencies are speculative assets, they are highly susceptible to sharp and extreme changes in sentiment. It is these extreme changes in sentiment that are responsible for the asset class’s notorious volatility and violent price swings.

Fear & Greed Index

The crypto market fear and greed index measures sentiment from extreme fear to extreme greed, and can tell a lot about the current state of the market and its participants. For example, there are several popular investment quotes that recommend investors are to be greedy when others are fearful, and fearful when others are greedy. Using such a tool, it is a lot easier to take positions based on greed or fear. However, this information is best used to confirm other forms of analysis.

[How To Analyze Cryptocurrency? A Guide To Crypto Technical Analysis - image3 1]

Social Media

Social media is another way to read the market and the sentiment of its participants. Coins trending on social media is a great sign, and there have been tools created that measure the number of mentions any coin gets online. Reading through social media chatter online can also help to understand the state of the market. If investors are exuberant, they could be blind to a coming bull market reversal. If they are frightened, then they won’t be willing to buy at the best opportunities. Using this to your advantage can be a major benefit.

Summary: Why Combining These Crypto Analysis Tools Matters

Whether you are a bear or bull, using these cryptocurrency analysis methods and tools to analyze crypto assets before you take a position is highly recommended. None of the tools mentioned above are a guarantee of success. There are always market factors that can come out of nowhere and suddenly change all available information. The onset of the COVID pandemic is an ideal example of a black swan event that the market can’t properly price in ahead of time.

Efficient market theory suggests that outside of these unknown factors, the market will effectively price in all available data, such as news, utility, sentiment, technicals, and more. Technical analysis might appear to be a guessing game to some, but it is a practice geared toward increasing probabilities by using statistics from the history of past chart patterns.

Several top crypto trading platforms have begun to offer technical analysis tools built directly into the trading platform dashboard itself for user’s convenience. The built in charting software features all of today’s most popular indicators and oscillators and allows users to plot trend lines, find support and resistance, and much more.

With this information, traders can go long or short on more than 50 different trading instruments all on one award winning margin trading platform. Margin accounts are offered in BTC, ETH, USDT, and USDC, and can be used to trade CFDs on forex, crypto, stock indices, commodities, and more. When first getting started with cryptocurrency analysis, all the charts, signals, statistics, and more can be overwhelming and even confusing. As such, we’ve prepared this helpful FAQ answering all the commonly asked questions about how to analyze crypto.

[How To Analyze Cryptocurrency? A Guide To Crypto Technical Analysis - en 05 0620]

FAQ: Frequently Asked Questions

What Is Cryptocurrency Analysis?

Crypto analysis is the practice of studying cryptocurrencies and doing due diligence and research before taking any kind of position in an asset as an investor or trader.

What Are The Three Main Types Of Cryptocurrency Analysis?

The three main types of analysis crypto traders and investors can use are technical analysis, fundamental analysis, and sentiment analysis.

What Is Technical Analysis?

Technical analysis is the study of price charts to find patterns and other signals that can be used to predict the future outcome of price action with a degree of accuracy and improve the chances for success.

What Is Fundamental Analysis?

Fundamental analysis looks at the core fundamental reasons an asset could or should have value. This looks at all the related numbers and intangible factors, such as a good gut feeling about a specific sector. Fundamental analysis includes both qualitative and quantitative analysis types.

What Is Sentiment Analysis?

Sentiment analysis helps measure the emotional state that market participants are currently in based on the impact of price action. For example, a big sell off could leave the market in fear, while a huge rally could leave the market greedy.

What Type of Crypto Analysis Is Best?

No type of crypto analysis is best and combining all three in some capacity is the best way to proceed after reading this guide.