The crypto market undergoes a clear negative trend that is expected to last for a while. Bitcoin has plummeted by 33% this week and reached the 18-month low. Bitcoin ceases to exist as “digital gold” for many traders. Still, the bearish trend in the crypto market is bad news only for those who have long positions for BTC or any coins. What happens in the market now is a unique opportunity to make a fortune. The last time it was possible was two years ago when BTC was steadily growing.

Our analysts have prepared the trading recommendations for BTC and ETH and a short guide on how to trade short. Everything for you to make the most of this market situation!

What is a short trade?

A short trade, or a sell position, is a type of deal that brings profits from asset depreciation. Traders sell the assets, which a broker owns, and rely on its future price drop. That way traders hope to buy out the same amount of assets to pay back their broker and keep the profit from a difference in prices.

Trading short also goes under the name of “naked shorting”, for traders sell the assets they don’t own. It is a part that frightens most of the traders who usually trade long. But they should try shorting, too. And here is how to do it.

A simple example

For instance, it is early November 2021. You check the Bitcoin chart with the timeframe 5Y (i.e. 5 years). You see that it hits the ever-high price, more than 56K USD. But you also read on the news that crypto mining had been banned in China. You came to the conclusion that the price was going to drop because of it.

In mid-November ’21 you opened a sell position at 56000 USD for Bitcoin and closed it 2 months later, already in the mid-January ’22, at a price of 31000 USD. The price of BTC has plummeted and decreased by half. So, shorting brought you 44.64% of gross profit only in 60 days. With leverage, this position would bring up to 10 times more.

You see that shorting works just like trading long. Only the open order is the opposite. Now let’s see how you can apply it to the real-time market. To guide you in the current trends of the crypto market, our analysts have prepared the trading recommendations for Bitcoin (BTC) and Ethereum (ETH) based on technical analysis.

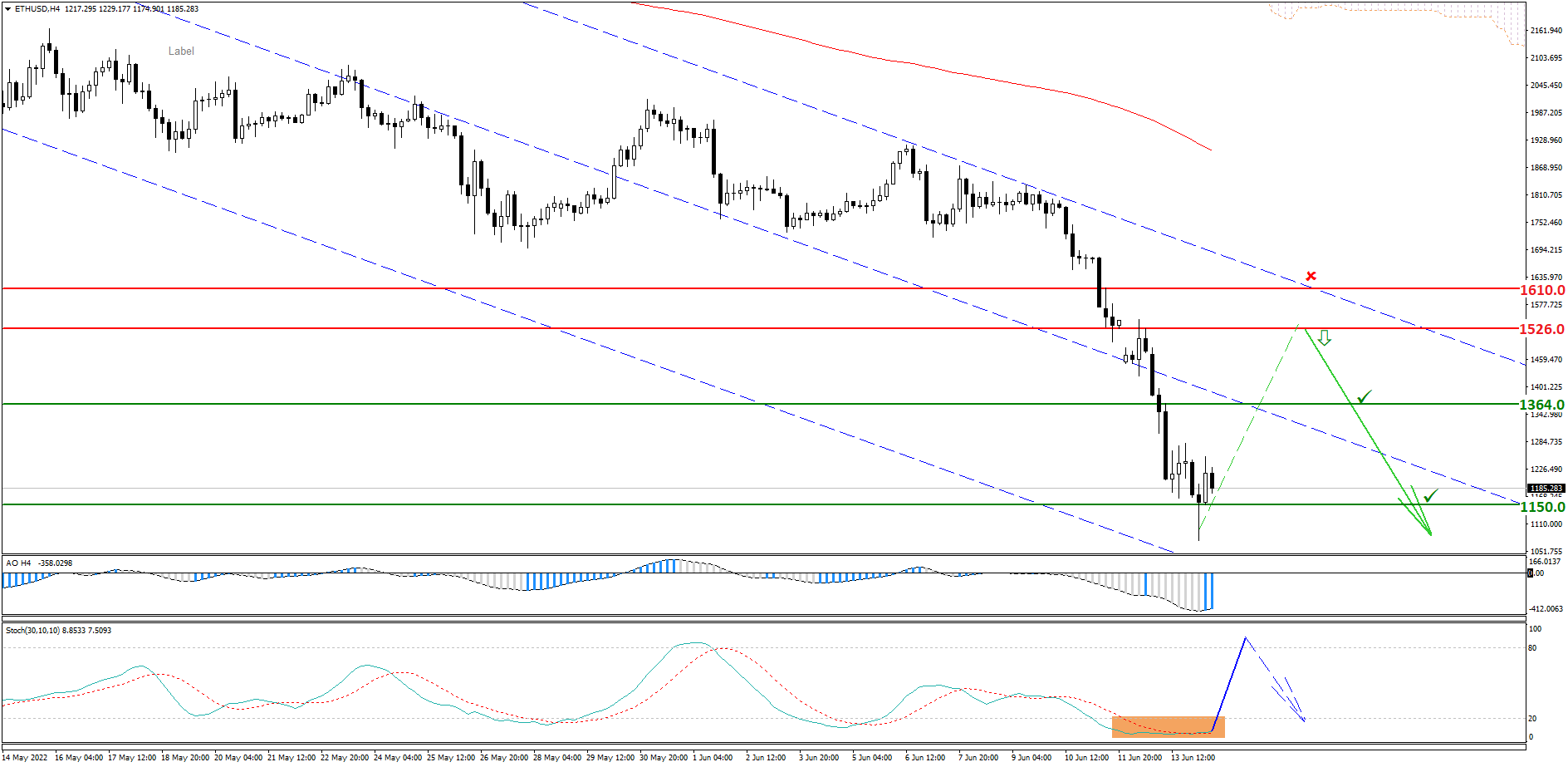

Open a short position for Ethereum (ETH/USD)

The general trend is descendant. The coin is traded in the descendant price channel’s lower border span. The reverse pattern pin bar formed on the H4 timeframe, which can cause a correction.

Trading idea:

- Sell from the mirror level 1526.0.

- Stop-loss: 1610.0.

- Target levels: 1364.0; 1150.0.

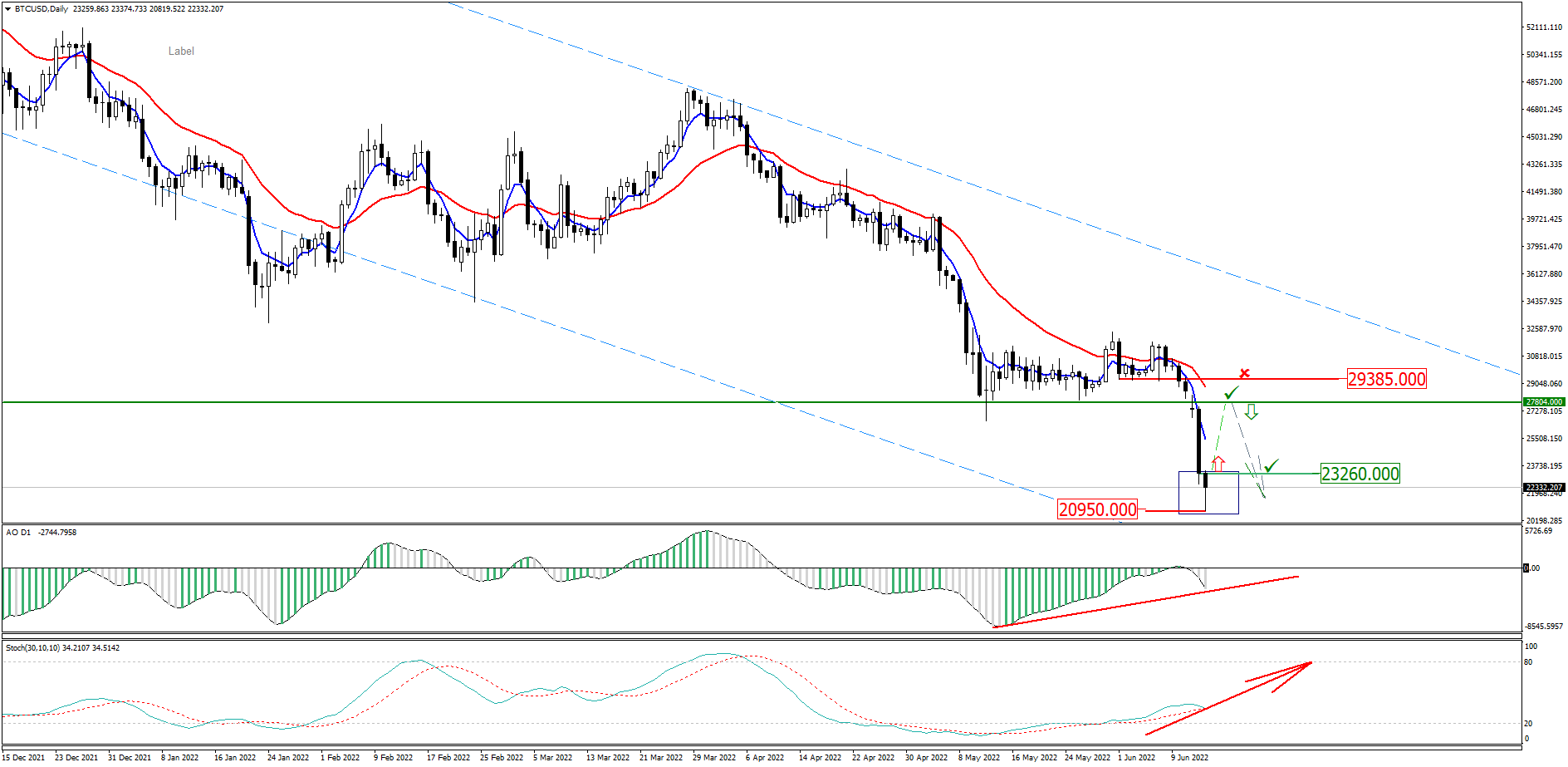

Double-profit from Bitcoin splash (BTC/USD)

This case involves two steps: both long and short positions coming in a row. This means you can earn with any market trend within a short time period. The general trend is descendant. The reverse pattern “hammer” is likely to form on the daily timeframe. Awesome Oscillator indicates bullish divergence, and Stochastic Oscillator signals oversold conditions.

Trading idea:

- Sell (short) position.

- Sell from mirror level 27804.0.

- Stop-loss: 29385.0.

- Target: 23260.0.

- Buy (long) position.

In case a “hammer” pattern (pin bar) forms — buy when the daily candle closes.

- Stop-loss: 20950.0.

- Target: mirror level 27804.0.

Now you know how to profit from the bearish crypto market by trading short.

Hurry up! The last chance to make money on crypto was two years ago when BTC was steadily growing. For the reactive crypto bears, we offer a +40% bonus for each deposit!

- Open a Crypto account in Grand Capital and make a deposit.

- Write in the LiveChat on the right that you’re willing to seize the moment and profit from crypto.

- You’ll see the +40% bonus in your Private Office.

- The support team can help you navigate the trading terminal to open positions if you don’t yet have enough experience.