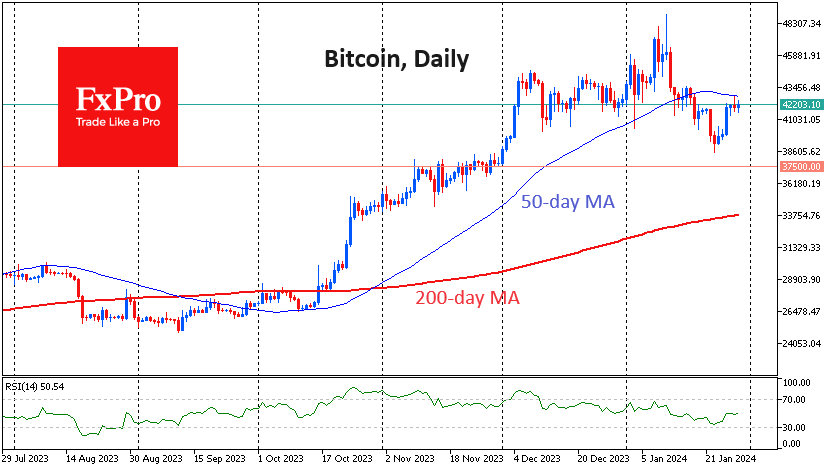

Crypto market capitalisation at around $1.62 trillion is less than 1% higher than it was seven days ago, thanks to a growth spurt on Friday. Bitcoin has added 3% in the same period and continues to be the driving force behind crypto volatility. The sentiment is gradually returning to greed territory, taking the corresponding index to 55 after lows of 48 in the middle of last week. Bitcoin has stabilised near $42K over the past three days. The 50-day moving average at $42.8K has acted as local resistance for short-term gains. This curve changed direction from rising to falling last week, which looks to be an additional short-term negative factor.

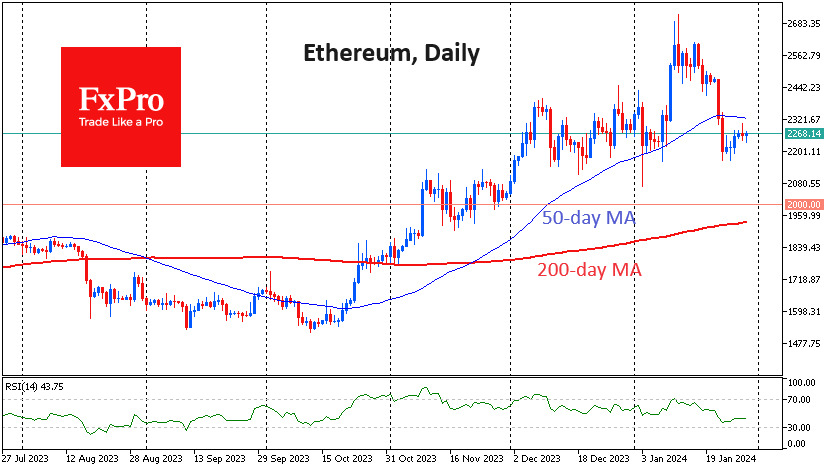

Ethereum, as the flagship cryptocurrency, has pulled back from local lows but is in no hurry to gain altitude, trading near $2270. The two major cryptocurrencies have started stabilising and rebounding higher than we expected.

But we assume that the current calm is a local trap for bulls, and the decline will continue after some pause. The trigger for the decline may be volatility in equities ahead of the reports of giant corporations, the results of the Fed meeting and the employment report.

The US Department of Justice has filed a notice to sell another batch of crypto assets confiscated from the criminal trading platform Silk Road. A total of 2,934 BTC worth $115 million is to be sold.

The US Securities and Exchange Commission (SEC) is likely to approve an ETF based on the spot price of Ethereum in the summer of 2024, Grayscale expects.

According to cryptocurrency payment operator BitPay, XRP has become one of the most used crypto asset for making payments, with the number of payment transactions up 42%. Bitcoin topped the top 10, followed by Litecoin and Ethereum.

According to Flipside, the Polygon project has equalled Ethereum in terms of new users. For 2023, Polygon recorded 15.24 million new accounts, compared to 15.4 million for Ethereum.

Matthew Schultz, co-founder of mining firm CleanSpark, believes that unless Bitcoin shows significant growth, 11 major mining companies will be unprofitable after the halving.