Hedging is a financial trading technique that investors should be aware of and employ because of its benefits. It protects an individual’s funds from being exposed to a problematic situation that might result in price loss as an investing. Hedging, on the other hand, does not guarantee that the investments will not lose value. Rather, if this occurs, the losses will be compensated by gains from another purchase.

Many market traders, particularly buyers, brokers, and corporations, employ forex hedges. This article will highlight what hedging is and how it works in the Forex market.

Making use of a Forex hedge

Spot contracts, foreign currency options, and currency futures are the most common hedging forex trading. Spot contracts are the most common type of deal undertaken by individual forex traders. Spot contracts are not the most effective currency hedging instrument since they have a relatively short delivery period (usually once or two days). In practice, regular spot contracts are generally the reason for the requirement for a hedge.

Foreign currency futures are the most often used currency hedging strategies. Like options on other classes of assets, foreign currency options offer the investors the right, but not the responsibility, to buy or sell the currency pair at a specific currency value at some point in the future.

How does a forex hedge operate?

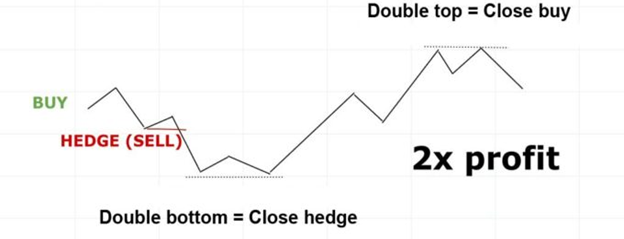

The concept of setting an FX hedge is straightforward. It begins with an existing open position - usually a long position - your initial trade anticipates a move up in a particular trend. A hedge is established by starting a position that stands in contrast to the predicted movement of the currency pair; make sure to keep the initial transaction open without incurring losses if the price movement goes against your forecasts.

Creating complex Forex hedges

Considering complicated hedges are not straight hedges, they need a little more trading skill to operate successfully. One strategy is to open positions in two currency pairs whose price movements are interrelated. Traders may use a correlation matrix to discover currency pairings that have a significant negative association, which means that when one pair rises in price, the other falls.

Such events can be minimized if the buyer employs a strategy to mitigate the impact of such a negative outcome. An option is a contract that allows an investor to purchase or sell a stock at a specified price within a certain timescale. For example, a put option would allow the buyer to gain from the stock’s price drop in this scenario. That return would cover at least a portion of his loss on the stock investment. This is regarded as one of the most efficient hedging methods.

Hedging strategies examples

Hedging techniques come in a variety of forms, each with its own set of advantages and disadvantages. For the greatest outcomes, buyers are recommended to utilize a variety of strategies rather than just one. The following are some of the most frequent hedging techniques to consider:

- Average down

- Diversification

- Arbitrage

- Staying in cash

Bottom line Hedging is a valuable tool that traders may employ to safeguard their assets against unanticipated developments in the Forex market. If you use hedging strategies correctly and successfully, you have a better possibility of becoming a prominent trader in the forex market.