Even the slightest tip can tip the scales in your favor. As the cryptocurrency market evolves, making informed and strategic decisions is crucial for maximizing returns and minimizing risks. With the rapid development and increasing complexity of the crypto landscape, your approach can evolve and adapt to current and future situations. Nothing in life is risk-free, but with these helpful tips, you can increase the chances for a favorable trade.

1. Use Reputable Exchanges

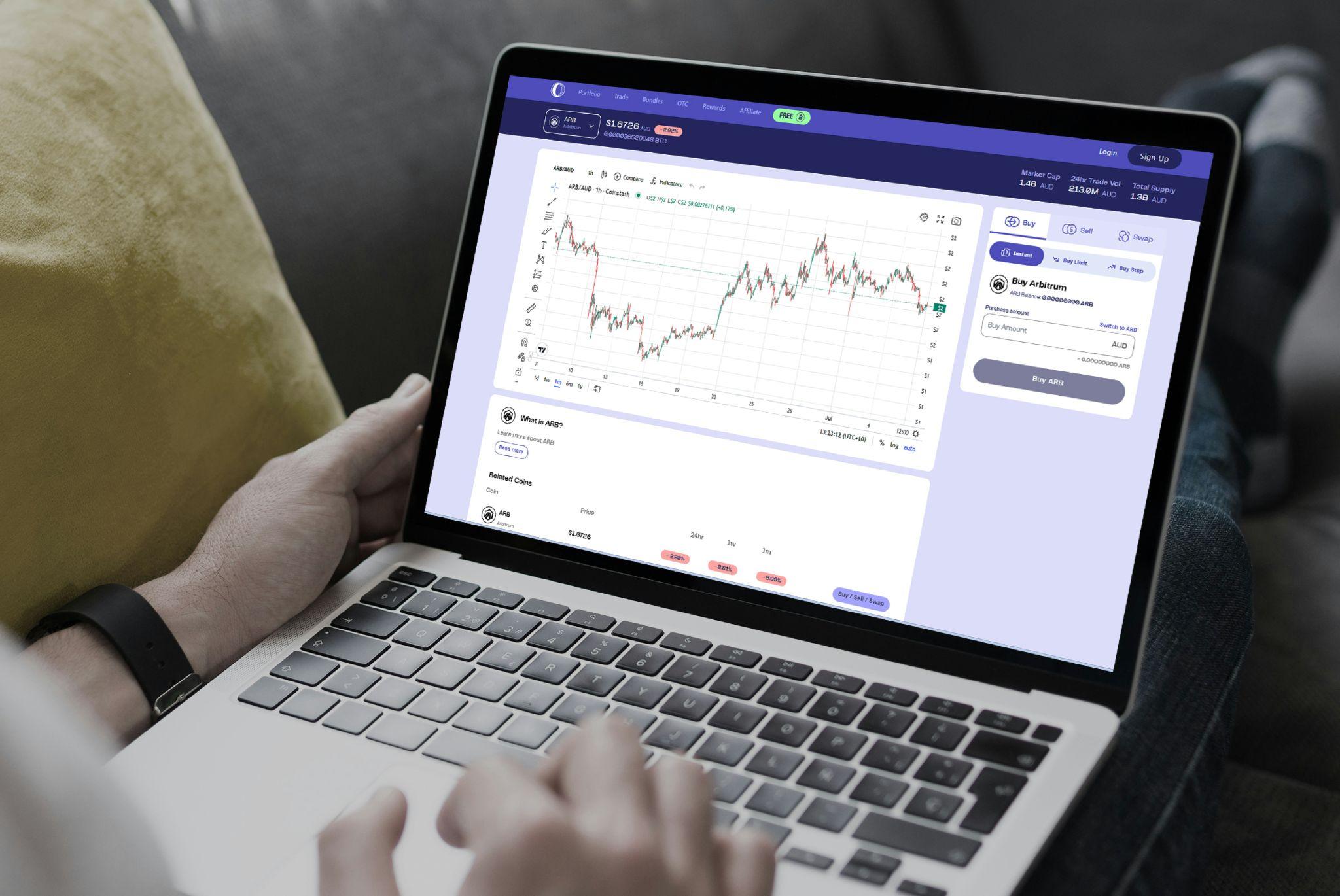

Ensure the exchange you use has a strong track record of security and customer service. These are the ones who care about their brand identity and are showing long-term commitment to growing a healthy customer base. Choosing a reputable and secure cryptocurrency exchange is essential for safe transactions and storage. Your first trade should be done via trusted crypto trading sites, where you can find out where your proficiencies lie. Always double-check your sources and take some time to find the ideal trading ground. Think of finding a reputable site in the same way as trading on a stock exchange. Would you rather visit the New York Stock Exchange or do business in some back alleyway? The same rules apply in crypto trading as in real estate and its location, location, location.

2. Research

Before diving into any cryptocurrency investment, you must do the legwork, homework, and all kinds of work. This involves understanding the cryptocurrency’s technology, use case, and the user behind it. For instance, Ethereum (ETH) is notable for its smart contract functionality and has seen widespread adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs). These are just some essential terms that need deep understanding before you even make your first trade. Researching the project’s whitepaper, technology stack, and development updates is necessary before your first and any crypto trade.

You might also decide that you want to invest in a presale instead of buying a more well-known coin. In this case, make sure you understand the potential behind the project so you’re making a worthwhile investment. Soobin Choi recommends that to verify the legitimacy of a cryptocurrency project, you should look for a verified project with a doxing and disclosure team. “Doxing” refers to disclosing personal information about individuals, including the names and backgrounds of project team members. This transparency gives investors confidence in the potential success of a project (source: https://www.techopedia.com/kr/cryptocurrency/best-presales).

3. Diversify Your Portfolio

Diversification is a vital strategy in reducing risk and enhancing potential returns. Don't put all of your eggs in a single basket, and refrain from putting all your funds into a single cryptocurrency. Consider spreading your investments across multiple assets. For example, alongside Bitcoin (BTC) and Ethereum (ETH), which are high-cost and high-yield but very popular, you might invest in emerging cryptocurrencies like Solana (SOL) or Cardano (ADA). Diversifying your portfolio within the crypto market can help mitigate the volatility of individual assets. The goal is to balance high-risk assets with more stable ones, optimizing the potential for overall portfolio growth.

4. Risk management

Cryptocurrencies are known for their high volatility and risk. Prices can fluctuate dramatically, sometimes within short periods, leading to significant gains or losses. We can refer to Bitcoin’s price fluctuations between $30,000 and $60,000 in 2021. Understanding these risks and investing what you can afford to lose is crucial. This is not a negative aspect of crypto trading, but a realistic industry state. Crypto trading happens fast and is always on the move. The Crypto Fear & Greed Index, which measures market sentiment, can be useful in gauging the level of fear or greed in the market.

5. Set Realistic Goals

Defining and setting clear goals helps guide your cryptocurrency choices and strategies. Are you looking for long-term growth, short-term gains, or diversification? For instance, if your goal is long-term growth, then investing in established cryptocurrencies like Bitcoin or Ethereum might be suitable. But, if you wish for short-term gains, you might explore newer, more volatile cryptos.

Clear goals allow you to tailor your investment strategy and make decisions that align with your financial objectives. According to a survey by Gemini, 59% of investors hold cryptocurrencies with a long-term investment perspective, showing that nerves of steel and steady hands can profit in the long run. Becoming immune to sudden changes and sticking to your plans could be a viable trading strategy.

6. Keeping Up with Market Trends

Staying informed about market trends and news is vital for making timely investment decisions. Following industry news through reliable platforms or social media can provide valuable insights into crypto market movements and technological advancements. Developments in Ethereum’s transition to Ethereum 2.0 have had significant implications for its price and functionality. Keeping one ear on the ground with one eye on the latest news may be taxing mental gymnastics, but it will keep you alert to upcoming changes and shifts. Remember that the market waits for no one.

7. Dollar-Cost Averaging is Your Friend

Dollar-cost averaging (DCA) involves investing a fixed amount of money into a cryptocurrency at regular intervals, regardless of price. This strategy helps mitigate the impact of market volatility and reduces the risk of poor timing. If you invest $100 in Bitcoin every month, you’ll buy more when prices are low and less when prices are high, averaging out your purchase price over time. If you have a set budget, stick to it and make regular investments, just like you would do with a savings account. Step by step, your crypto portfolio will rise, and while this may be something glamorous or provide bragging rights, it will give you a steady possible income.

8. Secure Everything

Securing your cryptocurrency investments is paramount to prevent theft and hacking. Use hardware wallets like Ledger Nano X or Trezor, for storing your assets offline, and enable two-factor authentication (2FA) on your exchange accounts. By implementing these security measures, you protect your investments from potential cyber threats and ensure their safety. Your entire portfolio's future rests on your security measures, and it can all be gone in a single hack. So ensure you properly protect your crypto assets, just like you would do with any others.

9. Watch for Regulatory Changes

Regulatory developments can have a substantial impact on the cryptocurrency market. Staying updated on regulations in your region and globally is essential for understanding potential implications for your investments. The U.S. Securities and Exchange Commission (SEC) has been actively scrutinizing cryptocurrency exchanges and initial coin offerings (ICOs).

10. Exit Strategy is a Good Thing

Or plan B, for short. Having an exit strategy is crucial for managing your cryptocurrency investments effectively. Determine in advance how and when you will exit your positions, whether it’s based on reaching a target profit, a significant market change, or other criteria. Setting profit-taking levels and stop-loss orders can help you lock in gains and limit losses. According to a survey by eToro, 41% of investors use exit strategies to manage their crypto investments, reflecting the importance of planning for both positive and negative market movements.