There are dozens of Forex trading strategies, and each one differs from another. With such a variety, it might take a lot of work to choose the right one, and even experienced traders might get concerned.We have analysed top Forex trading strategies to save you time and nerves. Every strategy is analysed by three criteria: portfolio volatility, analysis complexity, and preferred instruments. Use the description below to discover the best strategy for you in 2023.

Trading strategies

What to consider when choosing a well-suited strategy?

- Day trading strategy

- Scalping

- News trading

- Long-term trading strategies

- Algorithmic trading strategy

- Crypto trading strategy

- Stock trading strategy

What techniques can strengthen your strategy?

- Hedging

- Grid trading

- Martingale trading

So, what differences should you consider to choose a well-suited strategy?

Instrument

- You can trade currencies, cryptocurrencies, indices, CFD on stocks, and commodities. For example, some strategies may be more suited to trading currency pairs, while others may be more suited to trading commodities or stocks.

- Timeframe. These are usually classified as long-term, medium-term, and short-term. You will see strategies that require you to use a one-minute timeframe along with strategies that best work with a month timeframe.

- Method of analysis. Some strategies can be based on technical analysis, fundamental analysis, or a combination of both. You can learn it all with us and our webinars.

- Volatility. This evaluates the intensity of price changes in a certain period. For example, a currency pair may be more volatile and have wider spreads, making a trend-trading strategy more suitable.

This is vital for traders to thoroughly consider the characteristics of the instrument they are trading and choose a well-suited strategy. And you first have to decide whether short-term or long-term trading strategies are better for you.

Day trading

- What to analyse: charts, macro factors.

- Preferred instruments: currencies, cryptocurrencies, commodities, derivatives on stocks, and indices.

- Main goal: to make a profit in one trading day.

- How it is achieved: a trader would open and close orders within one day.

One type of popular short-term strategy is intraday or day trading. Day trading strategies in Forex involve opening and closing orders during the same day to capitalise on short-term price movements in the market and potentially make a profit. Day trading strategies can be based on various technical and fundamental analysis tools, such as chart patterns, price action, and news events. It is important to note that intraday trading can be risky, and traders must carefully manage their risk and make informed decisions with the help of a variety of instruments and indicators.

What are the most popular indicators used by day traders?

- Charts

- Moving average

- Relative strength index (RSI)

- Bollinger bands

What is the best timeframe for intraday trading?

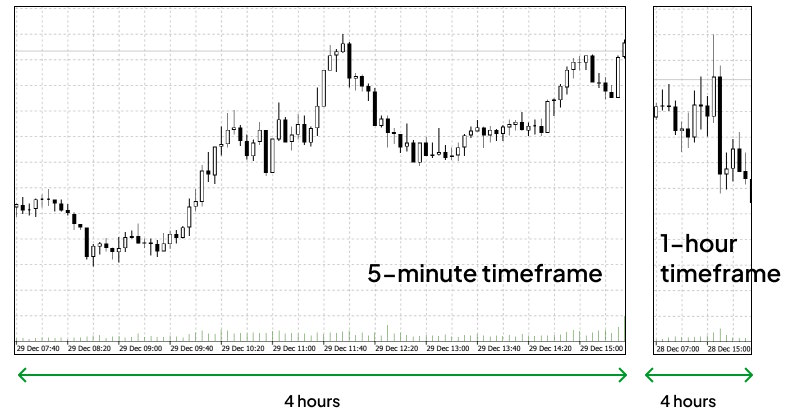

One thing we can say for sure is that it should contain enough data. Some suggest using a 5 and 15-minute time frame, while others use a 1 and 30-minute chart. There are even traders who utilise a 30-minute and 1-hour time frame. So, you should experience it yourself and see what works best for you. Opportunities to profit depend on the amount of information.

What are specialised intraday trading strategies?

- Buying the dips. This is when you buy an asset within its downward trend, expecting it to recover within the same day.

- Selling and buying during rallies. This is when asset prices rapidly rise over a short period because of the increased demand. Rallies happen when something surprising happens in economics, and you can always take advantage of it around Christmas and New Year holidays. Rallies bring higher volatility and more profit opportunities for traders.

- Looking for breakouts and reversals. This is all about closely watching the charts and studying technical analysis.

We will tell you more about two main day trading strategies.

Scalping

- What to analyse: charts.

- Preferred instruments: currencies, crypto, and commodities.

- Main goal: to earn small profits that can add up to a large sum.

How it is achieved: a trader would open and close many orders within a short period, often within minutes or even seconds. The most important indicators scalpers use are the exponential moving average (EMA) and the simple moving average (SMA). Each of these indicators illustrates short-term price changes in trends of a currency pair. Scalpers love using the SMA indicator for its capacity to react to change quicker than others.

News trading

- What to analyse: asset-related news.

- Preferred instruments: currencies, stocks, derivatives on stocks, and indices.

- Main goal: to predict the market movements based on news and make a profit.

- How it is achieved: a trader would follow the news, predict the market’s reaction, and execute orders based on it.

The foremost tool a news trader employs in their arsenal is our Economic Calendar. This tool helps them track upcoming releases and predict the market impact. You can even filter future events using various categories. It is good practice to consume the news for each currency of a pair you are considering trading.

Our Economic Calendar lets you receive the latest information from the top economists worldwide on specific events. You can understand and learn different patterns by harnessing both tools.

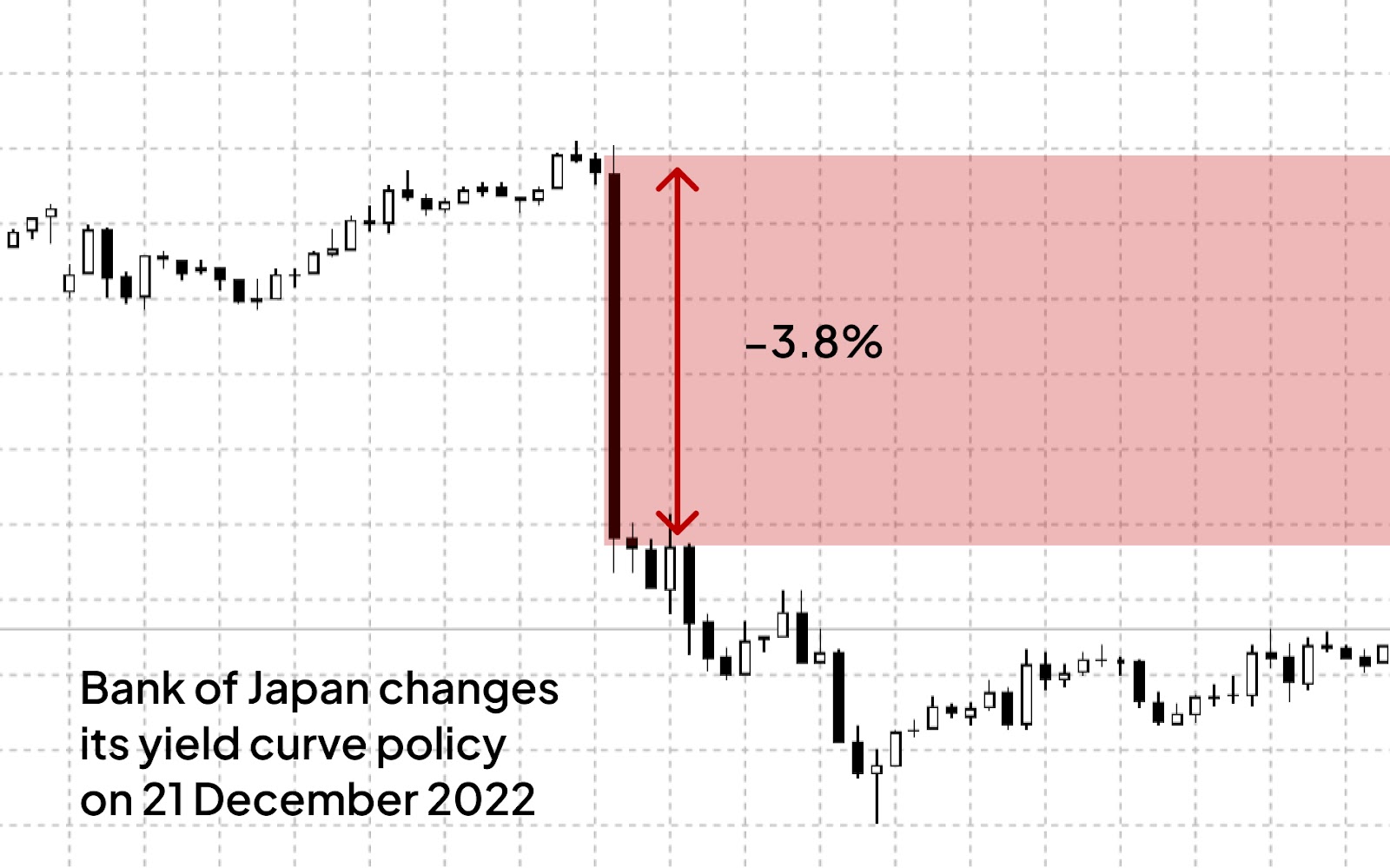

News affecting the USDJPY price, 21 December 2022

Here is an example of this strategy. Look how the Bank of Japan’s decision to change its yield curve policy affected the JPYUSD prices in less than 10 minutes. Our introduction to fundamental analysis will provide you with further insight into how to trade off the news.

Long-term trading strategies

- Preferred instruments: stocks, ETFs, and indices.

- What to analyse: macroeconomics, sector and industry, and company financial statements.

- Main goal: to profit outside the market hours or earn on a highly-volatile asset.

- How it is achieved: a trader would trade crypto.

Long-term trading is usually called position trading. This is the opposite of scalping. Position traders tend to be very patient and possess strong fundamentals.

Long-term or position trading compared to swing trading

What is the best timeframe for position trading?

The best timeframes are 50-days and 200-days EMA's. Position traders wait for when moving average lines begin to intersect.

What instruments do position traders prefer?

One of the best instruments for position traders is stocks or indices. This is because governments or central banks can make policy or economic adjustments that impact the economy over time. These policy decisions can enable a position trader to earn over six months or longer if they can predict the price trigger and trend.

Algorithmic trading

- When to use: no particular situation.

- What to analyse: charts, trading robot reviews, and testing results.

- Main goal: to make a trading robot trade for you.

- How it is achieved: a trader would install a trading robot, test it, and let it trade instead of themselves.

With algorithmic trading strategies, you are harnessing the power of coding and bots to trade for you. One of the benefits of this type of strategy is that it removes the emotional aspect of trading. Removing emotion is a crucial ingredient for risk management. However, you don't need to be a coder to enjoy the benefits of algo trading strategies.

Where to get the trading program?

Some programs and services write the code based on your desired inputs. There is also an MQL5 marketplace to search for and purchase a robot that suits your style.

How to understand if the trading program is reliable?

- There are many robots, and not every one of them will let you make a profit. Testing helps you understand whether a trading robot or program may be beneficial. There are generally two types of tests you can run to understand whether the program is right for you:

- backtest to simulate orders based on historical data

- forward test to simulate trading on real market conditions without the risk of loss by using a demo account or tracking the results yourself.

Once you have fine-tuned the backtest trading strategy and program, you are ready to go. An additional advantage of algorithmic trading is that it does not require much maintenance. However, while the program can run by itself, it still requires human oversight.

Crypto trading

- What to analyse: chart, crypto exchange news, and hash rate.

- Main goal: to profit outside the market hours or earn on a highly-volatile asset.

- How it is achieved: a trader would trade crypto.

Crypto trading strategies differ from other types of strategies mainly due to the high volatility, market participants, size, and some other factors. Nevertheless, cryptocurrencies are still popular since Forex traders thrive on volatility.

Why is crypto trading different to other assets?

There are generally three crypto market participant types: miners, exchanges, and traders. In comparison, the market participants in the currency market include commercial banks, central banks, money managers, and hedge funds. So this means that one person holding a large crypto or group stake can influence the market far greater than in the currency market.

The crypto market is famously known for its volatility, making it an attractive instrument to trade for savvy Forex investors. The highly speculative nature of crypto is one of the main reasons cryptocurrencies are so volatile. Unlike currency trading, which national governments back, crypto is almost purely based on supply and demand. There is also the issue of scalability. When a smart contract is not validated within a specific timeframe, it can create downward pressure.

What indicators do crypto traders prefer?

- Moving averages (MA) crossovers tool. Using this tool, you will gain a clear picture by removing some randomnesses of price changes.

- Relative strength index (RSI). This tool used by intraday traders recognises momentum in either direction and lets you know if the crypto asset is overbought or oversold. At its core, the RSI is a simple formula that calculates the most profitable time to close an order versus a suboptimal time.

- News. It is important to not only implement the tools intraday traders use to make a profit, like the RSI, but also leverage the skills news traders utilise. News coverage surrounding crypto can greatly impact an asset's direction due to the reasons mentioned above. In addition, experienced traders notice strong media attention on an asset and use that as a signal for a potential price trend change. Trading on crypto news also makes this a popular strategy for first-time traders.

Stock trading

- What to analyse: macroeconomics, sector and industry, and financial statements of the company.

- Main goal: to earn on stocks—either short-term or long-term.

- How it is achieved: a trader would use both fundamental and technical analysis to trade on stocks.

This strategy involves buying and selling shares of publicly traded companies listed on a stock exchange. When you trade stock with us, you are speculating on the stock price fluctuation. Stock prices are influenced by various factors, including the company's financial performance, industry trends, and overall market conditions. That is why stock traders take into all the pertinent details related to the company, the market conditions, and other relevant industry information.

What can help you build a strong stock trading strategy?

The main advantage your broker can offer you here is the diversity of stocks. When using the stock trading strategy, it is important to analyse the industry before opening any order. Also, browsing the latest news might help you understand the overall situation regarding the asset. Some traders stick to green companies, so here is again where diversity helps you make a profit. We offer assets from 16 stock exchanges so that you can pick the right ones for you.

What are the stock benefits?

Another point that might encourage you to trade on stocks with us is that you can receive dividends. These are parts of the profit a company distributes among its shareholders. And when you open an order for any of the 230 shares we offer, you automatically become a shareholder for the time you hold an asset. The great thing is that if you use leverage, you get dividends for every share of your leveraged position.

In summary, traders must know each currency in the pair they are utilising, meaning they should research and understand each country's economic and fiscal policy, whereas, in stocks, you have a more narrow search pattern to gauge their potential success.

What techniques can strengthen your strategy?

When considering which instrument and strategy to use, whether it is a scalping or if you prefer to hold onto your position longer, you must evaluate which tools you can use to succeed. You will likely use the same indicators for all your strategies, but it is important to understand what makes them different.

Other indicators traders consider useful

- Moving average convergence/divergence or MACD

- Fibonacci

- Pivot point

- Stochastic

- Candlesticks.

There are other aspects to consider other than generating profitable orders. A savvy investor will also introduce risk management into their trading routine. Applying basic risk management rules protects you from overly negative results. Remember that we offer negative balance protection, so even if your account becomes negative, we will automatically adjust it back to zero at no cost.

Top 5 risk management rules

Several risk management tools are commonly used in Forex to help traders manage and mitigate their risks. What are the most popular ones?

- Stop Loss. This is a tool you use to buy or sell an asset when it reaches a certain price level with the goal of closing a position with a loss before falling too deep. Stop-loss orders can help traders limit potential losses by automatically selling their position regarding a certain loss level.

- Take Profit. This is a tool you use to buy or sell an asset when it reaches a certain price level with the goal of closing a position with profit. Experienced traders advise never to wait for further profit without properly analysing the asset. So, only reset Take Profit further if you can explain to yourself why the price would move to your advantage.

- Risk-reward ratio. This is a measure of the potential reward of order compared to the potential risk. By setting a risk-reward ratio, traders can determine the maximum amount of money they are ready to lose to make a profit and the minimum amount they hope to profit from.

- Position sizing. This involves calculating the size of an order based on the amount of money the trader is willing to risk. For example, if you have a capital of 500 USD and are only ready to risk 1% of it at a time, you will invest 5 USD into one order.

- Diversification. Diversifying a portfolio by investing in various assets can reduce overall risk by spreading it across different asset classes, trading other currency pairs, or investing in various sectors or industries.

Hedge trading

- When to use: before the high volatility period.

- Main goal: to reduce risks and choose the right trade direction.

- How it is achieved: a trader would open two opposite positions at the same time.

When seeking to diversify and reduce risk, hedge trading is one option that comes to mind. Investors can be less prone to adverse price changes by limiting their risk exposure. Hedging is done by opening another order but in the opposite direction of your main position. Your margin will remain divided between these two orders.

Investors should note that by applying this risk management strategy, they are still not fully protected from losses. Spreads play a significant role in determining whether you will profit or not when hedging, regardless if you are in a long or short position since buy orders are closed at the bid price, while the inverse is true for sell orders.

How might hedging save you from loss?

Grid trading

- When to use: the prices are good but might be better.

- Main goal: to minimise risks and buy at the best prices.

- How it is achieved: a trader would set many Buy or Sell orders at different price levels.

Grid trading is used because traders do not need to implement classic market forecasting of the instrument's direction without an evident trend. Placing pending orders at specific intervals below and above a certain price level defines the grid trading strategy.

Martingale trading

- When to use: you expect the price to reverse after requiring a floating loss.

- Main goal: to convert loss into profit.

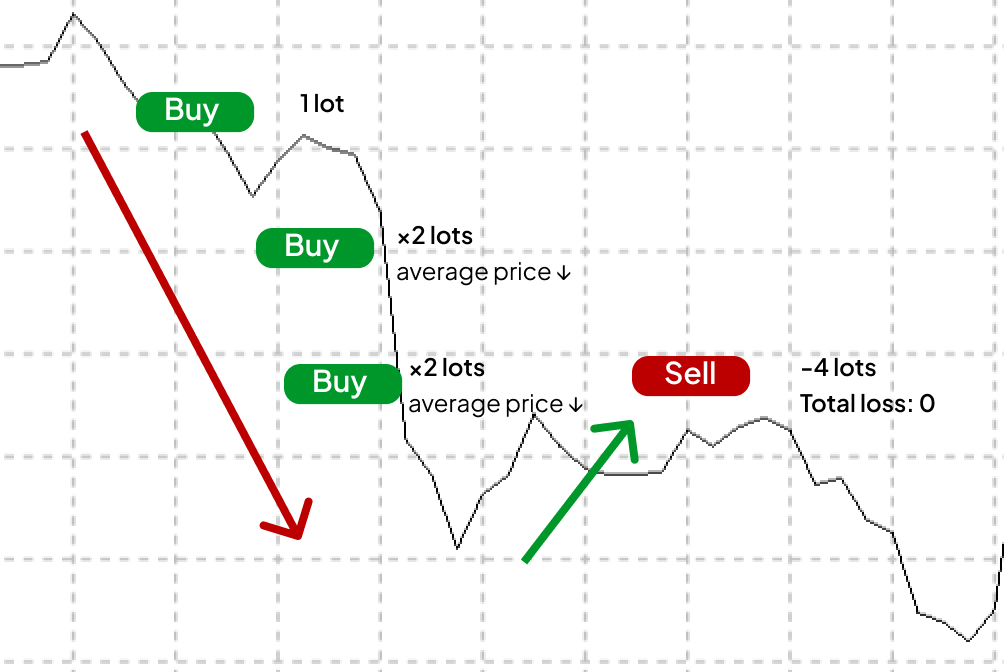

- How it is achieved: a trader would double the order volume with a floating loss and wait for the asset’s price to turn around.

This type of strategy involves first accruing a loss, followed by an increase in your primary position. Precisely, a trader would double the order volume after a loss. As strange as it may sound, this is a mathematically approved strategy.

The idea is to recoup what you have lost. On the one hand, you will earn no profit but will potentially lose nothing in the end. On the other hand, if the order becomes unprofitable again, the strategy calls for continuing to double your investment. This type of strategy, of course, is for traders with a risk-averse nature who can handle the emotional and financial impact of the results.

How to use Martingale to convert loss into profit?

How to choose the best forex trading strategy

There are several factors that you should consider before selecting the best trading strategy.

- Your trading style and objectives. Different trade strategies are suited to different objectives. For example, suppose you are a long-term investor. In that case, you might prefer a strategy that involves holding positions for an extended period. At the same time, if you are a day trader, you might prefer a strategy that consists of taking advantage of short-term price movements.

- Your level of experience. Different Forex trading strategies require different levels of experience and expertise. If you are a beginner, you might want to start with a simpler strategy that is easier to understand and implement.

- Your risk tolerance. Your risk tolerance refers to your willingness to take risks to achieve your investment objectives. You should consider your risk tolerance when selecting a trading strategy, as some strategies involve higher levels of risk than others.

- The market conditions. Different strategies are more or less effective depending on the market conditions. For example, certain strategies work well in a trending market, while others are more effective in a range-bound market.

- Your time commitment. Different strategies require different levels of time and attention. If you have little time to devote to trading, you might prefer a less time-intensive strategy.

- Your capital. The amount of capital you have available to trade will also influence your choice of strategy. Some strategies require larger amounts of capital, while others can be implemented with smaller amounts.

It is important to carefully consider these factors before selecting a trading strategy, as the right strategy can help you achieve your investment objectives, while the wrong strategy can lead to losses.