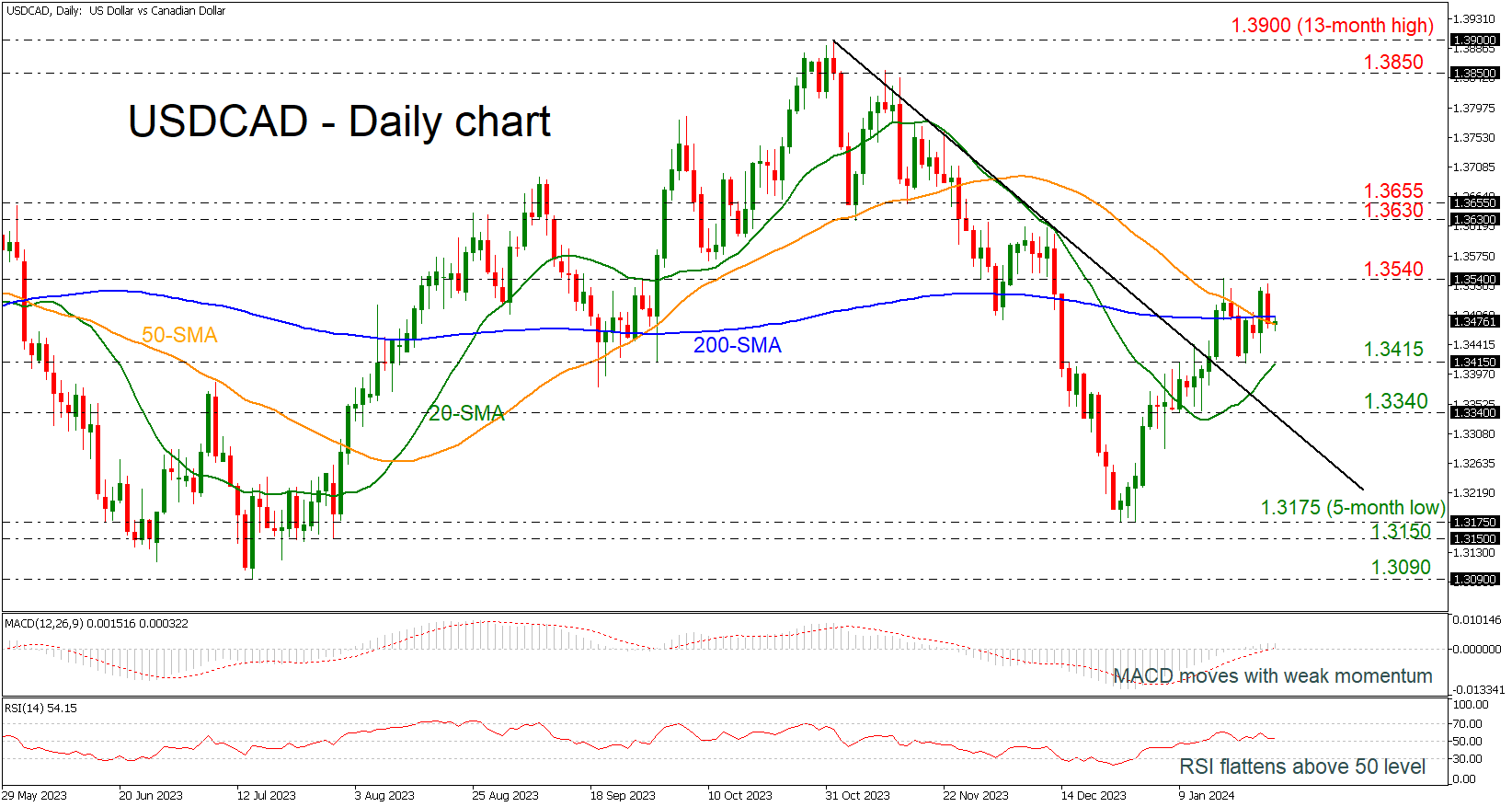

The USDCAD currency pair finds itself in a precarious position as it grapples with key technical levels and indicators that suggest a possible bearish retracement. In this analysis, we delve into the current status of USDCAD and the factors that may influence its future direction.USDCAD and the 200-day SMA: USDCAD has been caught in a battle with the critical 200-day Simple Moving Average (SMA), which is currently situated at 1.3483. This level serves as a significant pivot point for traders, as it often dictates the broader trend of the currency pair.

Maintaining the Ascending Trend Line

Amidst this struggle, USDCAD has managed to cling to its medium-term ascending trend line. This trend line has provided crucial support, preventing the pair from sliding further downward. However, its ability to hold above this line is not the sole determinant of its future trajectory. One of the primary factors that traders closely monitor is the momentum of a currency pair, as indicated by technical indicators. Currently, USDCAD's momentum indicators are sending out relatively weak signals.

The Moving Average Convergence Divergence (MACD) is still in the bullish territory, with a slight extension above its red signal line. However, the momentum exhibited by the MACD is notably feeble, indicating a lack of robust buying pressure.

Furthermore, the Relative Strength Index (RSI), another key momentum indicator, is pointing marginally upward but remains near the pivotal 50 level. This reading can be interpreted in two ways. On one hand, it suggests that bullish momentum is still present, albeit weak. On the other hand, it may be seen as an indication that the recent rally has potentially been overdone.

Potential Scenarios for USDCAD

Given the current technical landscape, there are several scenarios that traders should consider:

- Bearish Retracement: If USDCAD retraces from its current levels, the 20-day SMA at 1.3415 could serve as immediate support. This level has proven resilient against bearish pressure in the recent past. Should the pair move lower, attention would then shift to the 1.3340 support level. A breach of this support, coupled with a violation of the downtrend line, would increase speculation that the bullish phase has concluded and a downtrend is underway.

- Bullish Breakout: Conversely, traders eyeing a bullish scenario would closely monitor a potential break above the 200-day SMA at 1.3483. Such a breakout would be a significant development and could trigger buying orders. More importantly, a move above the 1.3540 resistance level would further bolster the bullish case, potentially paving the way for a rally toward the 1.3630 resistance. In this scenario, the bullish momentum could extend until the 1.3630-1.3655 zone.

Conclusion

In summary, the USDCAD currency pair is at a critical juncture, where technical indicators suggest the possibility of a bearish retracement. Traders should remain vigilant and consider both bearish and bullish scenarios. While the recent breach of the descending trend line initially painted a positive picture, the consolidation between 1.3415 and 1.3540 raises the likelihood of a potential downside retracement. As always, risk management and careful analysis are paramount in navigating the ever-changing forex landscape.