The functionality of modern trading platforms allows traders to implement almost any trading ideas. However, there are methods of money management that allow forex speculators to get a stable profit without using advanced analytical tools. One of these tactics is the so called “pair trading”. This trading style is significantly different from classic asset management. It is based on correlation. This term can be defined as the interdependence of financial instruments.

To determine the level of correlation, a coefficient, that varies in the range from -1 to 1, is applied. To understand the principles of the practical application of pair trading, the first thing to understand is the concept of correlation. The second thing is understanding its role in the pricing of financial instruments.

Pair trading and correlation

Pair trading involves the simultaneous trading of two or more financial assets, or currency pairs. This method, as it was mentioned earlier, is based on correlation and is used by experienced traders to hedge trading positions in order to diversify potential trading risks. A similar technique can be used for trading stock and commodity assets, as well as when working with Forex currency pairs. The essence of earnings is that the correlation between financial instruments does not have a fixed value. The interdependence coefficient varies under the influence of increased volatility and most often this happens during the publication of important macroeconomic data, making this strategy akin to trading on news.

The correlation coefficient of liquid assets, depending on fundamental factors, is determined on a scale from 1 to -1, where 1 means the movement of price charts in the parallel direction, and -1 - in the opposite. If the coefficient value tends to zero, then this indicates the absence of interdependence.

Practical example

How can you make money on it? To understand the principle of pair trading, it is recommended to pay attention to a rather simple example: crude oil is still one of the most sought-after commodities on the international financial market. Changes in the level of demand significantly affect this asset’s value. A striking example is the events of 2014 and 2020. Saudi Arabia significantly increased oil production, which led to a significant predominance of supply over demand. As a result, the price of oil has decreased by almost 70% within 5-6 months. 2 brands of crude oil are the most popular: Brent and Light. The latter is somewhat inferior in quality and its cost is always lower. Let’s suppose that in the absence of geopolitical and macroeconomic upheavals, the price of Brent crude oil is about 100 USD, and Light brand is 94 USD per barrel. The spread is 6 USD. This is a normal value with moderate volatility.

In 2014, the cost of oil decreased significantly, as a result of which Brent hydrocarbons were sold by suppliers on average for 40 USD, and Light brand oil for 28 USD. The spread was already 12 USD. Obviously, the collapse of world oil prices was specially planned and such prices could not remain relevant for too long, as it caused significant losses to producers. At the moment, prices have stabilized and the spread has returned to its original value - to 6 USD.

Classic trading is associated with high risks, which can be significantly reduced by using pair trading methods. To make money on the situation considered, it was possible to apply one of two tactics:

- Classical. Buy oil at the lowest cost and wait until prices stabilize, earning up to 100% without even using leverage. This method is quite effective, but extremely risky. Between 2014 and 2015, many competent analysts believed that 60 USD per barrel was the limit of the fall in the price of Brent crude oil, but in practice this turned out to be different. Opening a BUY order at a price of 60 USD with a potential profit level of 100 USD would lead to significant losses.

- Pair trading. During the period of intensive decline in oil prices for Brent hydrocarbons, buyers were ready to pay 60 USD, for the Light brand - 50 USD. The spread was 10 USD with a value of 6 USD with moderate volatility. The difference in the spread could be earned with virtually no risk to capital. To do this, open a Sell order for one asset and Buy for another. Such an action looks like a normal hedge, but it is not so. By investing 60 USD in the purchase of a barrel of Brent crude oil and 50 USD in the sale of a Light barrel, it was possible to earn 3.5% of the investment amount without risk for capital, due to stabilization of the spread.

Note! The potential profit is indicated without taking leverage into account, that is, with a capital of 1000 USD, the income would be 3.5%, but if using margin trading, for example 1:30, this value would amount to 105% of equity.

The considered trading method is also appropriate for trading in currency pairs. In this case, a positive swap can also provide an additional earning for a trader.

The Usage of Pair Trading at Forex

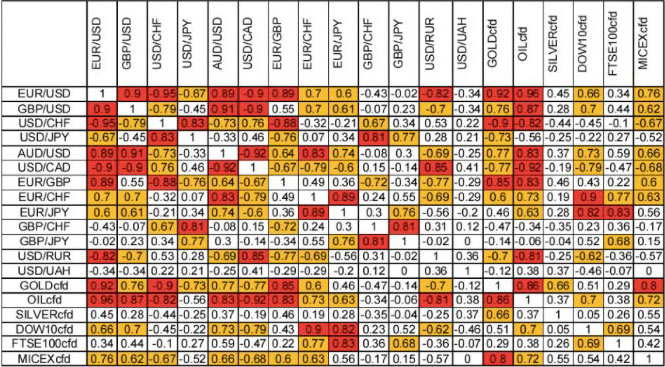

There are two most affordable ways to use pair trading when working with currency pairs, each of which should be considered separately. The first method is similar to that considered earlier. It is recommended to pay attention to the correlation table of liquid currency pairs:

This table shows the moderate values ​​of the correlation coefficient. To trade, you will need to find 2 currency pairs, the interdependence between which tends to 1 and open two transactions in opposite directions. To determine a favorable market entry point, you will need to use special correlation indicators. The availability of such analytical tools is not provided by the developers of MetaTrader terminals, however, they can be downloaded on specialized sites and integrated into the platform independently, following standard recommendations. Among the many correlation indicators, it is recommended to pay attention to iCorrelationTable:

The indicator displays the current correlation value in an additional window of the trading platform. When changing standard indicators, two orders should be opened in the opposite direction on currency pairs with a correlation from 0.7 to 1.

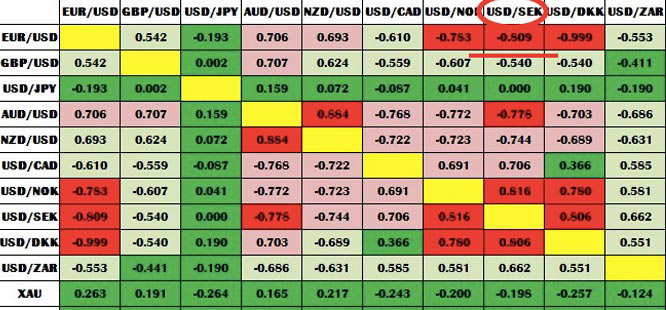

It will be necessary to look for assets with an inverse correlation for practical application of the second method, that is, the coefficient of financial instruments; interdependence should be from -0.7 to -1. It is important to understand that the price charts of these currency pairs move mainly in the opposite direction, therefore both trading positions must be identical, that is, either Sell or Buy. The essence of earnings, unlike the first method, will be to obtain a swap, so this method involves medium-term or long-term trading. You should pay attention to another correlation table of currency pairs:

Among all the assets represented, the USD / SEK and EUR / USD pairs deserve special attention. The correlation coefficient of these financial instruments is -0.809. This suggests that the price charts of these assets are moving in the opposite direction, so you will need to open transactions in the same direction for hedging. Choosing between Buy and Sell is key. It is important to pay attention to the specification of contracts, which can be found on the website of any trustworthy broker.

It is important to note that for each of the mentioned assets, a positive swap, payment for transferring the transaction to the next day, for long positions is provided, that is, opening 2 transactions on USD / SEK and EUR / USD pairs can not only hedge risks, but also earn daily 2.47 points for the transfer of trading positions to the next day. If the volume of each order is equal to 1 lot, then the daily profit will be at least 24.7 USD after working out the spread. Do not forget that the transfer of transactions from Thursday to Friday swap is paid in triplicate. Since before the market closes on Friday evening the spread widens significantly, it is recommended to close orders during the European trading session on Friday.

Advantages and disadvantages of pair trading

A significant advantage of the pair trading practical application is a stable and quite predictable profit, especially if we consider medium-term trading. Also, this type of trading can be used in combination with classical trading styles as a tool for obtaining additional and stable profit.

The usage of pair trading in practice is acceptable in the short-term timeframes, but this is a risky approach. We are talking about earning on changing the value of the spread, which was considered in the material presented. In the Forex market, a similar phenomenon occurs when publishing important macroeconomic news. To find the entry point, you need to use the correlation indicator. The disadvantage of this method is the relatively high risk. In addition, novice traders cannot always correctly determine the point of entering in a transaction, which significantly affects indicators’ profitability.

Conclusion

Pair trading is more suitable for experienced traders who have time to familiarize themselves with the specifics of individual financial assets. This is a reliable trading approach that will effectively diversify risks and bring stable profits.

Beginners are advised to work on the tactics discussed in the article in a demo trading mode for 2-3 months. If it is possible to achieve stable profitability, then it is permissible to consider the management of real assets.