The Moving Average Convergence Divergence (MACD) is a versatile and widely used technical indicator that offers insights into trends, momentum, and potential reversal points in the forex market. Developed by Gerald Appel in the late 1970s, the MACD has since become a staple in traders' toolkits. In this comprehensive review, we delve into the intricacies of the MACD, its components, interpretation, and practical applications in forex trading.

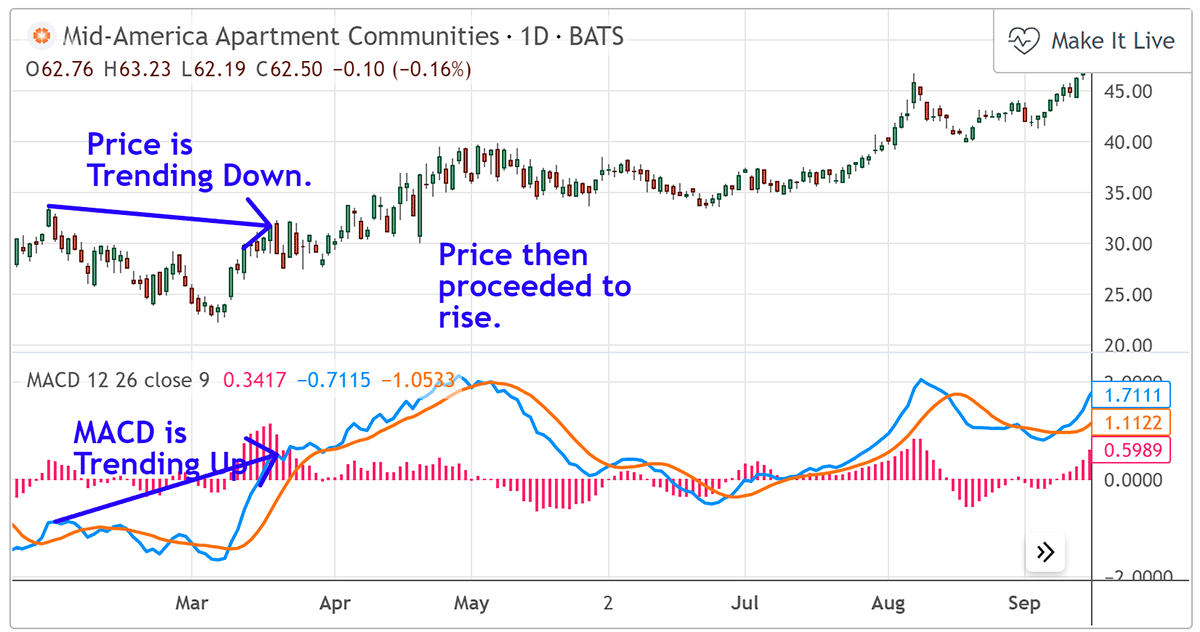

MACD Bullish Divergence

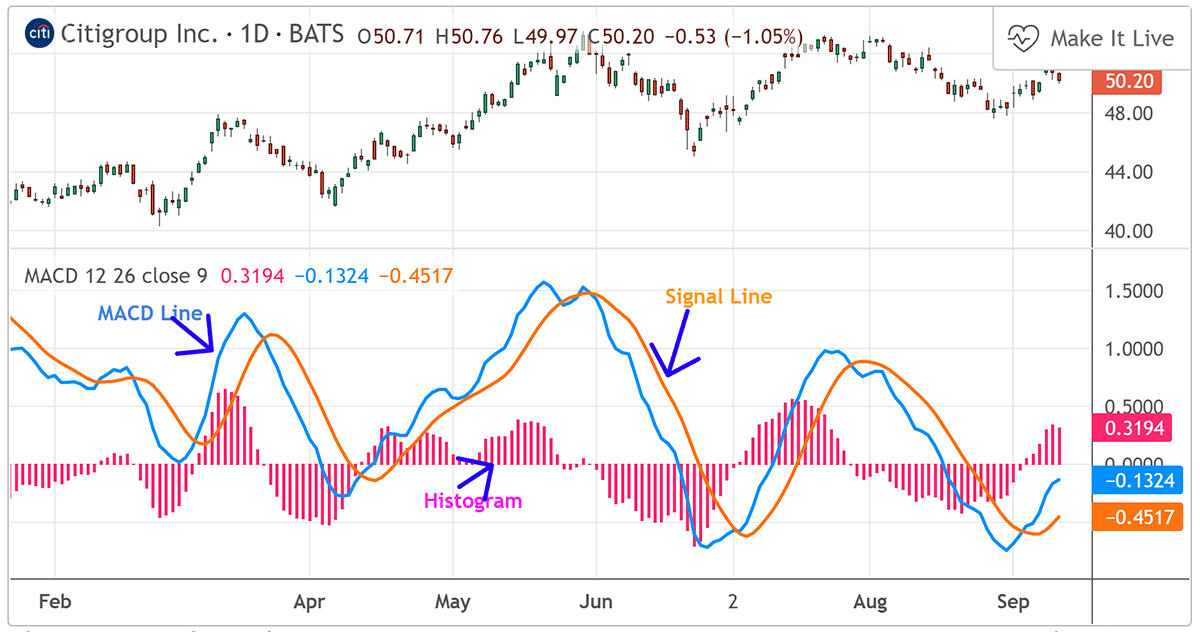

Components of MACD

The MACD consists of three primary components:

- MACD Line: This is the main line of the indicator and is calculated by subtracting the longer-term Exponential Moving Average (EMA) from the shorter-term EMA. It represents the difference between the two moving averages and highlights changes in momentum.

- Signal Line: Often referred to as the trigger line, the Signal Line is a moving average (typically a 9-period EMA) of the MACD Line. It smoothens the MACD Line and generates trading signals when it crosses the MACD Line.

- Histogram: Derived from the MACD Line and Signal Line, the histogram represents the vertical bars displayed above or below the zero line. It showcases the difference between the MACD Line and the Signal Line, providing insights into the strength of the trend and potential crossovers.

Three features of MACD

Interpretation and Practical Application

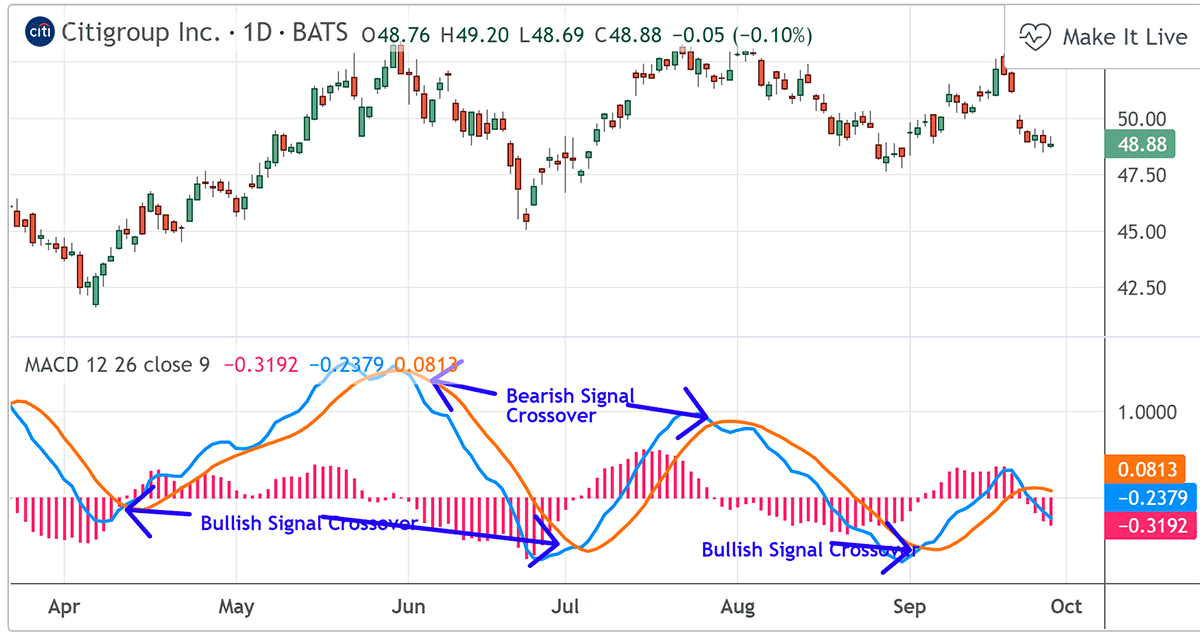

- MACD Crossovers: When the MACD Line crosses above the Signal Line, it generates a bullish signal, indicating potential upward momentum. Conversely, a crossover below the Signal Line suggests bearish sentiment and potential downward movement.

- Divergence: MACD Divergence occurs when the price movement and the MACD Line move in opposite directions. Bullish divergence suggests a potential reversal from a downtrend, while bearish divergence indicates a potential reversal from an uptrend.

- Histogram Analysis: Traders often pay attention to the histogram's size and direction. A rising histogram suggests increasing momentum, while a falling histogram might indicate waning momentum.

MACD signal line crosses

Application of MACD

- Trend Identification: MACD helps traders identify the strength and direction of trends, enabling them to align with prevailing market conditions.

- Crossover Strategies: Many traders use MACD crossovers to generate buy or sell signals. For example, a bullish crossover (MACD Line crossing above Signal Line) might signal an entry point for long positions.

- Divergence Signals: Divergence between the MACD Line and price movements provides valuable insights into potential trend reversals.

MACD Crossover Trend Indicator

Conclusion

The Moving Average Convergence Divergence (MACD) is a powerful technical indicator that offers traders insights into trends, momentum, and potential reversal points in the forex market. Its versatility and widespread use make it a valuable tool for both beginners and experienced traders. However, like any technical indicator, the MACD is most effective when used in conjunction with other analysis methods and indicators to make well-informed trading decisions. It's important for traders to practice and develop their understanding of MACD through real-time market experience.

Discover how to interpret forex charts like a seasoned trader. We'll guide you through the anatomy of candlestick patterns, trend lines, and technical indicators that illuminate market trends. Learn how to spot potential breakouts, reversals, and trend continuations using chart patterns. With our expert insights, you'll have the tools you need to navigate the forex market with confidence.