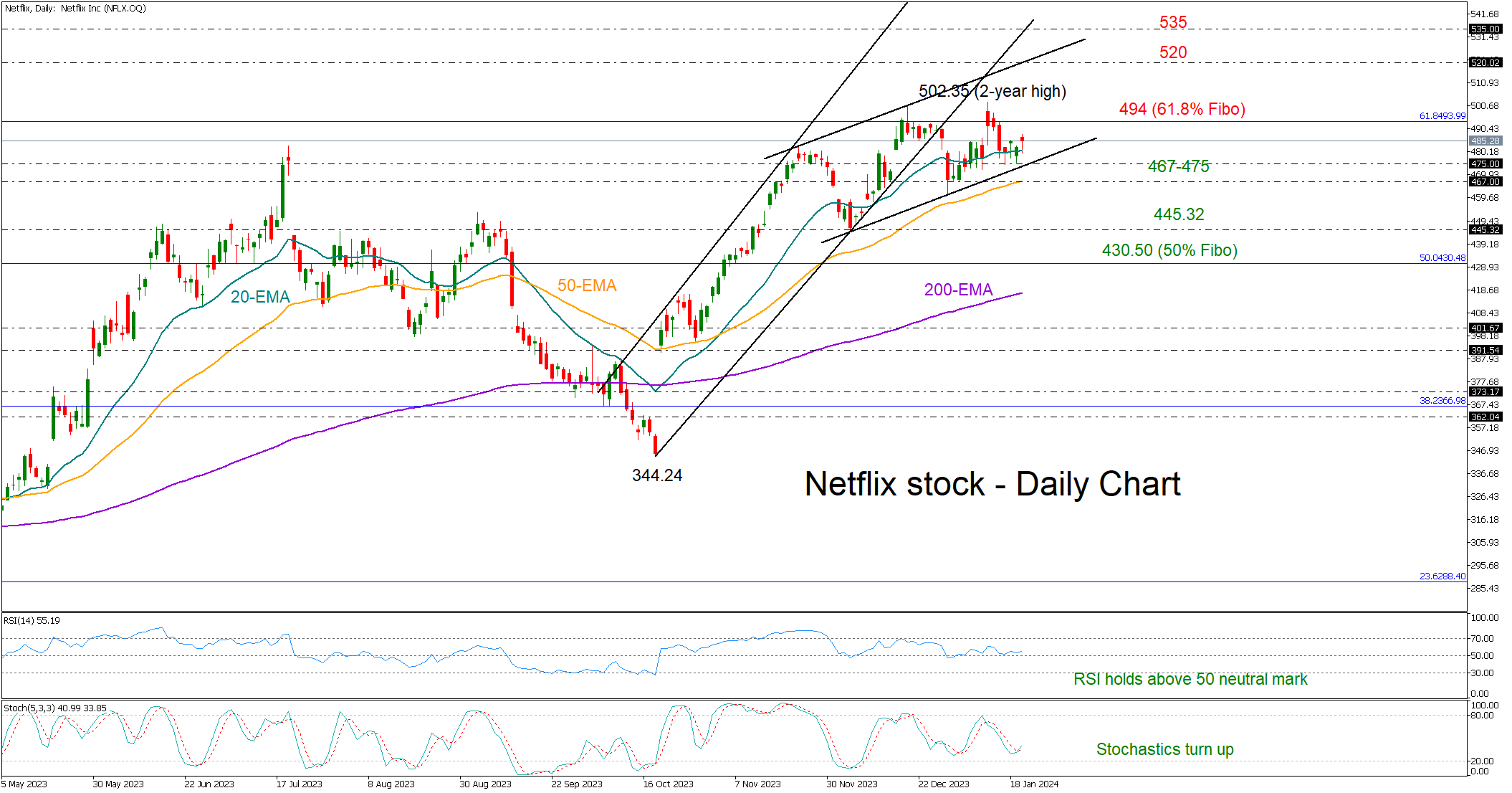

Netflix's stock performance continues to exhibit a neutral stance as investors and analysts eagerly anticipate the release of the company's Q4 earnings after the market closes. Currently, the stock is navigating within a range that suggests a cautiously optimistic outlook from the market. Recently, Netflix shares were unable to achieve a breakthrough at the peak of the current short-term bullish channel. Additionally, despite reaching a record high of 502.35 a fortnight ago, the stock concluded trading below the highs witnessed in December. This pattern of trading has resulted in the stock remaining somewhat dormant, thereby tempering expectations for a robust bullish surge in the near term.

However, technical indicators offer a silver lining for bullish investors. The Relative Strength Index (RSI) has notably managed to stay above the 50 mark, which is generally considered neutral. This indicates that the stock has not yet lost its upward momentum. Furthermore, the stochastic oscillator, a momentum indicator, appears to be gearing up for a potential upturn. These factors collectively imply that an upward correction may still be a viable outcome, particularly if the stock price continues to operate within its current bullish formation.

A critical point of interest for traders will be the stock's behavior around the 61.8% Fibonacci retracement level of the 2021-2022 downtrend, which stands at 494. Surpassing this level could pave the way for an ascent towards the upper band of the bullish channel, projected around 520. Should the momentum gather greater strength, the stock might even aim to rechallenge the previously breached support trendline stemming from the lows of October, which is now at around 535.

Conversely, should Netflix's stock exit the bullish channel and fall below the 50-day Exponential Moving Average (EMA) at 467, a bearish scenario could unfold. Under such circumstances, the stock price might retreat towards the low recorded in December at 445.32. A decline beyond this point would be indicative of a nascent downward trend, potentially triggering further selling pressure targeting the 50% Fibonacci retracement level at 430.50.

In summary, Netflix's stock is currently maintaining a state of equilibrium, with market participants closely watching for a decisive move either above the 494 mark or below 467. This breakout will likely set the tone for the stock's short-term trajectory in the wake of the upcoming Q4 earnings report.