The crypto market capitalisation reached $1.99 trillion, according to CoinMarketCap estimates, an increase of over 10% in one week. Forbes estimates that the $2 trillion mark was reached last week. Either way, the growth momentum is clear and very strong. Over the last 24 hours, Bitcoin gained 1.4%, overtaken by Ethereum (+4.4%) and Solana (+3.5%). BNB (-0.6%) and XRP (+0.9%) could not keep up with the current market.

Bitcoin is approaching $52.5K, having quickly found buyers after Saturday's drawdown. Monday starts with active buying, bringing the price back to the range highs of the last five days, which are the highs since November 2021. Technically, bitcoin has no meaningful resistance levels until the area approaches $64K.

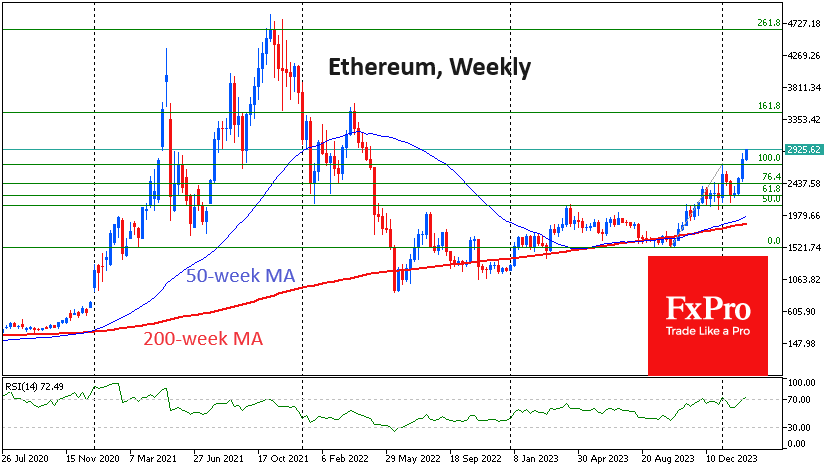

Ethereum is also trading in weak resistance territory after breaching the $2900 level. In April 2022, it plunged from levels near $3500 to $2000, with a complete capitulation at levels below $900. A recovery from $2000 to $3500 could be just as quick. This level is also close to 161.8% of the October to early December rally, which is a Fibonacci pattern.

Active building of call option positions with strikes of $60K to $80K, as well as fierce demand for ETFs, could push Bitcoin to an all-time high as early as March, according to QCP Capital.

The Coinbase exchange posted a net profit of $273 million in the fourth quarter. For the year, the figure was $95 million on total revenue of $3.1 billion, the company said in a letter to investors. Coinbase acted as custodian for nearly all the spot bitcoin ETFs that received SEC approval in January.

MicroStrategy, the largest corporate holder of bitcoin, told shareholders that the company's capitalisation would grow significantly in 2023 and that it was ready for inclusion in the S&P 500 index.

Bankrupt cryptocurrency lender Celsius said that $2 billion worth of crypto assets have already been transferred to lenders, including 20,255 BTC and 301,338 ETH.

Investment firm VanEck has filed a revised proposal with the SEC to launch a spot Ethereum-ETF. VanEck joins Franklin Templeton, Grayscale, BlackRock and Invesco in the race for Ethereum-based exchange-traded products. Some experts believe the regulator will register the products in May.

Galaxy Digital estimates that about 15-20% of the total computing power of the Bitcoin network will be unprofitable after the halving in April. The calculations are based on a BTC price of $45,000 and a 15% transaction fee.

The attractiveness of Tether's USDT compared to other stablecoins is likely to diminish as future regulations in the US will require greater transparency and compliance with new KYC/AML standards, JPMorgan said. The bank believes that regulations for stablecoins will be coordinated globally through the Financial Stability Board within the G20.

Christopher Waller, a member of the Federal Reserve Board of Governors, believes that the popularity of stablecoins pegged to the US dollar will help maintain the dollar's status as the world's reserve currency.