The information presented in this article is aimed at training beginners and intermediate traders. This information will allow you to understand the essence of fundamental analysis and learn how to apply it in practice. In addition, after getting acquainted with the material, novice traders will have a correct idea of the over-the-counter market. Successful practical application of the considered strategy will allow to achieve stable indicators of profitability. In order to evaluate the effectiveness of the trading system presented below, it is essential to understand the main misconceptions of 99% of novice traders.

Currency market myths

The daily turnover of funds in the over-the-counter foreign exchange market exceeds $ 4 trillion. This is mentioned by many brokers for marketing purposes. This information creates the illusion of easy and impressive earnings for novice traders, but in practice everything is different. In the network you can find descriptions of various strategies, the use of which allegedly guarantees a monthly doubling of capital. “Break-even” strategies relying on dubious trading tactics are also colorfully described by trading “gurus”. The most popular of such strategies are known as the Martingale and averaging methods. However, keep in mind: when hiring traders in international investment funds, the key requirement is compliance with risk management, which implies the rejection of the use of the Martingale and averaging methods in daily operations.

Some traders have great hopes for “innovative” automated trading systems as they are advertised as based on artificial intelligence and have a profit potential of 300% per month. The profitability of such programs is limited only by the imagination of developers.

In fact, an average profit margin of an experienced trader adhering to moderate leverage constitutes not more than 20% per month. This figure can even be called remarkable. If there really is an interest in such activities, then it is important to take this fact for granted and decrease the appetite for the sake of security of your investment capital.

Another common myth about trading on the foreign exchange market is that it’s easy to master. The trading process really seems pretty simple. The trader only needs to specify one of two potential directions for the price chart and make a profit if the forecast turns out to be correct. Many blog authors interested in promoting the services of intermediary companies and questionable brokers, an integral part of cooperation with which is a conflict of interest, try to convince novice traders in the absence of the need to obtain specialized knowledge for successful trading. In fact, in order to achieve stable profits, it is important to have not only specialized education, but also certain skills and personal qualities, of which self-discipline can be called a priority. Before you start trading real money you should study:

- The structure of financial markets;

- Types of displaying graphics, as well as the advantages of using Japanese candles and Price Action patterns in trading;

- Understand the principles and features of the application of all methods of analyzing graphs;

- Understand the fundamental difference of currency pairs from an analytical point of view.

The list of necessary knowledge to start trading looks daunting, but after reading the presented material to the end, even a novice trader can learn how to consistently profit from the pricing of liquid financial instruments.

Practical application of fundamental analysis in Forex trading

Fundamental analysis is one of the main types of analytical work with price charts, involving the study of the most important macroeconomic indicators and their impact on the pricing of national currencies. This type of analysis is regularly criticized by both experienced and novice bidders. This is due to the ineffectiveness of the practical application of this method.

In fact, the problem is that for most traders, fundamental analytics is limited to working with the economic calendar. Of course, some events have a short-term impact on the value of the asset, but to predict the direction of the price impulse in this case is almost impossible. The fact is that the change in the value of the national currency at the time of publication of macroeconomic data does not depend on the news, but on the delta of trading volumes. Only by knowing the difference between the number of contracts for buy and sell and the amount of capital it is possible to place the correct order in advance. Similar information is presented on paid analytical platforms:

- VolFix;

- SB-Pro;

- NinjaTrader.

The developers of the mentioned terminals provide a free trial period.

Macroeconomic and geopolitical factors influence the dynamics of the value of the national currency only in the long term, so experienced traders recommend beginners to begin work with the analysis of H4 or D1 charts. The advantages of trading on these timeframes are obvious:

The absence of market noise, which creates favorable conditions for the effective application of technical analysis and indicators.

Opportunities for the practical application of fundamental analysis. Correctly composed trading plan is successfully implemented in 80% of cases. This practice is followed by large investment funds.

Long-term trading positions, depending on the specification of contracts, will provide the trader with additional passive earnings on swaps.

The key currency in the global financial arena is still the US dollar, therefore, in fundamental analysis, priority should be given to the economy of this state. To do this, you should pay attention to the stock index S & P 500, the cost of which reflects the pricing dynamics of the largest US companies operating in different sectors of the economy. Equally important is the Dow Jones index, which displays the average stock price of the largest companies operating in the industrial sector.

Important! Among traders, it is widely believed that the growth of the US stock market has a positive effect on the growth of the national currency. In fact, the opposite is true. This is due to trading volumes. With a positive trend in the value of shares of companies with high capitalization, large investors invest in the stock market, which in turn provokes an outflow of capital from foreign exchange. By reducing the value of stock assets, the national currency displays growth. This can be explained by a popular risk diversification strategy. With the decline in prices for the shares of large companies, investors are beginning to more actively buy US government bonds, which has a positive effect on the exchange rate of the national currency.

How can this be applied in practice? It is important to monitor the dynamics of the value of large-scale stock indexes and, with significant changes, open transactions in the foreign exchange over-the-counter market in the opposite direction.

Description of the strategy and rules of trade

Ðnalytical work does not imply the need for you to examine the quarterly reports of large US companies. It will be enough to open the chart of the S&P 500 index, since it is this asset that most objectively reflects the current situation in the stock market. It is important to wait for the formation of a price element, the range of which will be at least 2 times higher than the value of the intra-day index volatility. The next day, you will need to open a trade in the opposite direction on the pair USD / JPY. This tool is the most optimal for the practical application of the strategy for several reasons:

- The relatively high volatility within the day provides a good profit potential;

- USD/JPY pair is characterized by medium and long-term trends;

- When trading on this asset, it is possible to define target levels on the Fibonacci grid, which are processed in 80% of cases.

In addition, the Japanese yen does not have a significant impact on the US dollar and is much less in demand in the global financial market. In addition, the peak of trading activity on the Japanese currency falls on the Asian session, and trading on the strategy will be carried out exclusively during the period of European trading.

To understand the principle of trade, it is recommended to consider several practical examples. The D1 period will be used to work with the S & P 500 schedule. The chart itself can be opened on Investing.com or on the Tradingview online platform. The timeframe of a currency pair does not matter.

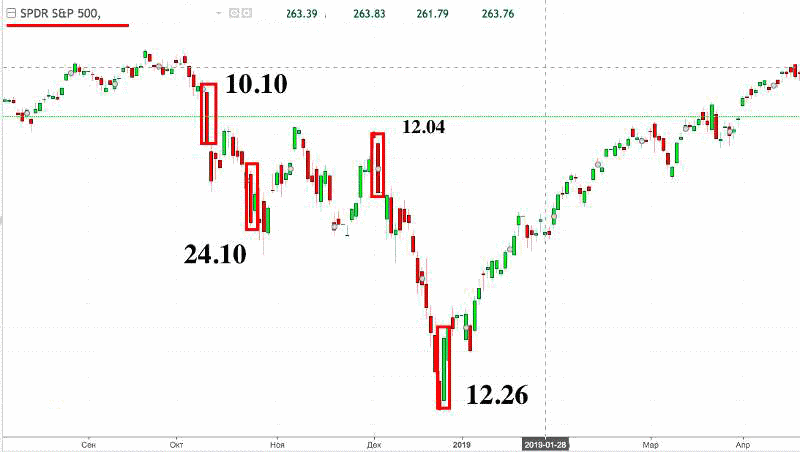

The most favorable trading signals were formed on the S&P500 chart on October 10 and 24, as well as on December 4 and 26. In fact, it is possible to open up to 4 trading positions within a month. In this case, the range of the signal candle should exceed the average value of intra-day volatility by at least 50%. However, novice traders are encouraged to work only with signals, open orders for which will be successfully implemented with a probability close to 100%.

To make sure that such signals are highly efficient, you will need to open the USD/JPY chart:

Trading is carried out only during the European session the next day after the formation of the signal candle on the S&P500 chart. The transaction must be closed before 16-00 GMT inclusive. It is at this time that the new trading day begins on the New York Stock Exchange and the opening of the market will be able to radically influence the situation.

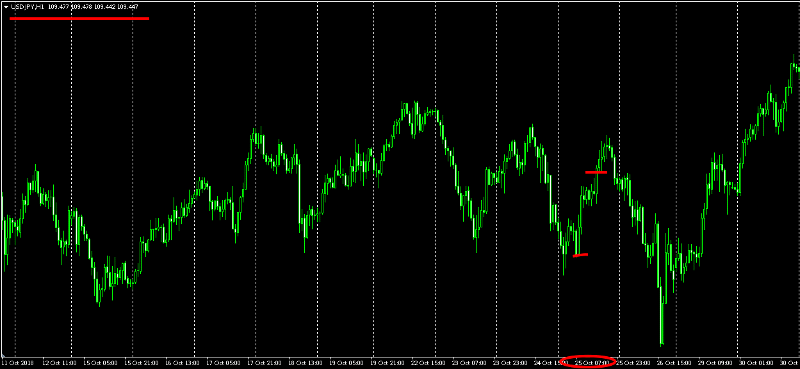

On October 10, the value of the S&P500 index dropped significantly. This suggests that investors will more actively start buying US government bonds, which will have a positive effect on the national currency rate. Consequently, the next day at the beginning of the European session for the pair USD/JPY you will need to open a Buy order. In the screenshot, a red marker marked the opening and closing points of the order in manual mode. Profit amounted to 40 points. The forecast fully met expectations.

On October 24, a similar trading signal was formed on the chart of the S & P 500 index, which gives grounds for opening a Buy order for the USD/JPY pair on October 25 at 09.00-10.00 GMT:

In the screenshot, the entry and exit points are marked. Profit amounted to 74 points.

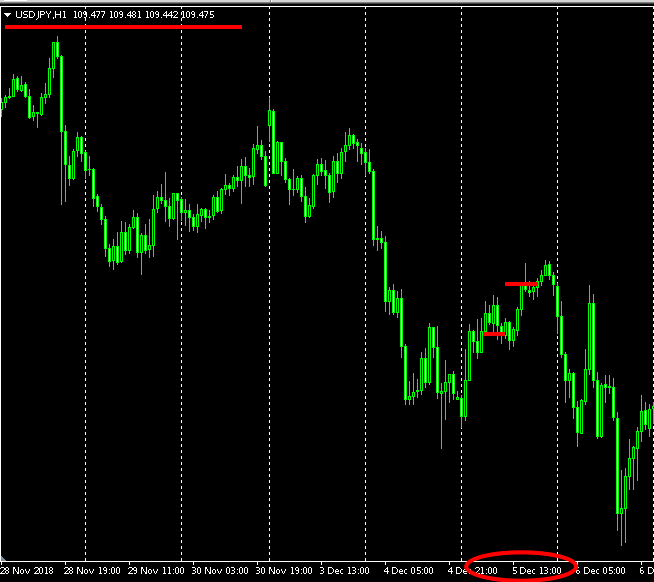

A similar trading signal on the S&P 500 chart was formed on 04.12, which gives grounds for opening a Buy order for the pair USD/JPY 05.12 at the beginning of the European session:

This time the financial result was more modest. Profit amounted to 27 points with the spread.

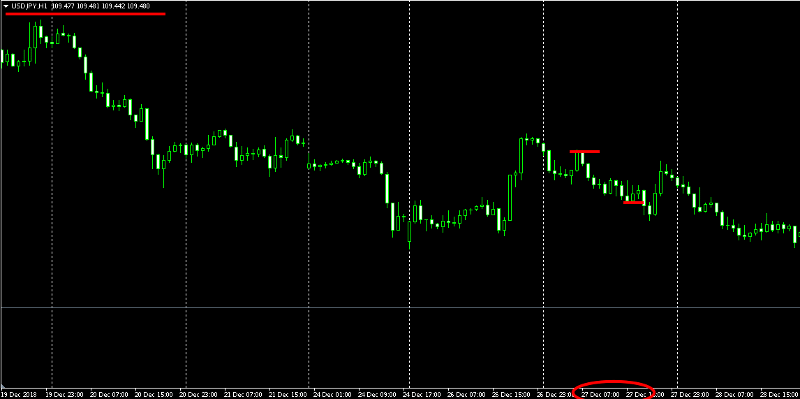

On December 26, the S&P500 chart showed an intense price momentum in the upstream direction, which is a convincing signal for opening a Sell order on December 27 at 09.00-10.00 GMT:

Profit amounted to about 50 points.

Conclusion

The article describes an alternative method of applying fundamental analysis in trading on the foreign exchange market. The main advantages of the strategy are:

- Moderate risks.

- Statistically confirmed result and the fundamental basis of the strategy.

- There is no need to use indicators, especially in order to confirm the trading signal.

With proper use of recommendations, obtaining a stable profit from Forex trading is almost guaranteed.

Important! The material presented is based on personal trading experience and is not a guide to concrete actions. Responsibility for the financial result is the trader himself.