Forex trading attracts new players by its unlimited earning potential and deceptive simplicity. After reviewing a trading platform’s functionality, it may seem that to make profit it’s enough to correctly “guess” the direction of the chart’s movement. It may be true to a certain extent, however, you can’t be “guessing” and earning constantly. After several successful deals you will open an order, which will lead to a loss of investment — guaranteed. Many traders had to learn this the hard way.

How to prevent this from happening? Trading gurus will say that you need to pay considerable attention to training and practical work with a demo account; webmasters, who earn on affiliate programs, will recommend that you familiarize yourself with some strategies, pick the most suitable one and put it into practice. If everything is really that simple, why, according to unofficial statistics, 97% of traders continue to lose money? And that’s because the above mentioned recommendations are totally ineffective. There are a number of reasons for this:

- In 99.9% of cases, "trading gurus" do not earn on trade. The main source of profit for them is educational courses themselves.

- Almost all sites dedicated to trading binary options or making money on Forex, mention strategies developed back in the last century that are not adapted to the current market volatility.

This article will present forex trading systems tested on personal experience. These are understandable and very effective strategies that even a novice trader can put into practice. If you want to convert trading from an expense item into a stable source of income, then the information presented below is definitely for you.

What go Gaps hide?

A gap is a break in the price chart that can be observed either during the publication of important macroeconomic data, or on the night from Sunday to Monday. This is what they write about on most sites dedicated to the Forex market. In fact, price gaps on the chart are formed daily, and on all currency pairs. This is what will allow every day to earn on gaps from 10 to 50 points of net profit.

Why is a gap formed on the charts? The reason is that macroeconomic processes cannot be “frozen” for the weekend. There is the concept of "trading session." These are time periods during which banks operate and traders from different countries trade. Pay attention to their schedule:

Thus, over-the-counter trading is available around the clock. It is important to understand that the main factor determining the price of an asset is trading volume. For example, at night, the EUR / USD pair chart is formed in narrow range (flat) charts, and on USD/JPY or AUD/USD, price impulses and even the formation of a local trend can be observed. The fact is that banks and traders from the USA and EU countries do not work at night. None of the banks work on weekends, so Forex trading is not available these days.

Despite this, macroeconomic processes in the world do not pause. That is why the value of a particular asset at the time the market closes on Friday evening may differ significantly from the price at the time of trading opening on Monday morning. It is noteworthy that the gap always seeks to close, that is, large bidders are interested in stabilizing prices. According to statistics, the gap is fully practiced in 80% of cases on popular currency pairs, which include EUR/USD and GBP/USD. Knowing this, you can derive the following trading rules:

- An order should be placed at the time the market opens on the night of Sunday to Monday (21-00 GMT).

- Trade should be considered only if the range between prices is more than 20 points. It is important to know that at the start of trading, the spread (price difference) expands by 2-3 points.

- Stop Loss should be set 7-10 points above / below the last local level.

- If the price of an asset at the time the market opens is lower than on Friday evening, then the opening of Buy orders should be considered, if higher, Sell orders.

Pay attention to an example:

The gap range seems small, but in fact it is 37 points. This is enough to open an order. As you can see, the forecast was fully justified within 12 hours. To make money on gaps, it is recommended to consider the H4 period and the following currency pairs:

- EUR/USD;

- GBP/USD;

- USD/JPY;

- GBP/JPY.

If at the time the market opened, the gap was not formed on one currency pair, then you should pay attention to others.

Important! The gap is not always displayed on the chart as a price gap. Take a look at the following example:

In such cases, it is quite difficult for novice traders to recognize a price gap, but nevertheless it exists. The last candle formed on Friday evening is a rising one; so pay attention to the closing point. The value of the asset at the time the market opens is much lower. The range between prices is 32 points, so in this case, you can consider opening a deal. It is worth saying that in most cases the gap is displayed without an obvious break in the graph. To identify a price gap and make a trading decision, you need to measure the range between the closing point of the last candle and the opening point of the market on the night from Sunday to Monday.

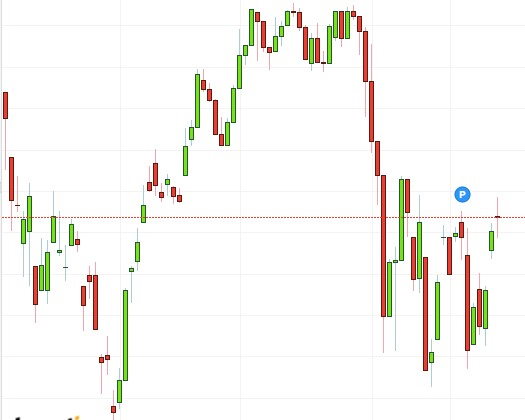

As mentioned earlier, the principle of earning on price gaps is not limited to the classical method. Gaps are formed every day. Pay attention to the chart of the NYSE index:

If you look closely at the presented schedule, you can see that the gap forms almost daily. This is due to the fact that trading on the Exchange is carried out from 7-00 to 14-00 GMT. On the OTC market, at the junction of trading sessions, a similar picture is observed. For example:

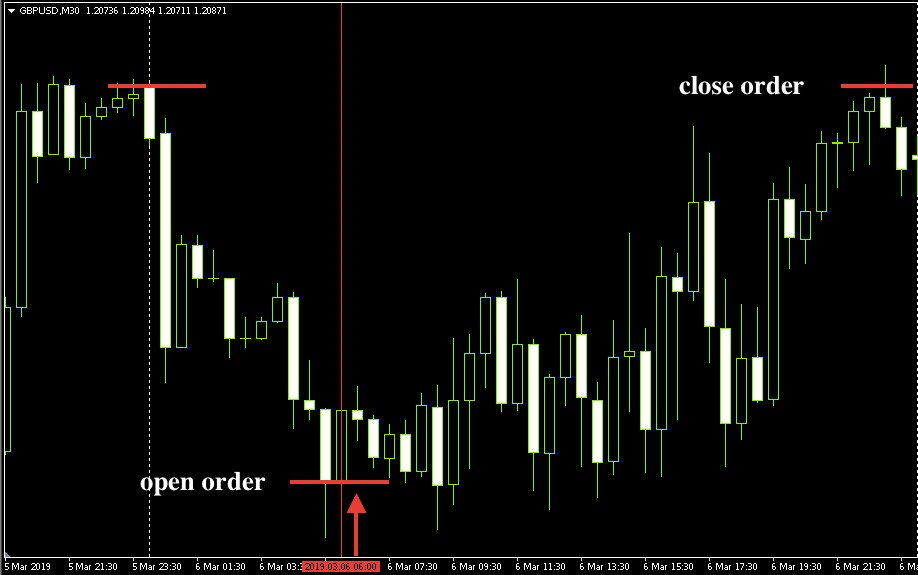

The screenshot shows a chart of the GBP/USD pair with a period of M30. The vertical line marks the candle formed at 03-00 GMT time (opening of the European session). The British pound and the US dollar are practically not traded during the Asian and Pacific sessions, therefore, when working with this asset, the distance covered by the chart for the mentioned period should be considered as a price gap that will be “compensated” during the day. As you can see in the image above, it happened.

Trading Rules:

- A transaction should be opened at 03-00 GMT only if the range between the closing point of the previous trading day, the opening point of European trading exceeds 20 points.

- Stop Loss will need to be set at the nearest local level, and Take Profit should correspond to the closing price of the previous trading day.

It is important to remember that placing Stop Loss orders is mandatory in the practical application of this strategy. Do not forget that price gaps work out only in 80% of cases.

Let’s review the trading examples for the considered trading strategy:

Quite often, the profit potential is limited to 20-30 points. This can be explained by a lack of liquidity during the Asian and Pacific trading sessions.

The Stop Loss level must be set 7-10 points above / below the last minimum or maximum (depending on the direction of the order). Putting safety warrants should be treated very carefully.

The transactions presented in the screenshots fully justify the effectiveness of the considered strategy. The statistics of potential profitability can be calculated independently, based non the history of quotes. It is strongly recommended that you follow the rules of money management when working with this strategy. The risk on the transaction should not exceed 2-5% of the deposit amount.

On average, novice traders, adhering to all the rules, will be able to consistently earn from this strategy from 10% to 30% monthly. The minimum capital to start trading with a leverage of 1: 100 will be 100 USD for standard accounts and 1 USD for cent. It is recommended to cooperate with brokers, according to which the spread on GBP/USD will not exceed 3 points.

Trading gold for beginners

Many intermediary companies provide traders with the opportunity to trade precious metals, the most promising of which is gold. The price of this metal is extremely predictable in the long run and is highly dependent on the investment climate. You should be aware that gold is the so-called “safe haven asset." Many large investors invest their free funds precisely in this metal during periods of economic instability, which increases its value against the backdrop of high demand. Pay attention to the dynamics of the development of gold prices over the past 20 years:

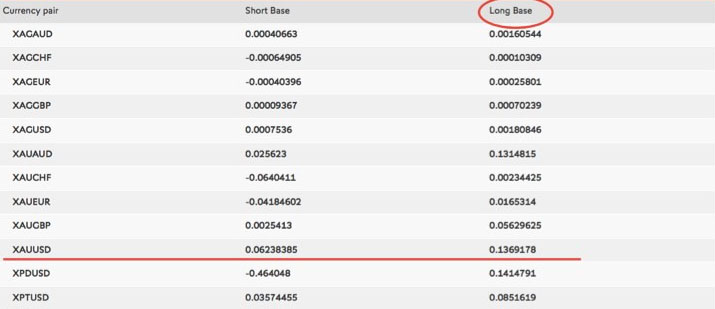

As you can see, in the long run, this asset is growing steadily in value. It should also be noted that large international banks, which are also Forex dealers, offer their customers a positive swap for this metal regardless of the direction of the order. Among these is Swissquote Bank SA, let’s review the contract specifications presented on the website of this bank:

Thus, to make profit, a trader only needs to open a Buy order with a volume of 0.01 from a standard lot (when trading gold, the lot is 150,000 USD) and hold it for 1-2 months. Swaps will be charged daily, which will provide guaranteed, passive profit. You can also consider closing the transaction with profit taking when the price reaches a local maximum.

Ho to act if a downtrend is formed? In this case, there are 2 options:

- Use locking. If, when a Buy order is opened, the price overcomes 50 points in a downward direction, it will be necessary to open a Sell order with the same trading volume. As mentioned earlier, the value of gold always grows in the long run, so making a profit in such situations is a matter of time. It is also worth noting that when locking, passive profit from swaps will double.

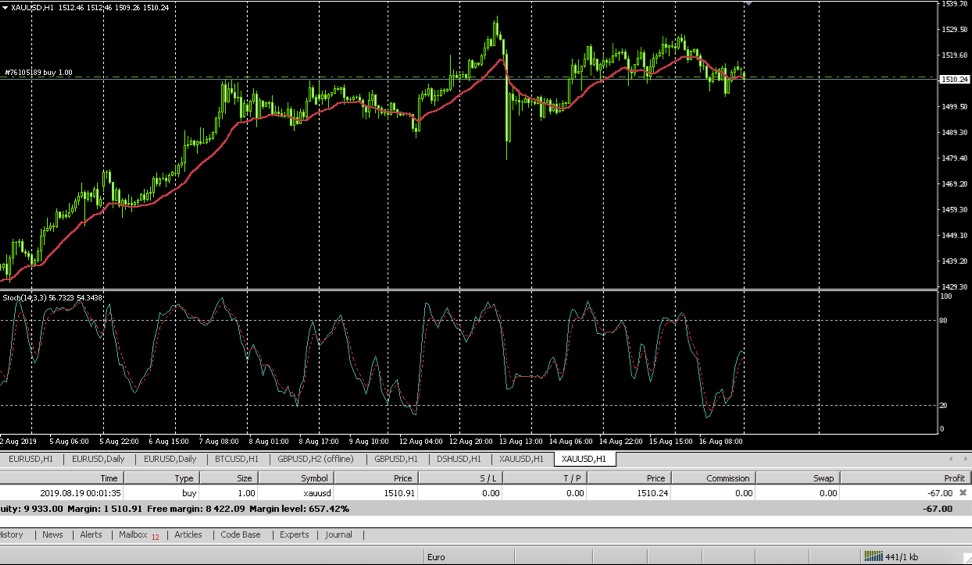

- Implement averaging. This technique should only be considered by experienced traders. The principle is largely similar to locking. If, after opening a transaction, the chart moves in the opposite direction from the forecast, then a Buy order with the same volume should be re-placed. Both deals will need to be closed as soon as the overall financial result reaches zero. Pay attention to a real trading example using this method:

When opening a deal, the chart began to move in a downward direction. A little later, the loss exceeded 50 points and it was required to open a second order using the averaging method. A negative financial result was observed for 4 days, but ultimately both transactions fully met expectations.

Both deals closed with profit taking at the local maximum. Profit amounted to 40% of the deposit during the week.

Important! Before applying the averaging method in gold trading, it is strongly recommended to gain experience. Beginners should consider locking.

As you can see, gold is a very promising asset for earning in the OTC market even for trading beginners. The only drawback is the high requirements for a starting deposit. For comfortable trading on the XAU/USD pair, you will need at least 1000 USD, but no one forbids starting with a cent account. In this case, the starting investment will be only 10 USD.