The cryptocurrency market experienced a downward spiral recently, with Bitcoin (BTC) leading the way. After a brief bounce during Martin Luther King's holiday, institutional investors returned, triggering a significant drop in BTC's price. Notably, Grayscale's Bitcoin Trust (GBTC) witnessed an exodus of redemptions, intensifying selling pressure. This article explores the reasons behind the crypto market's decline and assesses its potential future trends.

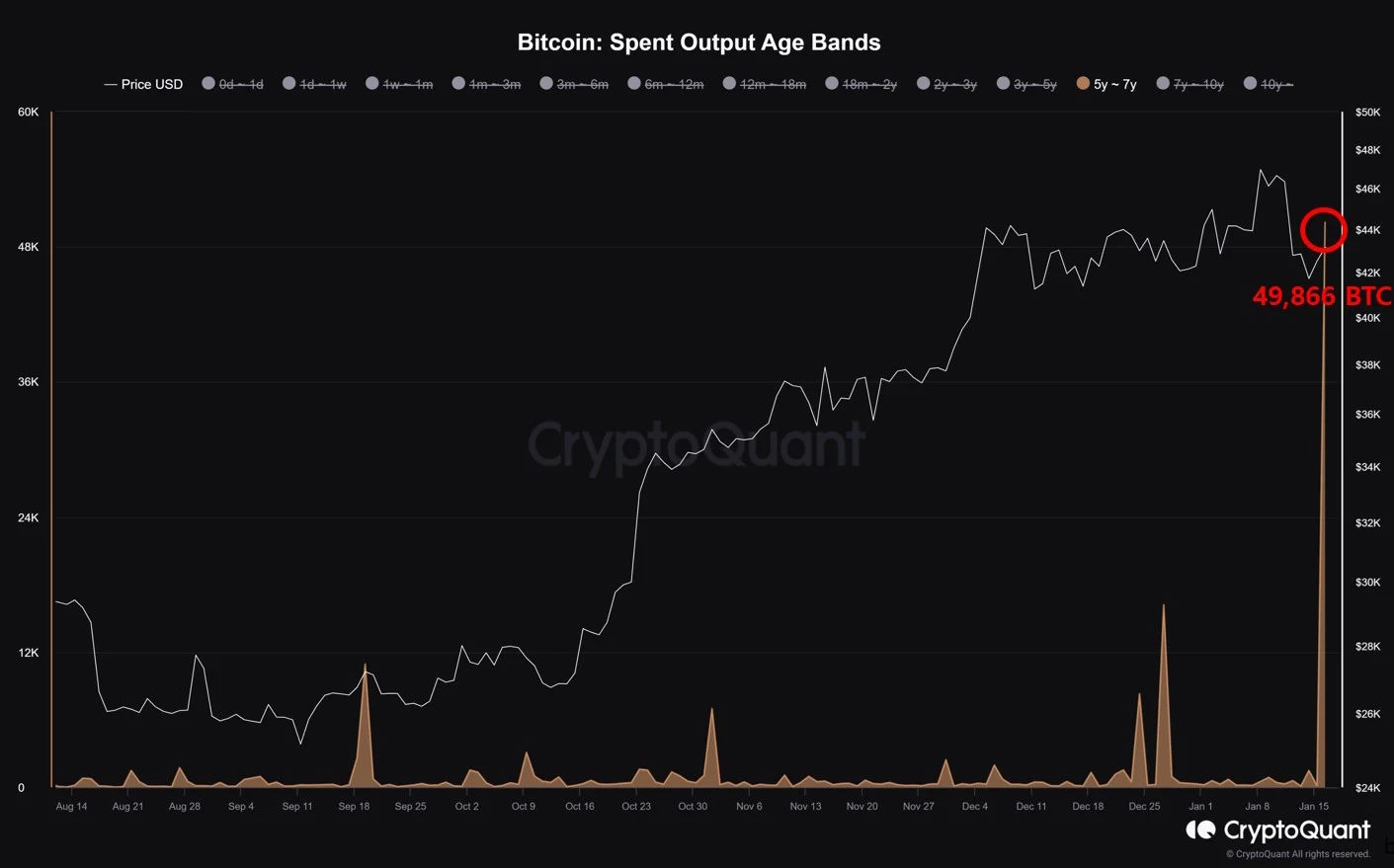

BTC's Price Decline: BTC's price faced a relentless decline, dropping nearly 10% from $43,500 to $40,200, following a 15% fall the previous week. The market turmoil was attributed to a combination of factors, including Grayscale's redemption wave and the release of 49,866 BTC held for approximately six years.

GBTC Exodus and Its Impact

GBTC, a major player in the market, experienced a substantial outflow of Bitcoin as clients redeemed their holdings. This massive sell-off, compounded by the higher fees charged by Grayscale compared to spot ETFs, contributed to the selling pressure. By the end of the week, GBTC had offloaded approximately 37,600 BTC.

Interestingly, despite the downturn, newly listed spot exchange-traded funds (ETFs) attracted over $1 billion in net inflows. Notable institutions like BlackRock and Fidelity led the way in these investments. However, the influx of institutional funds was insufficient to counter the selling pressure from Grayscale's redemptions.

Uncertainty Looms

With Grayscale still holding around 585,000 BTC that clients may opt to sell in the coming weeks, uncertainty prevails in the market. Additionally, the possibility of Mt. Gox's redemption and Celsius' ongoing asset sale adds to the potential for further client sell-offs. The recent surge of over 250% in BTC's price over the past year could encourage profit-taking.

Assessing Market Frothiness: One indicator of market frothiness is the Korean Premium, also known as the Kimchi Premium. Historically, this premium emerges during bull markets and disappears during bear markets. A surge of over 3% in the Korean Premium relative to the Coinbase Premium often signals overheated conditions, suggesting that BTC's price may need to cool down in the short term.

Market Consolidation Ahead

While the Korean Premium reverts to its mean, the price of BTC may undergo a consolidation phase lasting several months. This period of price stabilization could indicate a relatively subdued market even after BTC establishes a new floor. However, this consolidation may pave the way for potential opportunities in the altcoin market.

Crypto Legal Developments: Amidst the market downturn, the cryptocurrency industry received a significant boost in a legal battle. In the Coinbase vs. SEC lawsuit, the judge leaned in favor of cryptocurrencies, stating that the SEC's classification methods were outdated. This favorable stance suggests the need for new regulations tailored to the crypto asset class. Such developments bode well for the crypto industry, especially for altcoins and the expanding DeFi sector.

Long-Term Bullish Metrics

Despite the current market turbulence, long-term BTC metrics indicate that the cryptocurrency is in the early stages of a larger bull market. The diagram below, illustrating UTXO Age Bands, shows that BTC's price typically enters a strong uptrend when long-term BTC supply held by whales begins to be sold. This cycle of disposal continues throughout the bull market, and the current cycle has only just commenced, leaving room for further price growth.

Market Developments Beyond Crypto: In the broader financial landscape, U.S. stocks demonstrated resilience, closing higher after a mixed week.

A boost came from better-than-expected economic data, with December retail sales surpassing expectations. Additionally, the University of Michigan's preliminary report showed a significant increase in consumer sentiment, signaling confidence in the economy.

Market Gains and Losses

Tech and growth stocks led the market, with the Nasdaq gaining 3.1%, the S&P rising by 1.3%, and the Dow edging higher by 0.8%. Gold and silver faced declines, down 0.87% and 2.3%, respectively. Meanwhile, oil prices increased by around 1% due to ongoing tensions between the U.S. and Houthi fighters in the Middle East.

Upcoming Events

This week holds several key events, including meetings by the Bank of Japan (BoJ), Bank of Canada (BoC), and the European Central Bank (ECB). Additionally, the release of the PCE price index will be closely watched as an indicator of inflation. These developments will set the tone for the financial landscape ahead of the Federal Reserve's meeting in the following week.

The crypto market's recent downturn, led by BTC, has been influenced by a combination of factors, including Grayscale's redemption wave. While market consolidation may be on the horizon, long-term metrics indicate a larger bull market ahead. Legal developments favoring the cryptocurrency industry, such as the Coinbase vs. SEC lawsuit, provide optimism for the market's future. Amidst these challenges and opportunities, the crypto market remains dynamic and poised for growth.