5 Ways to Get More Investors to Copy Your Strategy

Copy trading is one of the popular ways that allow professional traders to earn additional income on their trading by offering investors to copy their trading strategies for a fee. Many IBs and PAMM managers also use this service to reach their goals. While becoming a strategy provider may be easy, finding and attracting investors to follow their strategy is not. However, there are platforms that already provide all the necessary tools to promote strategies.

Let’s have a look at cTrader Copy. This is an innovative investment platform and a copy trading service that has recently been added to a popular cTrader trading platform. It really stands out in the market thanks to its transparency and flexibility, as well as effective strategy promotional tools.

So if you are a Strategy Provider and struggling to find Investors, here are 5 ways how to get more investors to copy your strategy with cTrader Copy.

1. Choose Platform with a Cross Broker Feature

Firstly, by creating a strategy provider’s account with cTrader Copy, you are already getting access to a pool of investors, since cTrader Copy is a cross-broker service. It means that all investors from all cTrader Copy enabled brokers will be able to copy your strategy.

2. Be the Best

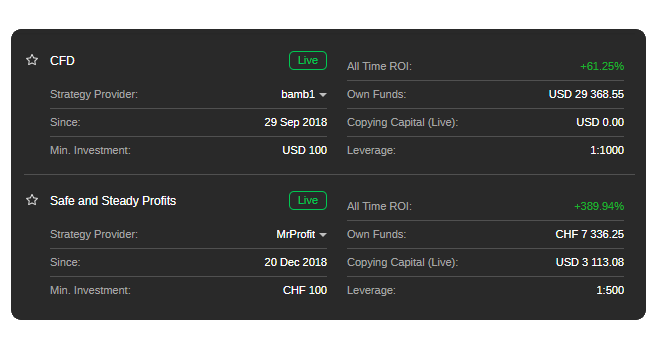

All cTrader Copy strategies that meet the requirements to be visible are added to the strategies list. The better your strategy is performing, the higher on the list it will be placed. The higher it is in the list, the easier it is for investors to find it.

3. Write an Engaging Strategy Description

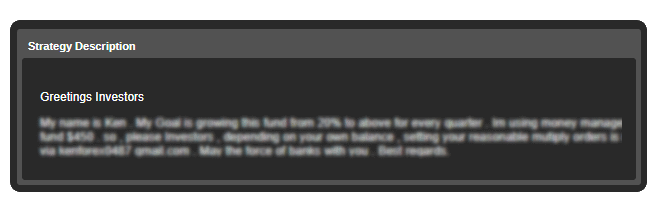

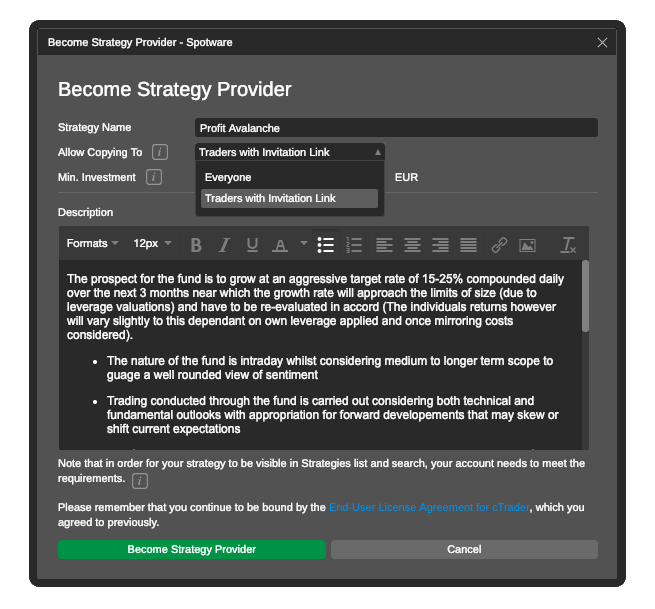

In cTrader Copy, each strategy has a detailed profile, which covers its trading performance statistics, history, and description that you can write. To attract investors, create an engaging and informative content stating all the important information about your strategy and why to follow it.

4. Share Your Strategy on Different Sources

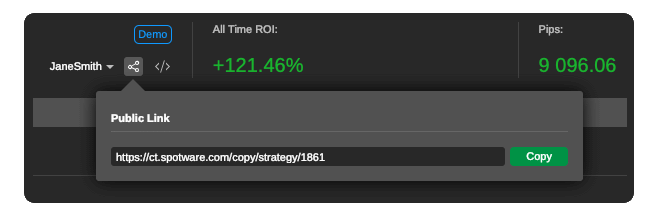

There are many trading forums, communities and social network groups where you can find prospecting investors and attract them to follow your strategy by simply sharing it with a link.

5. Create a Website with Your Strategy

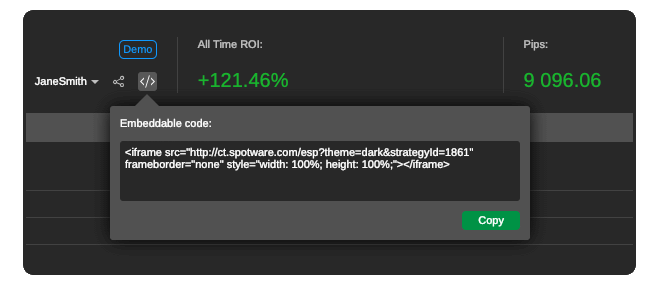

Nowadays, creating a professional looking website or blog is quite easy. And this is a great way to make investors familiar with your strategy. With cTrader Copy, you can embed your strategy profile into your website or blog to showcase it in real time.

Bonus: Offer Your Strategy as Exclusive

If you have a group of selected investors that you would like to copy your strategy exclusively, you may do so in cTrader Copy. Such strategies cannot be searched and discovered from the Strategies list, they are hidden from anyone else except those who have unique invitation links that you can send them in a private message.

Other than that cTrader Copy has many other advantages for strategy providers including flexible fees structure and a minimum investment amount.

If you are ready to open your Strategy Provider account with cTrader Copy, follow this link