The stock market has often been regarded as an indicator or predictor of the real economy. Its suggested that a large downward movement in the stock market (20% and below) is telling of a future recession. Meanwhile, a large upward movement in stock prices hints toward future economic growth. However, this notion doesn’t exist without its controversy. Sceptics point towards events that questions the stock market’s supposed predictive ability of the real economy. A leading example is the strong economic growth that followed the 1987 stock market crash.

Moreover, the recent Coronavirus recession, that saw the U.S. economy contract by 19.2% from its 2019 peak, also led to a substantial rise in the S&P 500 during the same period.

Then again, the hypothesis has held true at other points in history. Steep market declines that preceded the Great Depression of the 1930s, along with the Great Recession of 2008 are both leading examples.

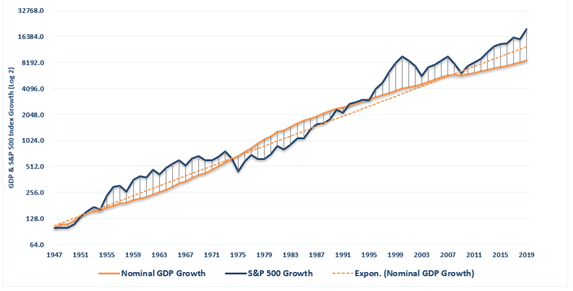

Nominal GDP Growth Versus S&P500, 1947- 2019

Looking at the past, it’s obvious that the relationship between the financial economy and the real economy definitely isn’t a clear one. At least not as clear as economists might think. The argument that posits a close relationship between Wall Street and Main Street is as follows.

Higher Returns, Higher Spending, Higher Growth

This argument, known as the Wealth effect, puts forward the idea that individuals increase their spending when the value of their held assets (such as real estate or stocks) are rising. This increase in economic activity, in theory, contributes to higher economic growth. Traditional financial models suggest that the financial markets reflect expectations about the economy. This offers predictive power over its future.

The idea is that current stock prices reflect the future earnings potential of corporations, which in turn, is directly linked to economic activity and fluctuations in the economy.

Fluctuations in stock prices are therefore thought to lead the direction of the economy. For example, if an economic recession is on the horizon, investors will anticipate this by bidding down the price of stocks.

Is the Economy/ Stock Market That Simple?

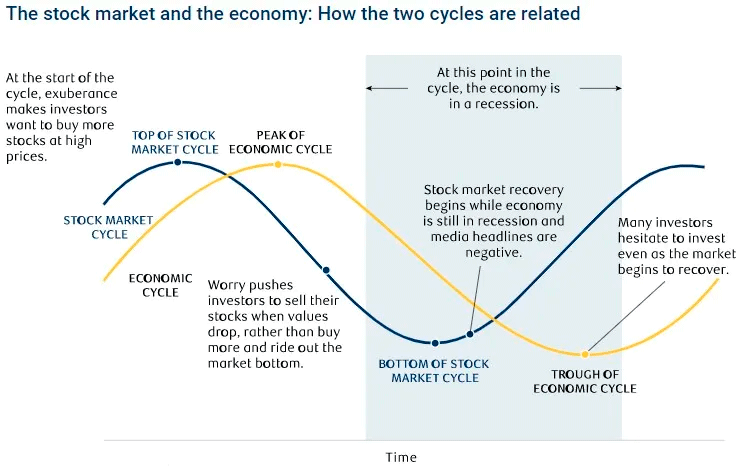

Unfortunately, it isn’t. The affiliation between the financial and real economy has never been a simple one. Whilst it’s generally accepted that the two move in a similar direction, they often perform differently to one another. This is particularly true in the short term. This divergent relationship comes down to several factors. First, stock market investors are forward thinking by nature. The price investors are willing to purchase a stock at today is based upon future expectations of a company’s financial performance. In contrast, economic data observes what has already taken place. Economic indicators like unemployment and GDP tend to lag the broader economy. Conversely, the forward-looking landscape of the stock market often causes it to lead to economic cycle. This can be visualised in the chart below.

An additional point to consider is how investors digest economic headlines. Economic news can either be good or bad, but what’s more important is how this news is translated and applied.

For example, positive news of lower unemployment and higher consumer spending indicates rising economic growth. For the stock market, investors could translate this news as the onset to higher inflation– leading to rising volatility in stocks.

Other times, bad economic news can be good for markets. For example, consider the scenario of rising unemployment. This can raise market expectations for governments to respond with policies to help stimulate the economy. Generally, expectations of higher stimulus in the future are an encouraging sign for investors, often boosting the financial markets.

The Correlation Isn’t Perfect, But It Is Increasing

No one would argue that the stock market and the real economy are the same thing. However, the distinction between Wall Street and Main Street is becoming increasing harder to draw, according to analysts. Household ownership of stocks have scaled to new highs in recent decades. In 2021, the share of household wealth that came from held stocks reached a record 41.9%. This has more than doubled from 30 years ago.

“Consumers have been big buyers of equities ever since 2016. We’ve seen a really big correlation between equity prices and discretionary spending,” remarked Steve Blitz, chief U.S. economist at TS Lombard.

If the financial markets can, even vaguely, uncover the direction of the economy, the sell-off taking place now strongly argues the case for a slowing economy. The mistake is to assume the stock market and real economy are interchangeable terms. Taking the COVID-19 economy as an example, the financial markets swiftly entered a recovery, powered by the internet and tech sectors that drove the ‘stay at home’ economy.

Energy and consumer discretionary sectors, both of which are arguably more telling of the real economy, still trailed for an extended duration of the pandemic. In parallel, real GDP growth remained negative. Therefore, the lesson is simple. We should not mistake the recent performance of the equity markets as representative of the economy as a whole.