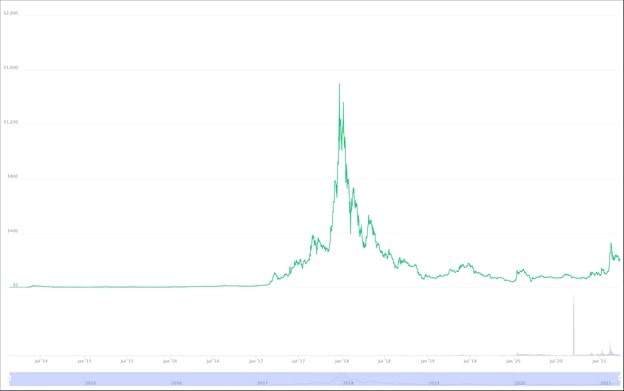

At one point, investments in Dash were highly profitable. Many traders received significant gains from the Dash cryptocurrency when the price action surpassed the $1,500 benchmark back in late 2017. Later, however, the coin's value dropped and fluctuated throughout 2018, the year of the cryptocurrency market's recession. At one point, investments in Dash were highly profitable. Many traders received significant gains from the Dash cryptocurrency when the price action surpassed the $1,500 benchmark back in late 2017. Later, however, the coin's value dropped and fluctuated throughout 2018, the year of the cryptocurrency market's recession.

In this article, we'll dive into what the coin's worth today and whether you should invest your money in this highly secure crypto with fast transactions. We'll also explore Dash's expected price in 2021 and further on. Read on to find out what major crypto advisors think about the future of Dash coin.

Dash Coin: Overview and Main Features

First things first, let's determine what Dash is and how it differs from other cryptocurrencies. Dash was introduced back in 2014, featuring a Bitcoin protocol as the first privacy-centric cryptocurrency. Back then, it was called Xcoin but changed to its current name, Dash, in 2015 after a rebrand.

Dash historical prices

The founders designed the cryptocurrency so that its governance and mining are split. While the creation of new blocks is the miner's prerogative, master nodes are responsible for governance and execution. The founders put anonymity and user privacy at the core of the coin. This is implemented with PrivateSend, which boasts strong and reliable encryption. The service allows users to remain anonymous: all Dash transactions are untraceable, unlike Bitcoin's.

Besides the focus on user data privacy, Dash was designed to become an easy-to-use cryptocurrency that can potentially substitute traditional payment methods. With the rise of digital cash, financial organisations entered the competition for customers' loyalty. Dash outperforms the competition because of fast and affordable transactions. For instance, with Dash’s immediate payment feature called InstantSend, you can instantly send money for less than 0.01 USD. Even Bitcoin can't boast such a service, which makes Dash a promising crypto for daily use.

Another argument in favour of Dash is its accessibility. The coin is traded on numerous crypto exchanges and can be bought for other crypto and fiat currencies.

What Did Analysts Think About Dash's Price in 2020?

Before we move to Dash price predictions for 2021 and further on, let's see what experts thought about it in 2020. The coin didn't have a particularly good year in 2019, with its value fluctuating significantly. However, some believed that Dash might move upward. CoinSwitch, in particular, saw promise in Dash's hardware, which was supposed to be introduced a year earlier. The coin's founders planned to put master node hardware on individual chips, something that would have allowed every master node to set up its own data centre and enjoy improved platform functionality.

Moreover, CoinSwitch thought that the creation of a new team in Hong Kong, Dash Labs, was supposed to maintain the platform's openness and transparency. With this in mind, Dash's price was expected to reach $950.

However, that prediction was over-exaggerated, considering that the coin's value in USD was only around $40 at the end of 2019. Nonetheless, many believed the price would rise. Many predicted that it would have reached the $100 milestone once again. That's exactly what happened at the beginning of 2020. Despite some fluctuation throughout the year, Dash was worth more than $100 in late December 2020.

Dash Technical Analysis

The Dash price prediction is shaped by many factors, with technical analysis being among the most crucial. Technical analysis illustrates the future Dash price based on its past performance. In other words, you need to determine the fluctuation patterns and then implement them when forecasting.

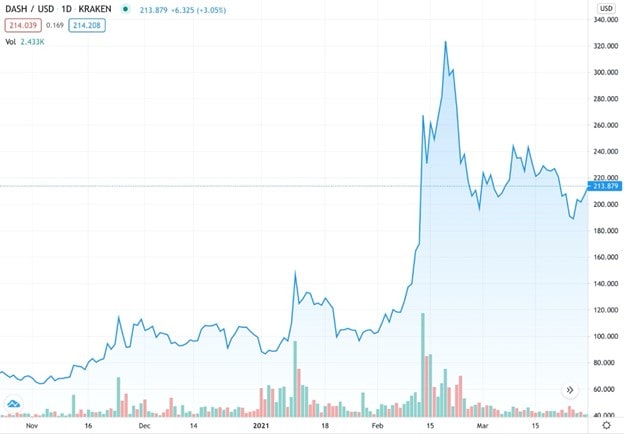

Dash technical analysis

Technical analysis looks at the cryptocurrency in terms of several technical indicators that help to determine whether to buy Dash. You can conduct the analysis on your own or consult reputable sources. TradingView, for example, suggests buying Dash in a one-month timeframe. The decision is based on two popular technical indicator categories: Moving Averages and Oscillators. At the time of writing, Moving Averages generate strong buy signals for the crypto, while the Oscillators remain neutral between buy and sell.

What Will Dash's Price Be in 2021?

At the time of writing, Dash's price is set at around $160, according to CoinMarketCap, which is a significant increase from $88 since 1 January, proving that the coin is moving upward in 2021. However, $194 isn't the maximum. The coin hit $324 in February 2021. At that time, many believed that $600 was a real possibility. In particular, this was attributed to the Relative Strength Index (RSI), which was directed towards the overbought region.

Nonetheless, the majority is sure about the upward trend and increase in value in the latter half of 2021:

- Analysts at Coin Price Forecast believe that Dash will be at $204 at the end of the year. That's a +26% change from its price in August.

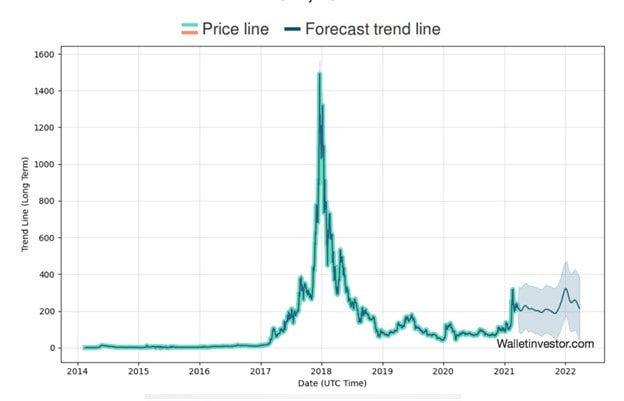

- Wallet Investor believes the price will keep fluctuating, with a rapid spike awaiting the crypto at the very end of the year. The price might move near $300 again, with some closing prices being over $400 in December.

- Digital Coin Price expects some positive moves for Dash, opining that the value might exceed the $250 milestone and possibly go over $260.

Wallet Investor: Dash Price Prediction 2021

The reasons for Dash's increasing price are different. Coin Price Forecast, for instance, puts its hopes on Dash establishing partnerships with payment systems and small- and large-sized businesses. If the collaborations are successful, the coin may become widely adopted because of its ease of use and accessibility. However, this may not lead to an instant price increase. TradingBeasts, for example, predict that the coin might marginally lose in value in 2021. At the end of the year, the price might go down to a local low of $130-$150.

Dash Price Prediction for 2022-2025

Generally, the Dash price prediction for 2022-2025 is positive. The majority of reputable sources believe that the coin will increase in value. Here is what can drive that growth:

- Scarcity. Since Dash features master nodes that keep a lot of coins off the market for sale, the cryptocurrency's price is going to rise once a lot of people buy it. The higher the demand, the more scarcity there is, therefore increasing the value.

- FinTech partnerships. Dash is actively widening its pool of partners, collaborating with various vendors and, thereby, enhancing its accessibility. This promotes widespread adoption and leads to a growing user pool.CoinSwitch, for example, believes that this factor can boost the price up to $2,822 in 2025.

- Fast and cheap transactions. InstantSend allows users to carry out transactions in less than a second. This is extremely fast and creates a competitive advantage even over the lions of the crypto market, like Bitcoin.

- Accessibility. You don't need to search for an exchange where you can buy Dash for fiat or other cryptos because it exists on all the major ones, making Dash easy to buy and sell.

However, the precise cryptocurrency predictions vary from source to source. Here are some of them.

Coinpedia

According toCoinpedia, Dash coin might enter 2022 valued at $805. By the end of that year, it might reach an impressive $1,000 and may even exceed $1,900. With that said, its potential future growth is even greater. The source believes that by the end of 2025, one Dash coin might be worth $3,500. As you can see, some experts recognise the huge potential of the crypto coin.

TradingBeasts

Although TradingBeasts believe Dash will lose value in 2021, the source doesn't see big fluctuations over the course of 2022. According to its Dash prediction, the price fall will continue at the beginning of 2022 at around $150. However, it will consolidate around the middle of the year near $155 and could potentially reach $198 at some of its highest moments.

Further on, the price movement is expected to move downward. According to the prediction, Dash will be worth $155 at the beginning of 2023 and gradually decrease to $127-$130 by the end of 2023. The trend will continue in 2024 at first, with a slight increase in value to around $120. But then, there might be an incredibly high jump to $170.

Coin Price Forecast

Coin Price Forecast released a Dash price forecast for the coming years that puts the coin's value ever-higher. The forecast looks as follows:

|

Year |

Mid-Year |

Year-End |

|

2022 |

$236 |

$307 |

|

2023 |

$376 |

$444 |

|

2024 |

$466 |

$526 |

|

2025 |

$546 |

$514 |

The Verdict

Dash is a promising cryptocurrency that can potentially become widely adopted. If this happens, the coin's price will likely see a significant spike. Since some coins aren't available for sale because of master nodes, the value will be able to increase as demand grows. There simply won't be enough supply.

Mass adoption is a real possibility, with both PrivateSend and InstantSend contributing to that possibility. Dash transactions aren't only fast and affordable; they're also highly secure and untraceable. The coin's anonymity combined with its transaction speed is an ideal blend that drives customers to Dash.

Although currently, the coin is far away from its all-time high, many believe that it will follow in the footprints of other digital currencies, which successfully regained their positions after the recession.

All these factors contribute to Dash's appeal to potential investors. That's why the majority of niche experts believe in Dash's bright future. For example, according to TradingBeasts, the price at the end of each year will look like this:

|

Year |

Minimum |

Maximum |

|

2021 |

$130 |

$191 |

|

2022 |

$130 |

$194 |

|

2023 |

$110 |

$190 |

|

2024 |

$97 |

$212 |

This isn't the most promising forecast, though. Some believe that the Dash's price might even reach Bitcoin's, hitting $80,000. While this may sound like utopia, one thing is certain: Dash shows the potential for steady growth within the coming years.

Dash Price Prediction FAQ

Here are some final questions regarding Dash's future price.

Is Dash a Good Investment 2021?

Yes, Dash is supposed to be a profitable investment in 2021. According to the majority of forecasts, the coin will steadily increase. While it may not spike in value, it's going to rise during 2021.

Does Dash Have a Future?

Yes, Dash has potential. Its secure and fast transactions may attract a lot of users if the founders manage to establish a number of strategic partnerships. This is the main reason why many believe Dash's price will greatly increase.

How Much Is a Dash Coin Worth Today?

As of today, Dash is worth $160. The price is slightly fluctuating, which is not surprising.

Will Dash's Price Drop in the Future?

Dash's price is fluctuating. However, it's unlikely to drop in value in the near future. Some experts, however, believe that its price will decrease until mid-2022 and will start to increase after that.

Is Dash a Fork of Bitcoin?

Yes, Dash was introduced in 2014 as a hard fork of Bitcoin. However, the cryptos have many differences: Dash features user data privacy and instant transactions.

How Is Dash Different from Bitcoin?

Dash offers anonymity and untraceable transactions, which Bitcoin doesn't do. Besides, it provides fast and affordable transactions.

Is Dash Mining Profitable?

It can be, but this is mostly dependent on Dash's price and prospects. However, when mining, be sure to keep an eye on electricity costs to minimise mining-related expenses.