A wide selection of financial and analytical tools allows the trader to put into practice any trading ideas. Moreover, ready-made and effective trading strategies based on fundamental or technical factors are regularly published on specialized Forex sites. All existing trading tactics can be conditionally divided into long-term and short-term.

Making a long-term trading plan based on fundamental factors is much simpler. In addition, the likelihood of successful implementation of such a forecast is significantly higher. The only drawback is the relatively low profitability, in comparison with the short-term trading style.

What is scalping?

Opening transactions in the short term with insignificant target levels is commonly called scalping. The main distinguishing features of this trading style are:

- high potential profitability associated with equal risks;

- the ability to trade at any time, regardless of the current market situation;

- high complexity of forecasting.

Scalping is unjustifiably a favorite tactic for beginner traders due to their potentially high profits, but experienced bidders recommend that beginners consider exclusively long-term trading based on fundamental analysis, chart patterns, or Price Action candlestick patterns. Scalping is indeed a rather complex trading tactic that requires extreme concentration and self-discipline. To apply this trading method in practice, certain trading experience is required.

Scalping can be of two types:

- The first is based on correlation. The essence of trading is to make a profit by changing the value of the spread.

- The second type of scalping involves short-term trading on short time periods of the chart (M1-M15) in accordance with the strict rules of the trading strategy. For the successful application of this trading style in practice, it is important for a trader to observe a key rule - the ratio of potential profit to possible losses should not be less than 1:1.

Among novice traders, it is the second type of scalping that is popular. The analysis of the price chart in this case is practically no different from the standard application of strategies. The difference lies only in the period of the chart itself. If the developers of a particular trading strategy recommend using it when working with timeframes of H4 and higher, then beginners do not consider this rule to be significant and easily neglect it, which often results in the loss of a significant part of the deposit.

The fact is that market noise prevails in the timeframes from M1 to M30, which negatively affects the quality of the trading signals of the indicators. It is also important to understand that when switching the timeframe, it will be necessary to adjust the input parameters of the oscillators. In the description of any trading strategy, specific settings are presented that you will need to set when transferring one or another analytical tool to the chart. The exact timeframe is also indicated. The likelihood that when changing the input parameters of the indicators or when changing the timeframe of the chart, the use of even a reliable strategy may not lead to the expected result.

This does not mean that scalping is a certainly unprofitable trading style. Just the opposite. Effective placing orders in the short term will allow you to earn tangible profits as a percentage of the starting deposit. Any indicator strategy can be adapted for scalping, but in order to use it effectively, you may need to change not only the chart timeframe, but also the settings of the indicators used.

Scalping Strategies

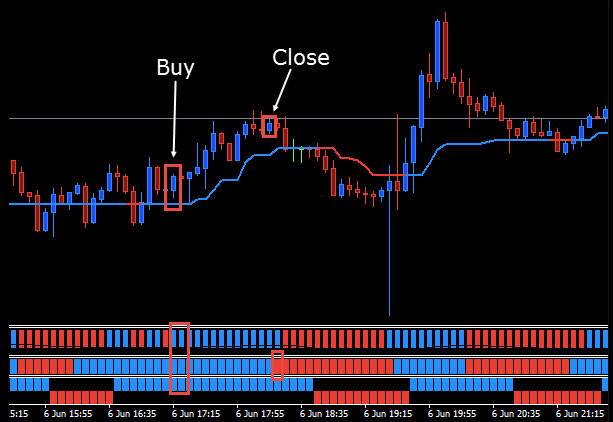

The scalping style of opening orders involves high-frequency trading, so the main analytical tools are trend indicators or oscillators. Most of the short-term trading systems that are reviewed on specialized sites are based on custom indicators. These tools are not included in the standard set of tools for computer analysis of the MetaTrader platform. When analyzing these strategies on historical data, it seems that the number of profitable transactions reaches almost 100% of the total number of orders. In fact, this is not so at all. The vast majority of custom indicators were developed for commercial purposes. The algorithm of these tools is almost completely based on standard indicators. The secret is that most of the custom indicators are redrawn, giving the impression of a high potential return. A good example of such strategy is Symphony TS:

The system fully involves the use of custom indicators based on the Bill Williams oscillator algorithm and Heiken Ashi candles. The trading rules are simple: if all indicators and the body of the candle are colored blue, then a buy order should be opened, and if it is red - a sell order. The Symphony strategy does not imply placing safety orders. A signal to close a deal is a color change of one of the indicators.

If you analyze the potential profitability of this strategy on historical data, the result will surprise any trader with a high profit. However, in practice, every second signal of the strategy is false and subsequently redraws.

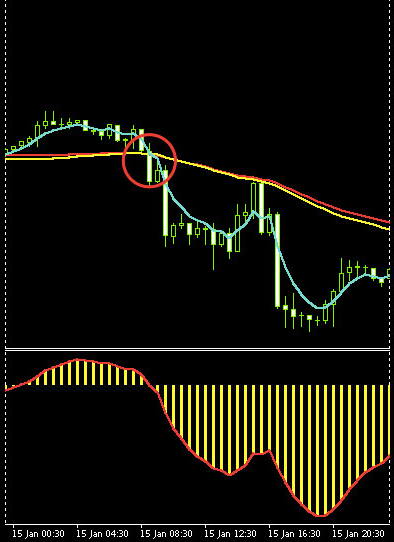

Another supposedly effective strategy for scalping is the Paint Bar, which is completely based on custom indicators. The finished template for this strategy looks something like this:

The principle of trade is completely analogous to that previously considered, as is the result of practical application. When analyzing profitability on the history of quotes, everything seems to be quite acceptable, but if it comes to trading in real time, half of the orders are closed with loss fixing.

For the successful application of the scalping trading style, it is recommended to consider only standard indicators and oscillators, since these tools are really tested by time and many successful traders.

The screenshot shows the strategy template “Puria Method”:

- Linearly weighted moving averages with periods of 75 and 85.

- Exponential moving average with a period of 5.

- Oscillator MACD with parameters 15.26.1.

The developers recommend using the M30 chart period for trading according to the rules of this strategy for EUR / USD and GBP / USD pairs. However, as you can see from the presented screenshot, the strategy remains quite effective even with short-term trading on the M5 timeframe. During one trading day, 4 signals were issued to open an order, each of which turned out to be profitable. It is important to remember that Stop Loss should be identical to potential profit. The recommended range is 10-15 points.

Now you should pay attention to the EUR/USD chart with M30 timeframe:

In this case, only 1 signal was generated to open an order.

There is a more aggressive scalping strategy, which involves taking profit from 3 to 5 points. It is worth saying that when trading on this vehicle up to 40 orders can be opened per day. The finished strategy template looks like this:

To receive trading signals, you need to set the following indicators on the chart:

- Two exponential moving averages with periods of 50 and 100.

- Stochastic oscillator with input parameters 5.3.1.

To open a Buy order, you will need to wait for the following confirmations:

- The chart crosses movings from bottom to top.

- Stochastic in the oversold zone (below level 20).

Chart period M1. To open sales transactions, the signals are mirror-opposite. An order will need to be closed manually after making a profit of 3-5 points. It is important to note that the number of successful transactions on this strategy averages about 80%, however, the potential loss for each order is 2-3 times higher than the expected profit. It is admissible to use the method of three screens of A. Elder as an additional filter of false signals.

The screenshot above with the strategy template displays a period of 7 hours. In an additional window of the oscillator, red marker marks signals for opening deals, most of which would close with profit taking. You can verify the effectiveness of this trading method yourself by analyzing a more significant segment of the chart.

Scalping on the news

The use of scalping trading methods during the publication of important news is extremely risky, but if successful, the profit will be tangible. Alternative methods of earning money on the publication of macroeconomic data are also possible, the most common of which is the use of pending orders.

Advance placement of pending Sell Stop and Buy Stop orders. The price impulse, which is a characteristic reaction of the market to the news release, knocks down one of the placed orders and, if the profit fixation level is correctly calculated, the transaction will close automatically. Applying this method in practice is not recommended, since no one guarantees that the impulse will be in one direction. It is quite possible that two pending trade orders will trigger, which will lead to significant losses. Also, do not forget about the expansion of the spread, which will absorb most of the potential profit. The difference between Bid and Ask prices depends on volatility and is almost unpredictable. In addition, significant slippage is possible due to a significant increase in liquidity.

Based on these arguments, it is safe to say that trading pending orders during the news release does not live up to expectations and is not recommended for practical use. Successful trading on the news is possible only if the trading position is opened in advance at the market value of the asset.

Effective short-term trading on the news is also possible with the help of cluster charts.

Which companies allow scalping?

Short-term trading styles are acceptable for use in cooperation with any reliable broker. Using scalping strategies involves opening a significant number of transactions in a short period of time, which is very beneficial for a brokerage company. Indeed, the income of an intermediary organization is based on the receipt of a commission for processing trade orders. Despite this, the administration of some companies indicates the following terms of cooperation in user agreements:

- Profit for each order should not be less than 10 points.

- The duration of each trading position must be at least 10 minutes.

- The permissible number of short-term trading operations should be no more than 20% of the total number of transactions.

The advantages and disadvantages of scalping

The positive features of this trading style include only potentially high returns. There are much more negative features:

- The complexity of the practical application, especially for novice traders;

- High trading risks;

- A significant number of false indicator signals, however, with the correct input parameters, this disadvantage can be avoided.

It is clear that the use of scalping in trade is justified by the high potential profit. That is why, despite the shortcomings, interest in short-term trading among traders will only grow.