To make forex trading as productive as possible and to make trades more accurate, it is recommended to use technical tools, such as indicators. The choice of indicators directly depends on a trading strategy chosen by a trader. In any case, a trader needs to understand what kind of moods are prevailing in the market at a given moment.

The two indicators - Bulls Power and Bears Power, which characterize the number of buyers and sellers in the market for a particular trading asset, do this best.

Bears And Bulls

In the currency market, there is a constant struggle between the buyers - bulls who raise prices and the sellers - bears who lower prices. At the end of the trading day, the price of the asset becomes lower or higher than on the previous trading day. If it is higher, the bulls took the initiative, and prices will rise. If it is lower, the bears imposed their influence on the market, and prices will fall.

But is it possible to determine when the market begins to be dominated by buyers or sellers? To solve this problem, one of the most famous and respected traders in the world Alexander Elder has created two oscillators for forex technical analysis: Bears Power, reflecting the superiority of the bears, and Bulls Power, showing the dominance of the bulls.

In the trading terminal, they are placed at the bottom of the price chart in the form of bar charts. These indicators are quite popular and are considered classic tools for trading forex.

Description Of The Bears Power Oscillator

The oscillator Bears Power determines the situation when the market power balance is in favor of bears. It is based on Alexander Elder's assumption, that the Moving Average shows the balance between bulls and bears for some time, and the minimal price shows the strength of bears. The author has suggested to take the period of 13 days as a base. As the result, the formula for calculating the tool looks like this:

PB = LOW - EMA, where:

- PB - the strength of the bears;

- EMA - Exponential Moving Average, a fair price in the calculation period;

- LOW - minimum price of the current bar.

In the Exponential Moving Average, the prices at the end of the period have the most noticeable influence on the oscillator values, which allows you to evaluate Bears Power quite accurately. If the values of this indicator for forex are below zero, price lows below the EMA, it shows the growing power of bears, if higher, price lows above the EMA, the bears give up positions, the trend can change, and the bulls can take over. The zero mark represents a parity situation, an equilibrium between buyers and sellers.

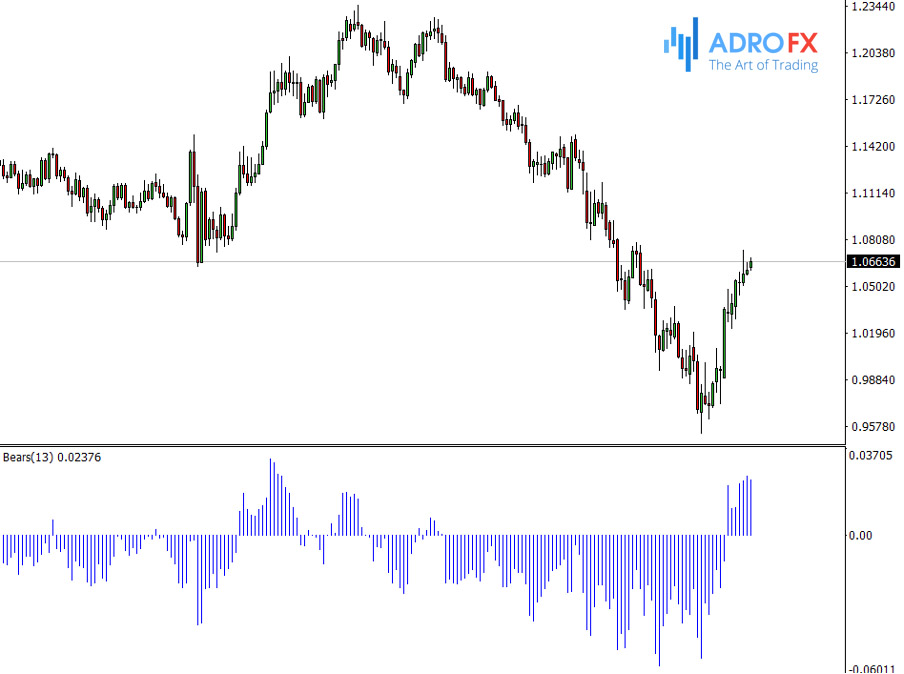

Bears Power oscillator in MetaTrader 4

The most positive signal for the bears is when in a downtrend, the next lowest oscillator reading is lower than the previous reading and coincides with the price movement. This can signify that the bears have gained a lot of strength and will continue to press the price to make new lows. If the price made a new low, but the next low is higher than the previous one on the bar chart, it can indicate that the bears are getting weaker and we should expect a trend reversal soon.

The Bears Power oscillator itself is designed to determine the forex signals to buy an asset only. It is rarely used in trading without other indicators, because, with all its merits, it does not show the sellers' strength with one hundred percent accuracy.

In particular, volume is not considered in calculations, which does not give a complete picture of the market situation, so it would be imprudent to use the Bears Power signals in trading decisions. It is more useful as an indicator showing the most probable trend direction. More often the Bears Power oscillator is used with trend indicators, mainly with a Moving Average of any type.

Description Of The Bulls Power Oscillator

The Bulls Power indicator mirrors the Bears Power. It is defined by the formula:

PB = HIGH - EMA, where:

- PB - Bulls Power;

- EMA - Exponential Moving Average, the fair price in the calculation period;

- HIGH - the maximum price of the current bar.

On an uptrend, HIGH is higher than EMA, histogram readings are above zero, which shows the growth of bulls' power. If in a downtrend HIGH is placed under the EMA, the oscillator indicators are below the zero line, which shows the weakening of the bulls' power, which allows the bears to seize the initiative.

Bulls Power oscillator in MetaTrader 4

Bulls Power is used to analyze the situation in the market, and to determine the moment of the beginning of a trend. But the Bulls Power signals are aimed only at selling the asset. Like the Bears Power, the Bulls Power oscillator should preferably be used with trend indicators. Of course, the two oscillators of power are often used together, because they were invented as complementary.

Bull Power and Bear Power Oscillators are on the list of standards in trading terminals. In MT4, they are placed in the navigation panel on the left side of the price chart. In the indicator settings, you can change the period:

Bull Power And Bear Power-Based Trading Strategies

The Bull Power and Bear Power oscillators are used in forex strategies to determine entry and exit points in "price overshoot" situations, i.e. when the price is very far from the average values (over the limit). For example, Bear Power is used in an uptrend to track the moment of maximum bearish dominance to enter the market when the price rises.

Also, these oscillators are used to determine the exit points from the market, and the position selection on the uptrend is made with Bulls Power, and on the downtrend - with Bears Power.

Bears Power and Bulls Power oscillators are most often used in conjunction with the trend indicators, such as Exponential Moving Average, EMA, which is needed to determine the direction of the trend.

Bulls Power (164) + Exponential Moving Average (34) + Bears Power (68)

On a downtrend shown by the EMA, the Bulls Power oscillator shows a sell signal when the Bulls Power readings are above zero but begin to decline. Also, the Bulls Power oscillator data does not confirm this trend and shows that the trend can change to a downtrend. In this case, the position to sell is opened when the Bulls Power figures are below zero.

For example, to implement this strategy, an Exponential Moving Average with a period of 34 is set, while a period of 68 is specified for Bears Power and a period of 164 for Bulls Power. The EMA crossing the price from bottom to top will be a signal to buy, the Bears Power histogram indicators should be below zero level, but they should show growth. The signal for selling will be the EMA crossing by the price from top to bottom, the Bulls Power oscillator readings should be above zero level, but trending downward.

The strategy using the divergence is based on the price divergence between the Bulls Power and Bears Power indicators, although it is a rare signal, it is more informative. In bullish divergence, the indicators on the Bears Power oscillator are placed below the zero mark, but they grow while the price keeps decreasing. A divergence indicates an uptrend can be expected. In a bearish divergence, the Bulls Power indicator readings are above the zero level but are declining while the price is rising. The divergence shows that we can expect a downtrend reversal to a downtrend soon.

Even though it is not recommended to implement strategies only with the considered oscillators without additional indicators, there is a trading strategy that uses only Bears Power and Bulls Power. For example, if the Bulls Power indicators in the histogram begin to decrease and the Bears Power bars increase, it can be a signal to sell. If the Bulls Power figures increase and the Bears Power figures decrease, it can be a signal to buy. But more often, the strategies with the Bears Power and Bulls Power oscillators use Stochastic, RSI, MACD, ATR, and Bollinger Bands indicators.

Bears Power and Bulls Power oscillators are also used with Bill Williams indicators, particularly in the Accelerator Oscillator strategy. In this strategy, Elder indicators are used as the main indicators, while Accelerator Oscillator is used as a signal filter:

Bulls Power + Bears Power + Accelerator Oscillator

This strategy is applied in a time frame from M30, all indicators are set with standard values. Sell positions are placed when the Bulls Power indicators are above the zero level and tend to weaken, cross the zero level below the zero mark, and the Accelerator indicator is colored red, placed below zero or equal to zero.

Buy positions are established when Bears Power is placed below the zero mark, you should wait for its indicators to cross the line to the mark above zero, the Accelerator indicator should be colored green and placed above or at the zero mark.

The other strategy uses Momentum and Elder Impulse System indicators with standard settings along with Bulls Power and Bears Power. Recall that Momentum is a trend indicator, which is included in the list of standard tools in trading terminals, it measures the amount of price change over time. The Elder Impulse System is basically a trading system consisting of EMA and MACD: the EMA is trend-following, and the MACD shows momentum.

Long positions are opened when the Momentum crosses above the 100 level, the Elder Impulse System indicator is green, and the Bulls Power oscillator is not only above zero but keeps rising. The opening of a short position presupposes a downward crossover of the Momentum indicator level 100, the Elder Impulse System should turn red, and the Bears Power indicators are placed below the zero level and continue to fall.

Bears Power + Parabolic

Another fairly popular strategy, for example, applies Parabolic SAR with Bears Power. In this case, the signals are generated by Parabolic, the points of which are placed on any side of a candle on the chart: if the point is above the candle, this is a sell signal, if the point is below the candle, this is a buy signal. Bears Power confirms the Parabolic signal under a candlestick.

Conclusion

Bulls Power and Bears Power oscillators have such advantages, as a fairly realistic display of the market situation, ease of use and interpretation of signals, the ability to predict further developments, and versatility. In general, they are quite effective indicators for trading. Their main disadvantage is that these indicators are not recommended for use without other market instruments. If used together, Bulls Power and Bears Power can be the basis of many effective strategies.