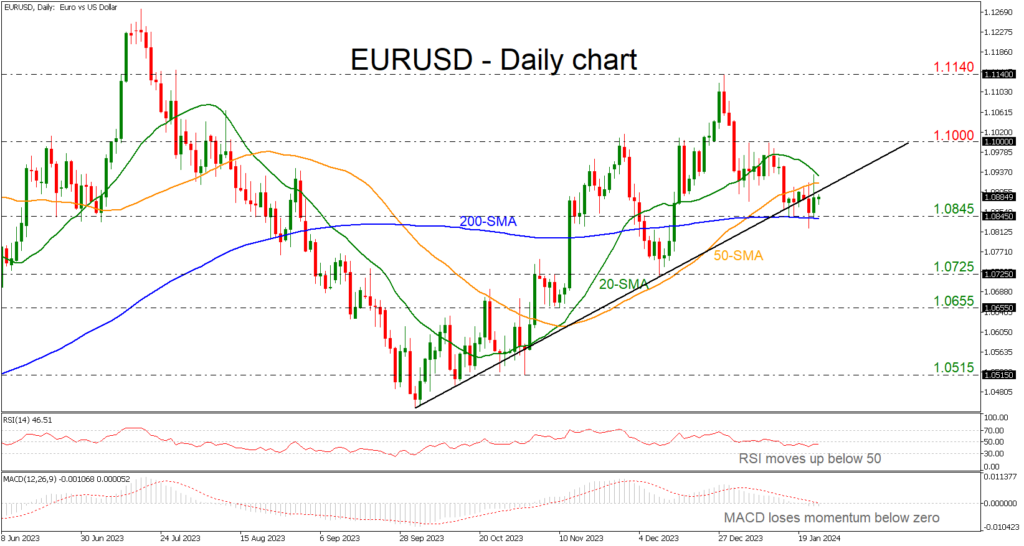

EURUSD Embarks on a Rebound Off the 200-day SMA, Yet Clings Below the Ascending Trend Line: The EURUSD currency pair has recently experienced a resurgence, with notable price action centered around the significant 200-day Simple Moving Average (SMA) and the prominent resistance level at 1.0845. Although it currently finds itself positioned just beneath a medium-term ascending trend line, the fact that it is managing to hold above the mentioned support level is generating optimism for a potential upward move in the near future.

However, the technical indicators are painting a rather mixed picture, leaving traders and analysts in a state of uncertainty. The Relative Strength Index (RSI) is showing signs of a slight uptick, albeit while still residing in the negative region. Simultaneously, the Moving Average Convergence Divergence (MACD) continues to extend its bearish momentum, persistently residing beneath both its trigger and zero lines.

Should the EURUSD pair indeed gather strength for an uptrend revival, its immediate targets lie around the 50-day and subsequently the 20-day SMAs, which are located at approximately 1.0920. Should the bullish momentum persist, traders may set their sights on the psychologically significant level of 1.1000, which has served as a formidable resistance zone for the past three weeks, culminating at the 1.1140 high.

On the contrary, if the bears gain momentum and manage to breach the sturdy support at 1.0845, this could unleash fresh selling forces into the market. Such a scenario may usher the price towards the 1.0725 hurdle, presenting yet another crucial test for EURUSD. A subsequent breach of this level could intensify the bearish wave, bringing the 1.0655 barrier immediately under the spotlight.

In the grand scheme of things, EURUSD appears to be moving within a narrow trading range in the short term, and any decisive movement below the 200-day SMA could potentially signal a shift in the broader market sentiment towards a bearish outlook.

In conclusion, the EURUSD currency pair's recent price action has generated intrigue among traders and investors alike. While it has shown resilience above the 200-day SMA and the 1.0845 support level, the mixed signals from technical indicators are adding an element of uncertainty to the market. Traders should closely monitor developments, particularly the interaction between price and the ascending trend line, as it may provide valuable insights into the currency pair's future trajectory. As the market remains on the edge, both bulls and bears are bracing themselves for potential shifts in momentum that could impact EURUSD's direction in the days and weeks ahead.