Many novice traders mistakenly believe that by devoting several days to training and replenishing the trading account with 100 USD for several months, significant financial results can be achieved. Unfortunately, this is not the case. Every year, Forbes magazine publishes a ranking of the best financial managers. Their yield rarely exceeds 24% per year, however, it is important to note that we are talking about professional traders, who manage significant investor capital. To reduce trading risks, such traders try not to use leverage in trading.

Best Deposit Acceleration Techniques for Beginner Traders

Knowing this, it is logical to assume that with financial support from a broker it is possible to earn 240% per year or 20% per month. This is indeed a very real task. The average monthly profit of experienced supporters of trading in the OTC market varies from 12 to 30% and this is a very good financial result as a percentage.

The profit level directly depends on the amount of the trader’s deposit, therefore, with a starting capital of 100 and even 1000 USD, a yield of 20% per month seems insignificant. To obtain tangible profits, the trader needs to manage the amount of 10,000 USD or more. These are quite substantial funds for novice traders, and without real trading experience, it is very reckless to deposit such an amount into a trading account. However, there are 2 ways out of this situation:

- Attracting investor funds through PAMM services or through your own advertising site. To get into the PAMM TOP rating, you must follow the rules of money management in trade and follow the rules of an effective, proven strategy. Today, many brokers are ready to offer PAMM accounts to customers, therefore this method of raising funds is the most optimal and does not require any financial investments in advertising the services of a trader.

- Open a personal trading account with a reliable company and work on intensive acceleration of the deposit. Acceleration of a deposit implies the use of aggressive trading strategies to get superprofits (from 100% per month or more). For most novice traders, the use of just such strategies can make it possible to increase start-up capital by several times during the year. Today we will consider the 3 most effective strategies that can be used to quickly accelerate a deposit.

Attention! Aggressive trading strategies practically guarantee a high profit for a trader, however, their practical application involves directly proportional risks. Therefore, under no circumstances should one invest in trading borrowed funds. It is permissible to work only with that amount, the loss of which does not entail a deterioration in the usual way of life.

Martingale method

This is the easiest way to multiply start-up capital at times in a relatively short period of time. Many information sites mention that this trading style is extremely risky to apply in financial markets. The Martingale method can only be considered in conjunction with a proven and independent strategy. The similar position of many experienced traders is justified and confirmed in practice.

For example, there are a lot of free trading advisors on the network, the operation algorithm of which involves opening transactions using the Martingale method. Unfortunately, they all drain the deposits of traders – it is only a matter of time. From personal experience I can say that the problem lies not in the strategy itself, but in the incorrect input parameters of such programs. Values of safety orders are often set at 10, 15, 20 points, but no more. If you reduce the volume of the order to a minimum and increase the level of fixing the financial result to 100 points, then the result from trading by the Martingale method will pleasantly surprise many traders.

Trading Rules:

- A transaction is opened only at the beginning of the week and in an arbitrary direction.

- The values of Stop Loss and Take Profit orders are equal and amount to 100 points.

- A trader will need to wait for the order to close automatically. If the transaction ended with profit taking, then the next should be opened in the opposite direction. Otherwise, at the beginning of next week, you will need to open another order in the same direction, but with doubled trading volume.

The risk on the first transaction should not exceed 5% of the deposit. As practice shows, unprofitable transactions can be no more than 3 in a row. The last order compensates for all losses and will bring the expected profit. Pay attention to trading examples for this strategy:

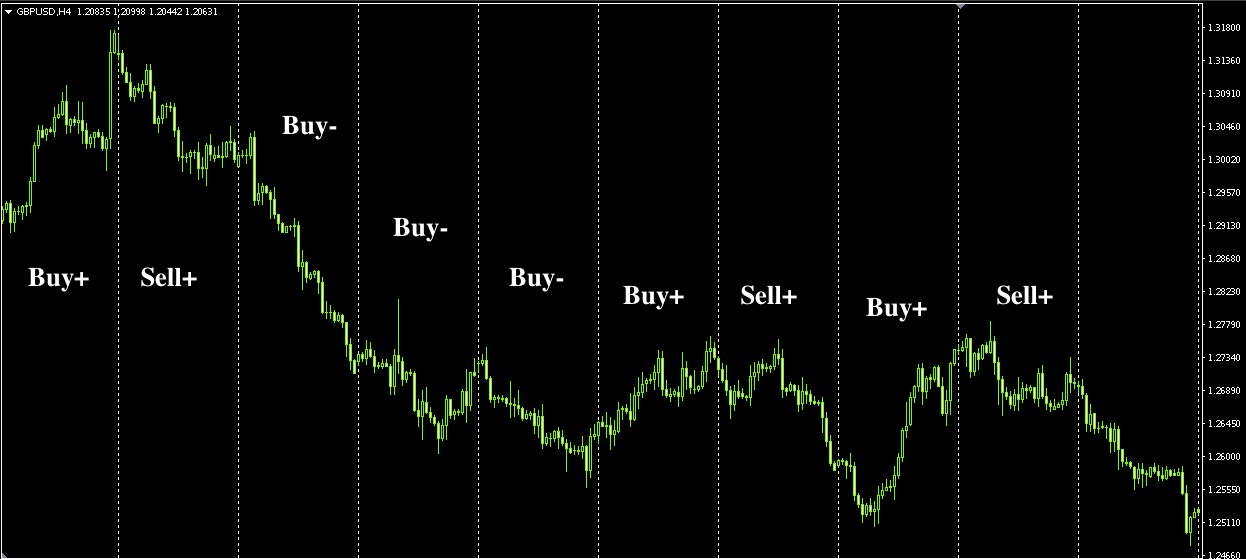

The graph section shown in the screenshot covers a period of 2.5 months. Vertical marking displays the beginning of the week. As mentioned earlier, the first order can be made in any direction. In this case, a Sell order was opened. The deal was closed with loss fixing, so the next one should be opened at the beginning of a new week in the same direction, but with doubled volume. That is, if the volume of the first order was equal to 0.01, then the volume of the second should be strictly 0.02 lots. This deal met expectations, so the next one should be opened in an upward direction. Three Buy orders were closed with a loss record, but the fourth offset all costs and brought a net profit of 100 points. The following orders were also opened in accordance with the rules of the strategy and all closed with profit taking.

Consider the reverse situation in which the first order would not be Sell, but Buy:

As you can see, the result is almost completely identical. It turns out that the direction of the first transaction does not significantly affect the final financial result. Isn’t this the dream of every novice trader?

Important! For the successful application of this trading strategy in practice, it is important to choose the maximum value of leverage. This will protect against forced closing of the order due to lack of available funds.

The results of the above study are as follows:

- The Martingale method can be used in trading in financial markets, since if applied correctly, the risks are fully justified.

- As a result of 2,5 months, the deposit was increased.

- Out of 9 transactions, only 4 were unprofitable in the first case and 3 in the second.

By following exactly the described method of accelerating the deposit, it is possible to consistently earn 240% per annum or 20% per month. It is important to understand that the presented strategy can be used on lower timeframes with a similar principle. The main thing is that the target levels are at a sufficient distance from the opening point of the order (at least 60 points for periods M5-M15). In this case, the yield can be from 1000% per year.

High Volume Trading

For a successful acceleration of start-up capital, it is perfectly acceptable to use simple but effective strategies:

- The Puria Method;

- Sidus method;

- Stochastic RSI;

- Strategies based on the Bollinger envelope and others.

In accordance with the rules of money management, the risk per transaction should not exceed 3-5%. This greatly reduces trading risks, but significantly limits the profit potential. For comfortable trading with increased volumes, it is important to choose a strategy that meets certain requirements:

- The ratio of profitable to loss-making transactions is at least 70%.

- Take Profit is greater than or equal to the Stop Loss value.

The trading strategies mentioned above correspond to these criteria, therefore they can be safely used to accelerate the deposit.

The potential profitability of the Puria Method strategy is about 15% per month, with a risk of 2% per order. Obviously, if you increase the trading volume by 10 times, it is possible to get the corresponding profit, that is, at least 150% per month or 1800% per year. If compound interest is applied, then at the end of the year, net income from invested funds can be from 3000% or more.

Attention! When trading on simple strategies based on standard indicators with increased volume, novice traders are strongly advised to gain practical experience through working with virtual tools. The preparatory period should not last more than 1 month. Otherwise, on an emotional level, it will be quite difficult to switch to real money management.

“All-in” strategy – a proven method of accelerating a deposit

Price charts are always developing in waves. Trends are constantly replaced by corrections. Trading according to the “all-in” strategy involves opening deals at the very beginning of corrections. For work, you will need to use daily charts of the following currency pairs:

- AUD/JPY;

- AUD/USD;

- EUR/GBP;

- EUR/JPY;

- GBP/USD;

- CHF/JPY;

- NZD/CHF;

- EUR/AUD;

- AUD/CHF;

- CAD/CHF;

- EUR/USD;

- EUR/CAD;

- GBP/CHF.

Immediately it is worth highlighting the advantages of this method of dispersal deposit:

- Successful trading will not require in-depth knowledge in the field of technical or fundamental analysis;

- Trading will require not more than 30 minutes a day;

- Profitability is confirmed by statistics;

- Compared to existing methods of acceleration of a deposit, the risks associated with trading with the Va-Bank strategy are significantly lower.

The essence of the strategy is to find on charts of the above mentioned currency pairs candles whose range exceeds the average daily volatility. In other words, if the chart overcame 100 points up or down during the day, then the next day you will need to open an order in the opposite direction. The Take Profit value is fixed at 30% of the range of the signal candle. Stop Loss should be equal to the target level.

To trade according to the “all-in” strategy, you will need to open a terminal from 20.00 to 23.00 GMT time and find the currency pair with the largest range of the last daily candle, and then place the order in the opposite direction at the current price. Let’s review an example:

On a lower period, the opening and closing points of transactions in this case will look like this:

The risk for each transaction should be no more than 20% of the deposit. Signal candles are formed almost daily, but on different currency pairs. For successful trading on this strategy, you only need to find the right asset to trade and place orders. According to the most conservative estimates, it is possible to earn at least 200% per month when trading on the “all-in” strategy.

Conclusion

The simplicity and proven effectiveness of the methods discussed in the article will significantly increase the starting capital even for novice traders from the first days of trading. The main thing is to follow the rules and not exceed the permissible values of the trading volume. Traders with no experience are strongly advised to devote some time to working with virtual tools. This is necessary to ensure the effectiveness of the strategies presented, as well as to familiarize yourself with the functionality of the trading platform.