A trade may be closed profitably or at a loss. Trading, as a whole, may become profitable or lead to losses. Risk management in Forex is about reducing the loss factors. Statistically, that means lowering the probability of losses and increasing the likelihood of profits. Naturally, traders may question the necessity of risk management. They can think that just following a good profit-oriented strategy is enough. In reality, whatever your strategy is, even if you stick to no strategy at all, it can become truly profit-oriented only with solid risk management. Let's look at it more closely.

Measure, Accept, and Control Risk

As the expression “risk management” suggests, its core activity is managing risks. That means, actively doing something about them. Just acknowledging that you may lose here and there is not enough. Money likes precision. Precision is measurement. Therefore, you first have to decide for yourself how much of your total funds you are ready to lose. That is, what’s the maximum loss after which you’d have to completely review your trading approach.

Practically speaking, it works as follows:

- Scenario 1. You deposited $1,000 on your account. You decided that you are okay to lose $150 in a month. After a month, you’ve lost $100. That’s unfortunate. However, the total loss limit is not reached. So, you decide that you will try to be more effective on particular trades with the same strategy.

- Scenario 2. You deposited $1,000 on your account. You decided that you are okay to lose $150 in a month. After a month, you’ve lost $300. That’s too much. You decide that you need to revise your entire trading approach to continue trading.

Essentially, you need to decide how much is “too much” of a loss according to the above scenarios. If you do that, you’ll create a solid foundation for an effective self-correction system. If you don’t do that, you may end up suddenly losing everything.

Martingale and Anti-martingale

There are two well-known approaches to managing investments that you can try in Forex. The Martingale strategy suggests making a bigger investment after a loss on a position or a portfolio in general. It is based on the assumption that you won’t be losing all the time anyway, so a bigger gain that may come next on a bigger investment will compensate for your previous losses.

The opposite strategy is anti-martingale. It suggests reducing your positions after losses and increasing them upon closing trades with profits. Martingale is loss-averse, anti-martingale is risk-averse.

Both are used in the Forex market by traders depending on their financial objectives and trading styles.

Analyze Your Trading Record

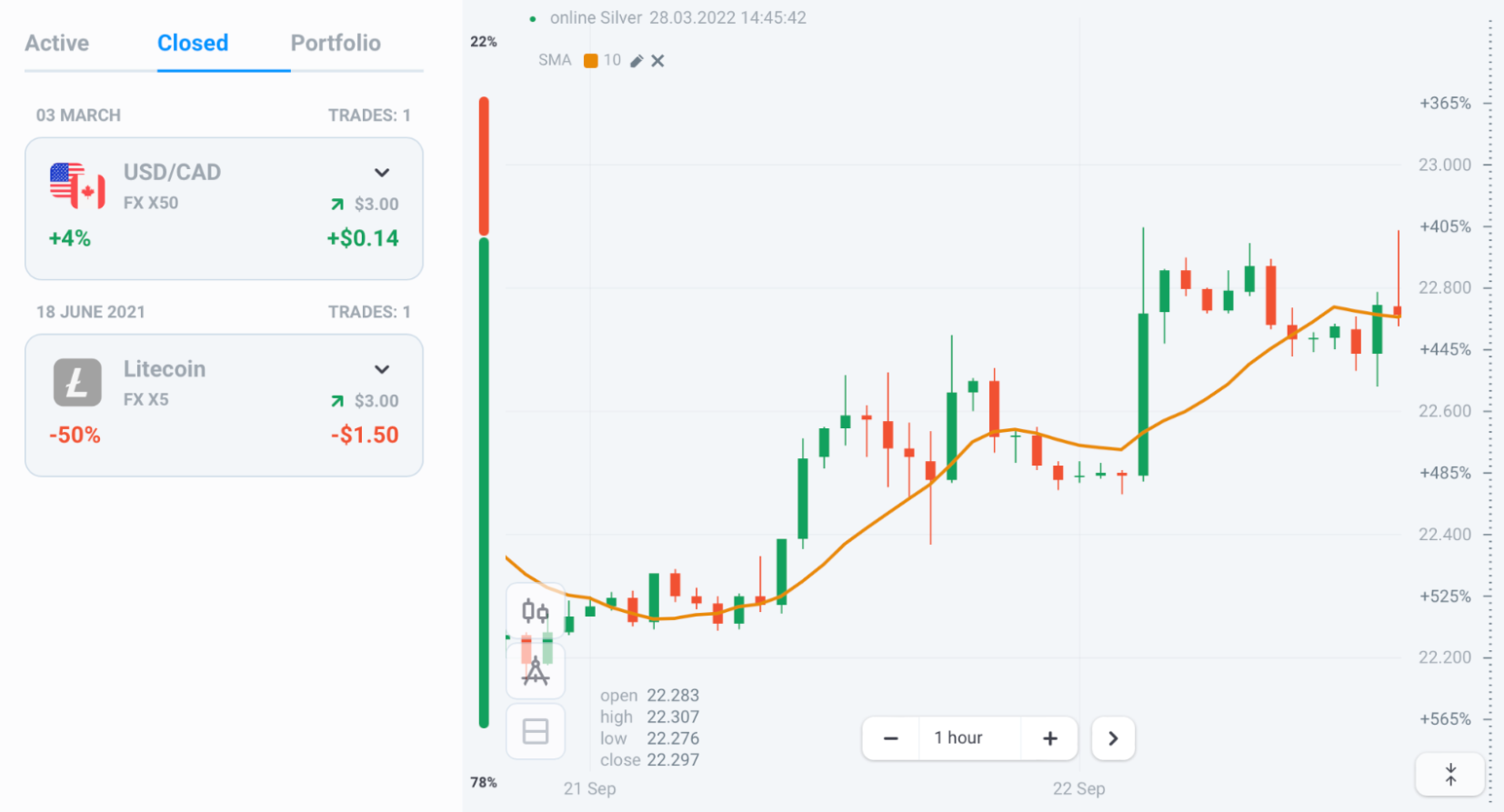

In the left-most sidebar, there are two arrows at the top. Tapping on them, you will access the record of your trades. Active and Closed trades will be there and the Portfolio as well.

Trades sidebar opened on the platform

Use this tool. To trade more effectively, you need to analyze your successful and unsuccessful trades. To do that, you will want to assess details of each one and then assess them in total, as a portfolio.

Here are some of the questions you’d be interested in answering when reviewing your trades:

- Did I make a total loss or profit over a certain period of time?

- Which of my trades were profitable and why?

- Which of my trades were closed with a loss and why?

- What is the ratio between profitable trades and those closed with losses?

- Can I improve this ratio by individually correcting trades or does my entire strategy need to be revised?

- Should I trade on different assets?

- Did I apply Take Profit and Stop Loss effectively?

- Did I open trades with an adequate position size?

- Did I open and close positions at the right moment?

- Does the multiplier fit my objectives?

Essentially, you need to analyze your trading results in every detail to regularly improve it. Below, you will find some risk management rules to help you with that.

Key Rules of Forex Risk Management

Determine the Trade Amount on Each Trade

The below table shows the recommended trade specifications if you have a total of $1,000 to invest, your daily losses are limited to 5% or $50, and the Stop Loss value is -10% on each trade.

| Multiplier | Trade amount | Fee (the approximate value for EUR/USD) | Stop Loss value per trade (fee – Stop Loss -10%) | The number of trades within the limit |

|---|---|---|---|---|

| х500 | 100 | -15 | -25 | 2 |

| х500 | 50 | -7,5 | -12,5 | 4 |

| х500 | 25 | -3,75 | -6,25 | 8 |

| х200 | 100 | -6,8 | -16,8 | 2 |

| х200 | 50 | -3,4 | -8,4 | 5 |

| х200 | 25 | -1,7 | -4,5 | 11 |

| х100 | 100 | -3,4 | -13,4 | 3 |

| х100 | 50 | -1,7 | -6,7 | 7 |

| х100 | 25 | -0,9 | -3,4 | 14 |

| х50 | 100 | -1,7 | -11,7 | 4 |

| х50 | 50 | -0,9 | -5,9 | 8 |

| х50 | 25 | -0,45 | -2,95 | 16 |

Based on the table above, you can make no more than two trades worth $100 each or one trade worth $200 using a x500 multiplier. Also, if you open a trade for $100, you can only make 2 trades using a x500 and x200 multiplier. However, the first multiplier’s profit potential is 2.5 times higher than that of the x200. Why is that and which one to choose?

The thing is, each of the trades has a different point value, or point cost. For a EUR/USD trade made with an x500 multiplier, one point’s value is $5. In contrast, a multiplier of x200 will reduce that value to $2 for the same EUR/USD.

Accordingly, there will be a five-point Stop Loss ($25 risk of a trade/$5 cost of point = 5) in the case of the x500 multiplier because a $25 risk on the trade divided by the $5 point cost is 5. Additionally, for the multiplier of x200, the Stop Loss will amount to 12,5 points.

Therefore, an x200 multiplier trade has a lower probability of accidentally triggering the Stop Loss. Such an assessment will help you set optimal trade conditions.

- Scenario 1. You want to trade on an economic news release. You know the time of the release and expect the price of your trading instrument to make a big leap upward at that point. As you will be time-specific with your trade and know when the price will leap, putting a Stop Loss far away from your entry point is not required. At the same time, you want to maximize the profit from the price move. Therefore, you choose to use the x500 multiplier on that trade.

- Scenario 2. You want to practice intraday trading. You are not planning to trade on big price leaps. Instead, you want to use multiple average price moves within a day. Price moves bigger than that need to be filtered out. With this approach, you will use the x200 multiplier to reduce the price swings and make sure it doesn’t accidentally trigger the Stop Loss or at least doesn't do that too often.

Trade Unrelated Trading Instruments

If USD gets stronger, then USD/CAD, USD/JPY, and USD/CHF will all likely go up. If USD drops, these currencies will go down. Their moves will be similar because they all have USD. Therefore, although these are three different currency pairs, they are like one and the same trading instrument, just technically divided into three. That’s risky. If you made a bad forecast on USD, all the trades opened on these pairs will bring losses. You can avoid it.

To diversify and therefore, lower your risk, you need to trade instruments that are not related. For example, USD/CAD, EUR/CHF, AUD/JPY, and GBP/NZD all have different currencies. Therefore, they will most likely follow different trends. That’s why, if you made an incorrect forecast on one or even some of them, there is still a probability that others will be profitable.

Try a Trading Idea on One Trading Instrument

If you have a trading idea for a currency pair, keep to just one trading instrument. That means, if you think that USD will grow, open a buy trade on USD/CAD. Don’t do the same on USD/JPY and USD/CHF at the same time. That’s because you might be wrong with your idea. If you used just one currency pair for it, that would be just one bad trade. If you applied the same trade idea across several currency pairs, there will be many bad trades and much bigger losses.

Move the Stop Loss or Use Trailing Stop

Stop Loss needs to be on every trade to limit losses. However, if you open a trade in the correct direction, you can also use Stop Loss to secure your profit. In order to do that, you have to move the Stop Loss in the direction of the price move, once you see that your trade is profitable. First, you can move the Stop Loss to the breakeven zone. That means, moving it in the profitable direction so that if the trade closes at the Stop Loss level, the profit obtained covers the transaction fee.

Later, you can move the Stop Loss further in the profitable direction. In this case, if the trade closes at the Stop Loss level, it will be profitable. Therefore, the Stop Loss in this scenario will secure the minimum profit, and the Take Profit will be securing the preferred one.

Alternatively, you can use the Trailing Stop Loss. It is the Olymp Trade platform tool that automatically does what the above paragraphs describe. Once you open a trade, the Stop Loss will automatically follow the price in the profitable direction. This tool is available to you on the Expert status or once you unlock it moving along the Trader’s Way.

Cross Check Trading Signals on Various Timeframes

Technical and fundamental analysis is not meant to be 100% correct. There is always a possibility of error. Your objective is to reduce that possibility. One of the simple ways to do that is to cross check your analysis on various timeframes. For example, if your analysis on a 1h chart suggests that your trading instrument will follow a downtrend in the next several hours, switch to 4h and check the larger picture.

Or, if you forecast an upward reversal on a 15m chart, check the 30m and 1h chart. If other timeframes confirm your analysis, you will have a higher probability of making a good trade. If they don’t, it may spare you another loss.

Make Trades at Certain Periods

Forex is a stressful environment. It may be quiet, but emotionally, it is very tense at times. Emotional decisions have a higher probability of being wrong because emotions cloud analysis. That’s why the easiest way to neutralize the effect of emotions on your trading process is making trades less often in certain periods. For example, you set a rule that you can open a new trade once an hour.

Then, if you open a trade at 14:00, and at 14:03 you realize it’s going to be a certain loss, you don’t rush to open another one to “quickly correct your mistake“. You wait the remaining 57 minutes until it is 15:00 to open a new one, and possibly to test the same trading idea. Alternatively, you might try another trading idea based on the one you just did. In any event, this approach reduces the likelihood of emotional losses which will definitely happen without a trading schedule.

Back-Test Your Strategy and Try it on Demo

Before using a trading strategy, look at the past performance of the price and see if it did what it was “supposed” to do according to the strategy where it was applicable. Also, count how many times the strategy would be correct with its suggestions and how many times it wouldn’t. This way, you can easily filter out the strategies of low efficiency from those worth trying.

As a next step, try using your strategy on the Demo account. If it works well, you’ll be safe to do it on the real account. If it doesn’t, you will avoid losing your funds on it.