In the world of forex trading, where price fluctuations are constant, moving averages stand as a steadfast ally for traders seeking to decipher trends, identify reversals, and understand market dynamics. These essential tools smooth out price data, providing traders with a clearer picture of price movement trends over specific periods. Let's delve deeper into the concept of moving averages and explore the distinctions between the simple moving average (SMA) and the exponential moving average (EMA).

The Essence of Moving Averages

Moving averages essentially create a single continuous line that represents the average closing price over a specified timeframe. This process smooths out the noise and fluctuations inherent in price data, revealing underlying trends that might not be evident at first glance.

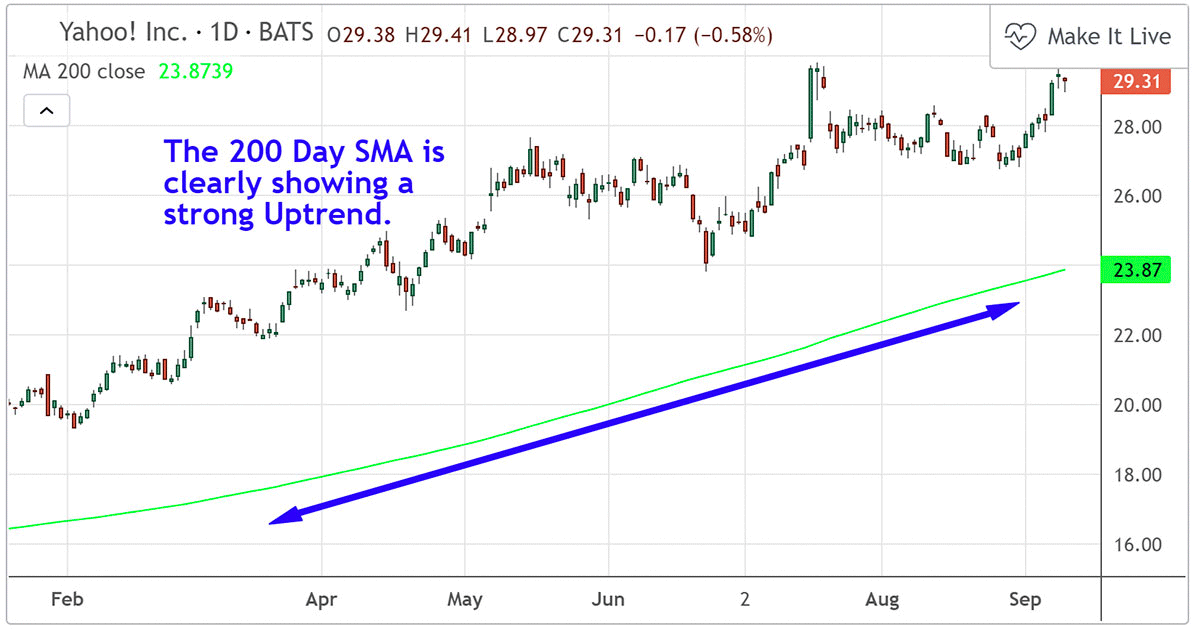

Long-Term Simple Moving Average

Simple Moving Average (SMA)

The simple moving average is as straightforward as its name implies. It takes the sum of closing prices over a specific period and divides it by the number of periods considered. The result is a single data point that represents the average closing price over that time frame.

Advantages of SMA

- Simplicity: The calculation is easy to understand and implement.

- Smooth Trend Indication: SMA smooths out minor price fluctuations, revealing the broader trend direction.

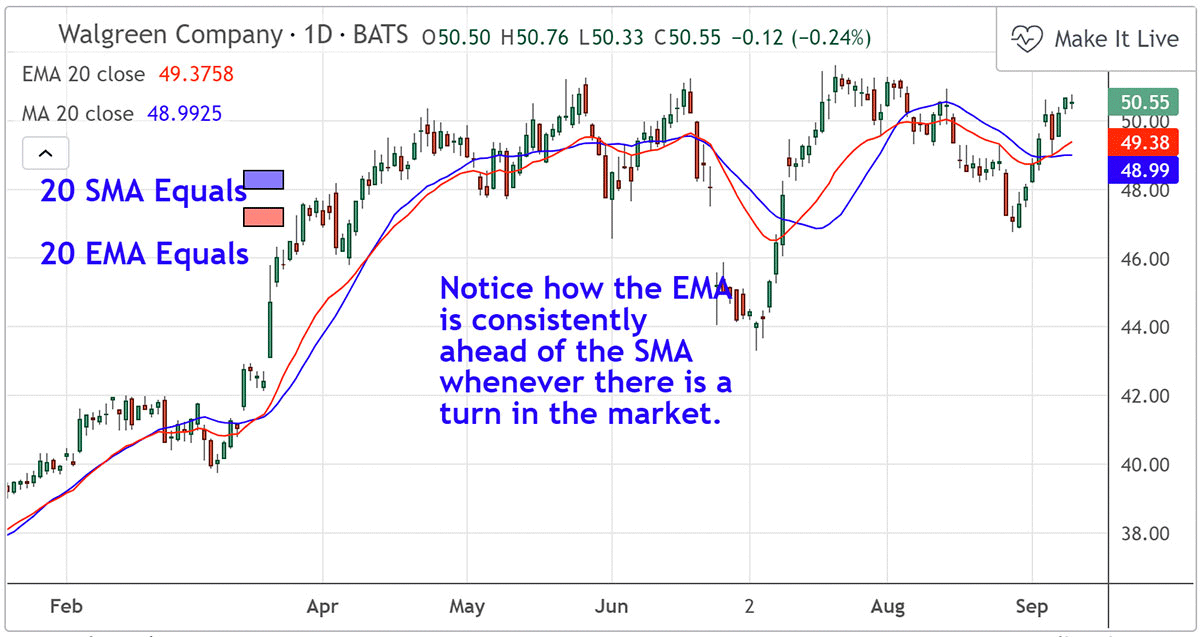

Exponential Moving Average (EMA): The exponential moving average enhances the concept of moving averages by placing more weight on recent price data. This gives the EMA a dynamic quality, as it reacts more swiftly to recent price changes, making it particularly useful for short-term analysis.

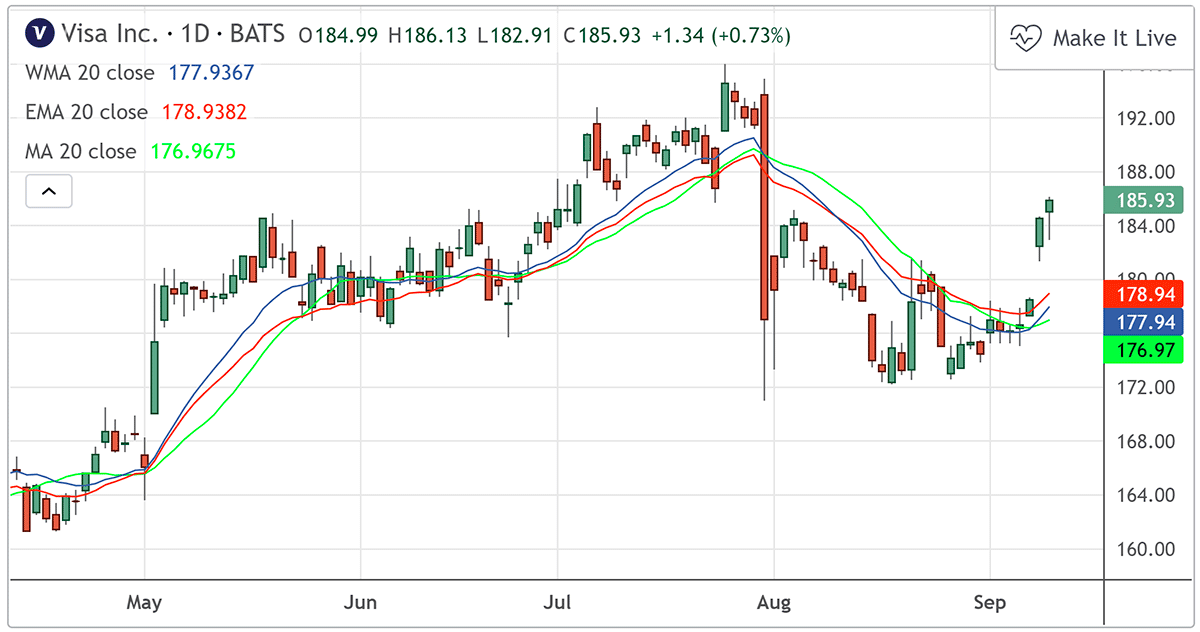

Types of Moving Averages: Simple Moving Average (SMA), the Exponential Moving Average (EMA) and the Weighted Moving Average (WMA)

Advantages of EMA

- Responsiveness: The EMA responds faster to recent price movements, making it ideal for identifying short-term trends and potential reversals.

- Emphasis on Recent Data: EMA captures the most recent price changes more effectively than the SMA.

Choosing the Right Moving Average: The choice between SMA and EMA depends on the trader's preferred trading style and time horizon. Traders looking to analyze longer-term trends might lean towards SMA, while those focusing on short-term opportunities might find EMA more effective due to its responsiveness.

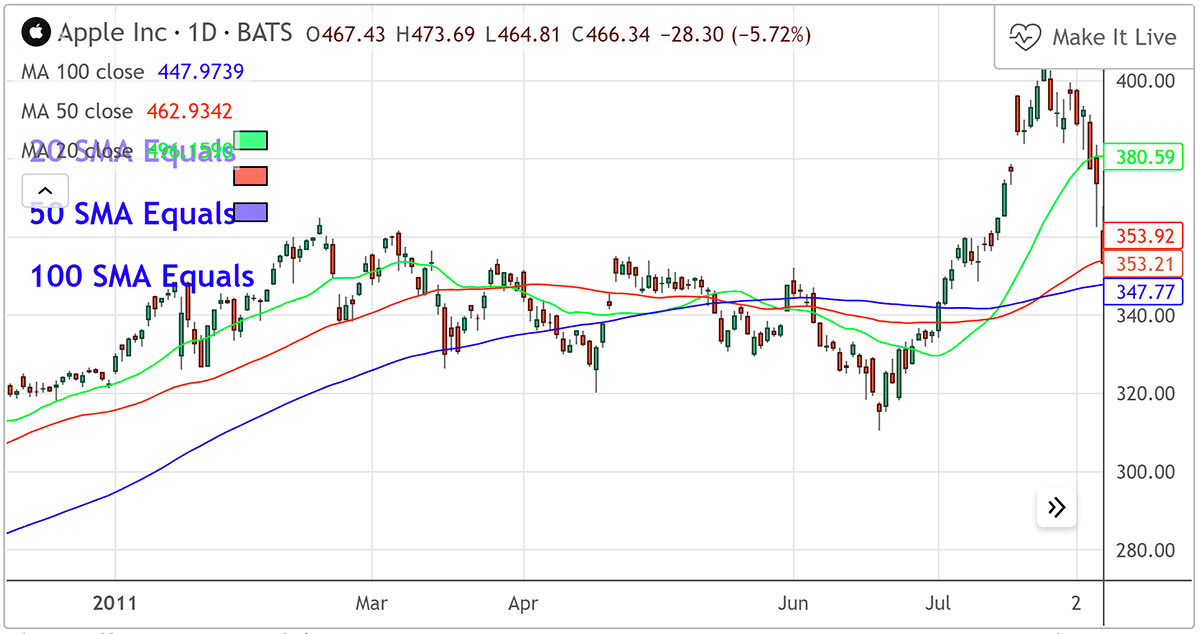

Three diggerent Simple Moving Average periods

Application of Moving Averages

- Trend Identification: Moving averages help traders identify trends, whether they are upward (bullish), downward (bearish), or ranging.

- Crossovers: When shorter-term moving averages cross above longer-term ones, it can signal potential upward momentum, while the opposite could indicate a reversal.

- Support and Resistance: Moving averages can serve as dynamic support and resistance levels, guiding traders on potential entry and exit points.

Simple Moving Average (SMA) and Exponential Moving Average (EMA)

In the realm of technical analysis, moving averages serve as foundational tools for traders seeking to decipher market trends, forecast potential reversals, and make informed trading decisions. The choice between the simple moving average (SMA) and exponential moving average (EMA) depends on the trader's preferences and trading style. As with any technical tool, it's essential to use moving averages in conjunction with other indicators and analysis methods to gain a comprehensive understanding of market dynamics and trends.

Discover how to interpret forex charts like a seasoned trader. We'll guide you through the anatomy of candlestick patterns, trend lines, and technical indicators that illuminate market trends. Learn how to spot potential breakouts, reversals, and trend continuations using chart patterns. With our expert insights, you'll have the tools you need to navigate the forex market with confidence.