The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder, RSI ranges from 0 to 100, providing traders with a numerical value that reflects the strength and potential direction of price trends.

Calculating RSI

RSI is calculated using the following formula:

- RSI = 100 - (100 / (1 + RS))

Where RS (Relative Strength) is the ratio of the average of 'n' days' up closes to the average of 'n' days' down closes. In simpler terms, RS compares the average gains to the average losses over a specific period (often 14 days).

Relative Strength Index (RSI)

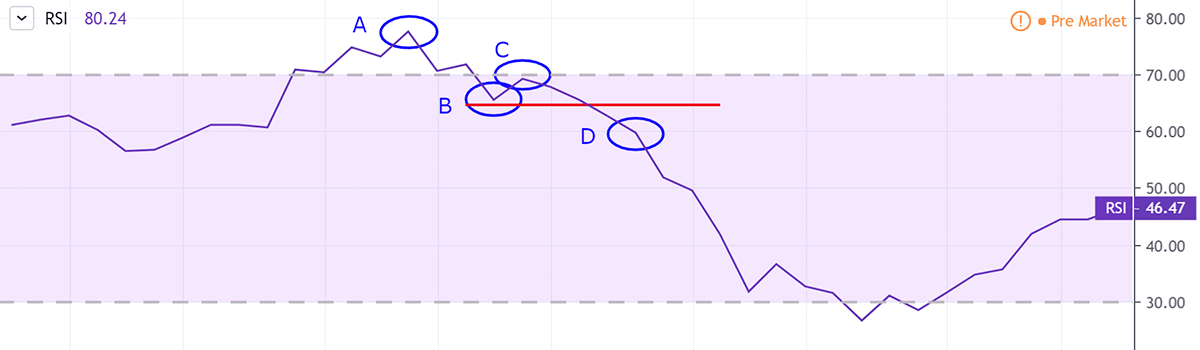

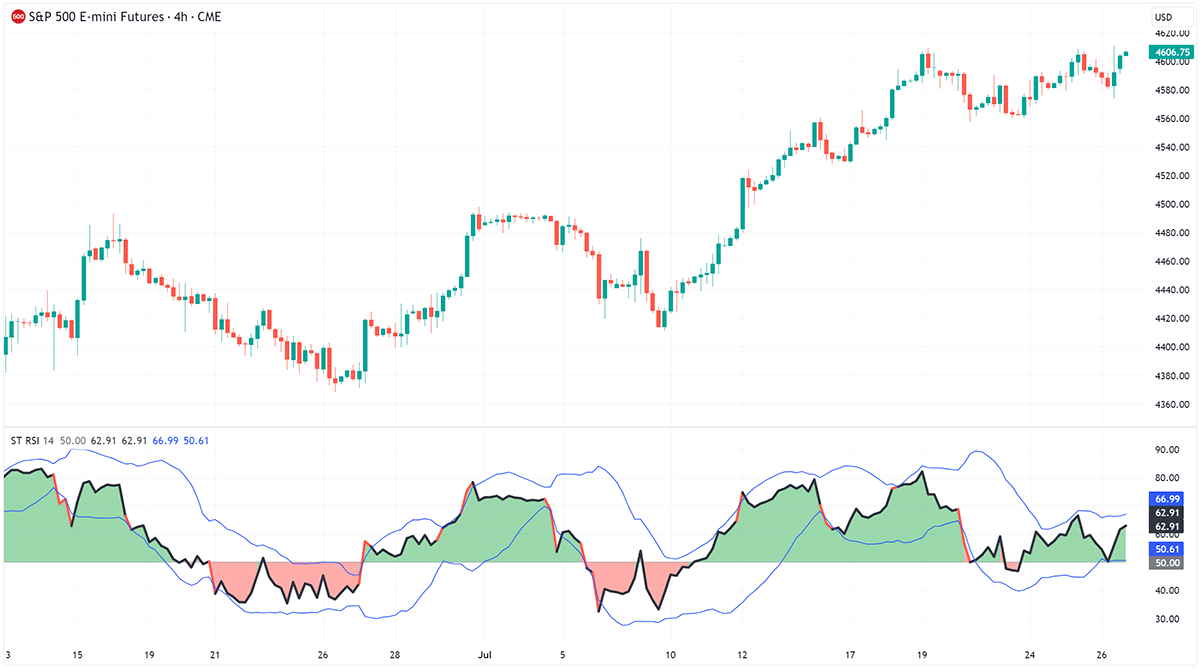

Interpreting RSI

RSI values are plotted on a scale from 0 to 100. Here's how traders generally interpret RSI:

- RSI above 70: When the RSI crosses the 70 level, it's considered overbought, indicating that the currency pair's price may have risen too fast and a potential reversal could be on the horizon. Traders might consider this an opportunity to sell.

- RSI below 30: Conversely, an RSI reading below 30 suggests that the currency pair's price may have dropped too rapidly and could be due for a rebound. This condition is known as oversold, and traders might see it as a potential buying opportunity.

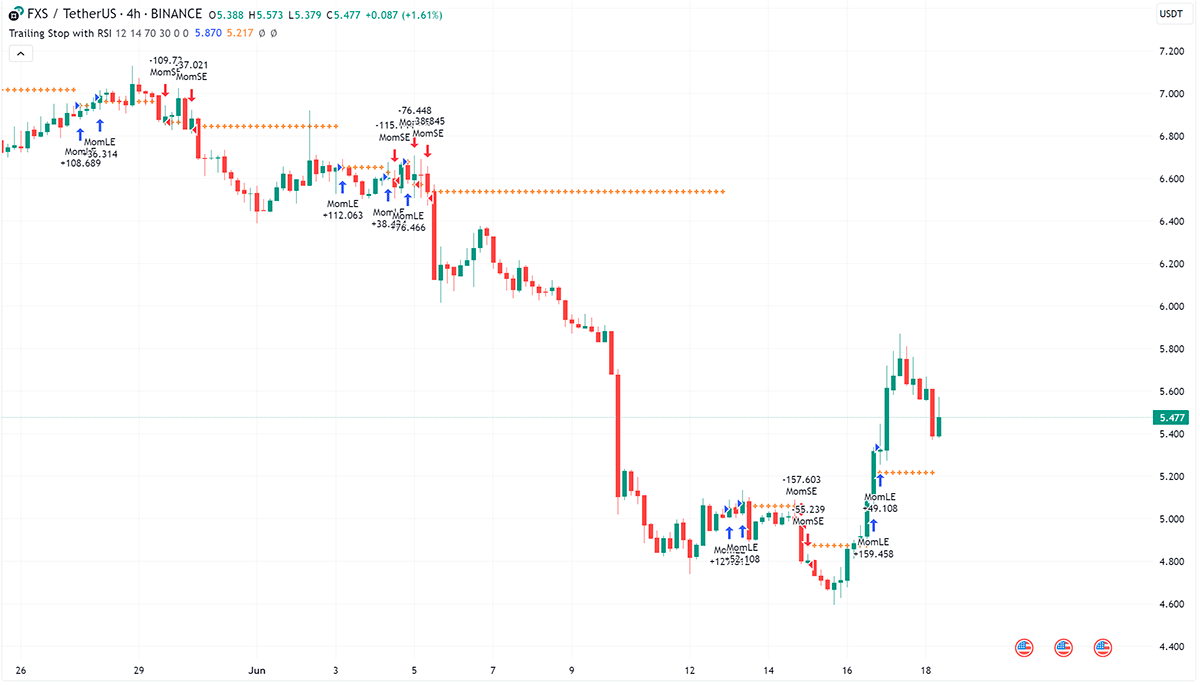

Trailing Stop with RSI - Momentum-Based Strategy

Significance of RSI

- Momentum Identification: RSI serves as a tool to gauge the strength of recent price movements. If the RSI is increasing, it suggests that gains are outpacing losses, indicating a potential uptrend. Conversely, a decreasing RSI might signify a potential downtrend.

- Overbought and Oversold Conditions: RSI provides traders with a clear indication of when a currency pair might be overextended in either direction. This helps traders anticipate potential trend reversals.

- Divergence: Divergence occurs when RSI and price movements move in opposite directions. This can signal potential trend reversals or changes in momentum.

- Confirmation: RSI is often used in conjunction with other technical indicators to confirm trading signals. For example, if RSI indicates overbought conditions and another indicator supports this signal, traders might consider it a stronger indication of a potential reversal.

Customized Relative Strength Index (RSI) indicator with added functionality

Conclusion

The Relative Strength Index (RSI) is a powerful tool that aids traders in identifying momentum, overbought, and oversold conditions in the forex market. It empowers traders to make informed decisions based on the speed and magnitude of price movements. As with any technical indicator, it's essential to use RSI in combination with other tools and analysis methods for a comprehensive understanding of market dynamics and trends.

Discover how to interpret forex charts like a seasoned trader. We'll guide you through the anatomy of candlestick patterns, trend lines, and technical indicators that illuminate market trends. Learn how to spot potential breakouts, reversals, and trend continuations using chart patterns. With our expert insights, you'll have the tools you need to navigate the forex market with confidence.