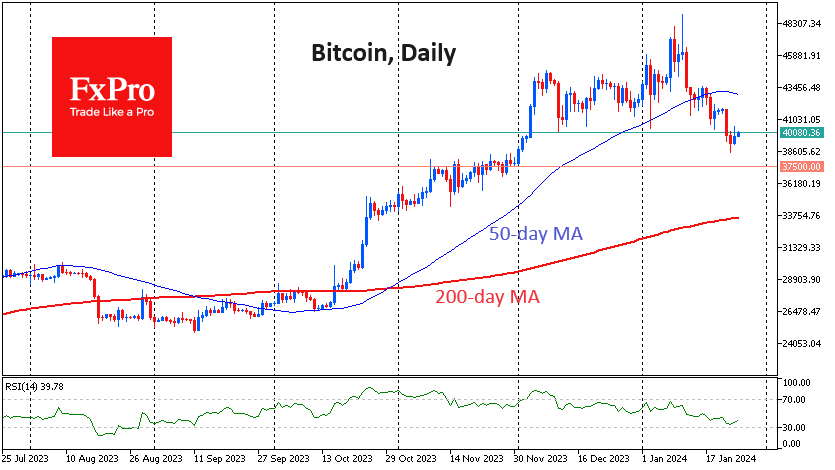

The Crypto Market Displays Stability with Bitcoin Around $40K: In the midst of the ever-volatile cryptocurrency landscape, the last 24 hours have provided a moment of respite as the market capitalization hovers around $1.56 trillion and the price of Bitcoin remains relatively stable at approximately $40,000. Major altcoins, often known for their dramatic price swings, have also exhibited a degree of restraint. The Fear and Greed Index, a sentiment indicator, is meandering around a neutral 50, reflecting the market's cautious sentiment. Bitcoin, the pioneer of cryptocurrencies, has shown signs of a cautious uptrend since Tuesday. Some market participants have chosen to secure profits from short positions or seize the opportunity to buy following a sharp sell-off. It's noteworthy that Bitcoin did not plunge into oversold territory before finding stability, leading to speculation that bears might be biding their time to accumulate liquidity before potentially instigating another sell-off.

However, the situation is quite different for XRP, which has almost entirely retraced the gains from its rally since October, regressing to the $0.51 price range. On daily timeframes, the Relative Strength Index (RSI) has dipped into oversold territory, signaling a potential increase in volatility and the prospect of a reversal in the coming days. Nonetheless, a cause for concern arises from the fact that XRP had been forming an upward trend since November 2022, and the recent price action has disrupted this trend, leaving investors on edge.

News Developments and Expert Opinions

In the realm of expert opinions and market predictions, a Deutsche Bank survey reveals a rather bearish sentiment, with more than a third of respondents anticipating that Bitcoin will dip below the $20,000 mark by year-end. Conversely, only 15% of respondents expect Bitcoin to surge above $40,000 in the same time frame. PlanB, the creator of the widely-followed Stock-to-Flow model, holds a more optimistic perspective, suggesting that Bitcoin is poised to consolidate around $40,000 before embarking on a journey towards the $60,000 mark.

CoinShares has drawn attention to the potential for increased inflows into Ethereum if the proposed Dencun hardfork successfully takes place and if a spot exchange-traded fund (ETF) based on the asset obtains approval. Interestingly, SEC Commissioner Hester Peirce highlighted that spot Ethereum ETFs do not necessitate a judicial process for approval, referencing a recent decision to convert the Grayscale Bitcoin Trust into a spot ETF.

In regulatory news, the US Financial Industry Regulatory Authority (FINRA) has identified potential violations in a substantial 70% of information materials pertaining to cryptocurrency products. This underscores the need for fair and balanced advertising rules that explicitly prohibit "false, exaggerated, promising, unsubstantiated, or misleading statements" in the cryptocurrency sector.

On a more positive note, Switzerland has given the green light to the first retail platform that will enable its citizens to trade tokenized securities and digital assets, further cementing the country's reputation as a blockchain and cryptocurrency-friendly jurisdiction. In conclusion, the cryptocurrency market has momentarily found stability in the midst of its usual turbulence. While Bitcoin exhibits signs of a cautious uptrend, XRP faces challenges in reclaiming lost ground. Expert opinions and market predictions remain divergent, underscoring the unpredictability of the crypto space. Regulatory developments continue to shape the industry, both in the US and internationally, with Switzerland leading the way in facilitating broader access to digital assets. As the crypto market takes a breath, market participants remain watchful, knowing that the storm may return with little warning.