The allure of the Breakout strategy lies in its promise to savvy traders and investors, offering a gateway into trade right as significant price action begins to unfold. With judicious application of technical analysis and rigorous risk management, the strategy's reward-to-risk ratio stands to unlock maximal profits from the myriad of market opportunities.

Delving Deeper: What Sets the Breakout and Retest Strategy Apart?

This trading technique distinguishes itself with its adaptability. Whether you're into intraday, day trading, or other styles, the Breakout and Retest strategy seamlessly integrates. The underlying reason? Market price action is a daily phenomenon, affording traders the chance to capitalize on price shifts across diverse time frames.

Its omnipresence across varying market conditions underlines its universal appeal, making it a strategy every trader should contemplate mastering.

Embracing the Breakout and Retest Strategy in Forex

Its application isn't confined to the realm of Cryptocurrency; it holds immense worth in the Forex market as well. Forex aficionados routinely deploy this strategy to pinpoint prospective support and resistance thresholds. This intel empowers them to make informed decisions about potential entry or exit points. Grasping the Break and Retest strategy mandates a deep dive into its foundational principles and the critical tools, including technical indicators, integral to its execution.

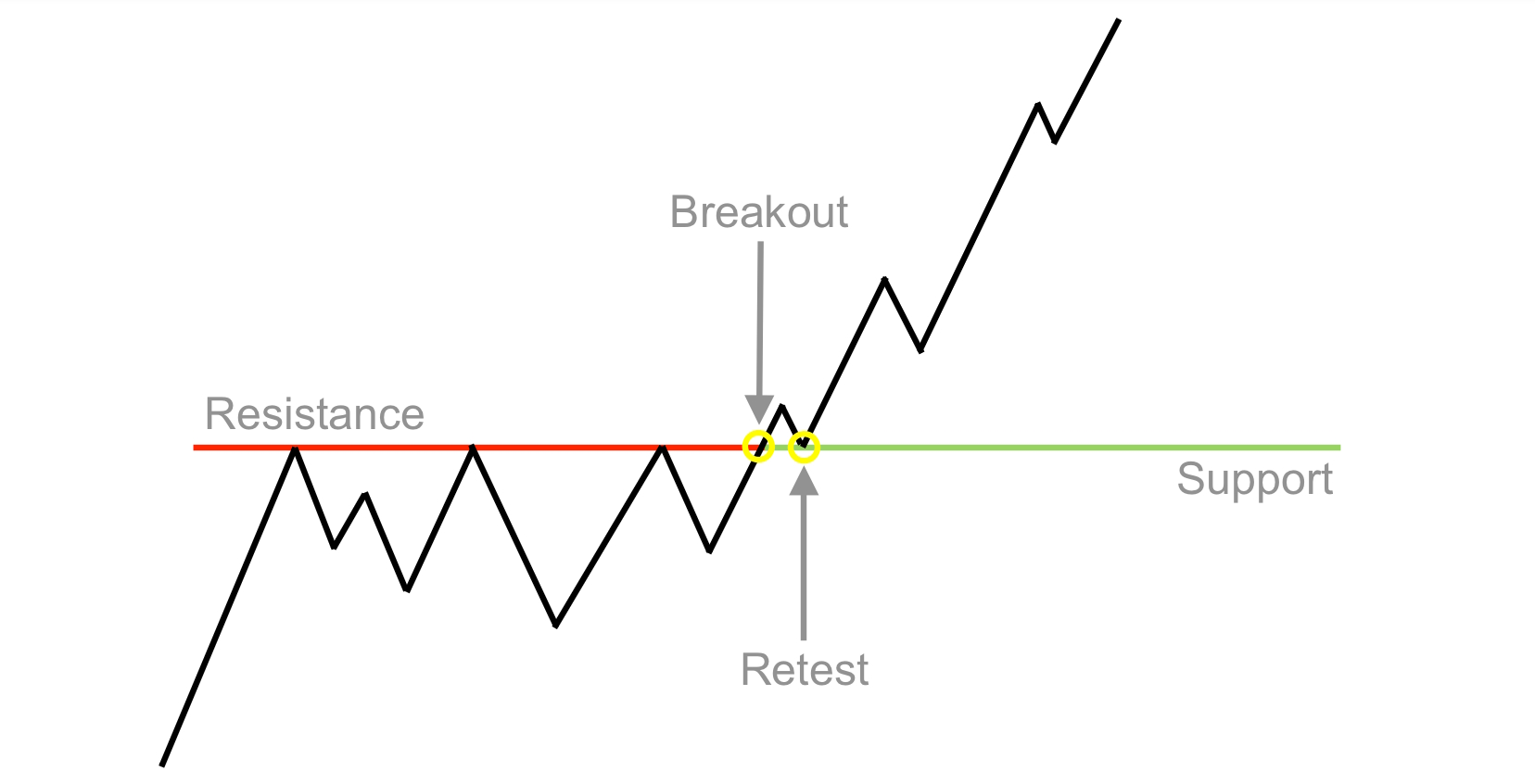

The strategy is underpinned by its titular elements: the Break and the Retest. Both are non-negotiable for the strategy's effectiveness. The process kicks into gear when an asset's price gains momentum, piercing either the support or resistance ceiling, a surge typically accompanied by a robust trading volume. Charts will showcase either bullish or bearish breakouts. While a bullish breakout is characterized by price surpassing the resistance threshold, a bearish counterpart sees the asset's value plummeting below the support.

However, for the strategy to truly take shape, the retest phase is pivotal. The retest phase materializes when chart patterns depict the asset's price reverting to its original support or resistance level. It's a harbinger of a potential trade, ushering in prospects of profit.

Yet, it's essential to note that a successful pattern isn't guaranteed. Unpredictable price movements might thwart expectations, resulting in "false breakouts." Patience, thus, becomes a virtue, with traders advised to await a retest's validation.

Identifying Chart Patterns in Breakout and Retest Trading

Zeroing in on the optimal entry point necessitates recognizing specific candlestick patterns manifesting on the chart. These patterns offer vital market condition insights, crucial for evaluating and initiating trades.

Prominent candlestick patterns integral to the strategy include:

- Wedge Pattern: Represents trend lines within a constricting price scope. Rising wedges indicate a dwindling uptrend, while falling ones signal a weakening downtrend.

- Consolidation: Signifies a steady price range, helping traders discern market indecision. Any breaks could potentially highlight viable entry points.

- Triangles: This pattern splinters into three categories—ascending, descending, and symmetrical, each hinting at potential breaks.

- Channel Patterns: Defined by parallel trend lines, they demarcate support and resistance thresholds. Any deviation suggests an emerging trend and potential trade opportunity.

For a more comprehensive analysis, traders can lean on technical indicators like MACD and RSI, fortifying their assessment of budding trends.

Implementing the Breakout and Retest Strategy: A Stepwise Guide

Trading breakouts demands finesse, even as its popularity soars. Here's a roadmap:

- Spotting Breakout and Retest Opportunities: Continuous monitoring of support and resistance levels is crucial. Additionally, indicators like ATR, Bollinger bands, and Volume can amplify your momentum insights.

- Zeroing in on Entry and Exit Points: While entry points manifest post a valid retest, exit strategies demand astuteness. Balancing profit objectives with realistic loss expectations can pave the way for optimal results.

- Backtesting for Strategy Validation: Tools like TradingView and MT5 enable traders to simulate their strategies on past data. Post-simulation insights can be invaluable for assessing strategy viability.

Weighing the Pros and Cons of the Break and Retest Strategy

Every strategy comes bundled with its own set of advantages and limitations.

Upsides:

- Vast applicability across multiple market scenarios.

- Compatibility with varied trading styles, including Crypto and Forex.

- Ideal for budding traders aiming to scale up their expertise.

Challenges:

- Unexpected price swings can derail projections.

- Failed retests or unpredictable price surges can induce losses or missed opportunities.

Navigating Potential Pitfalls

Impatience and hasty decisions can result in overtrading in hostile market conditions. Ensuring diligent risk management is the antidote to potential losses. The Break and Retest strategy, while lucrative, comes with inherent risks. Emotions, coupled with unpredictable market conditions, can sway outcomes. However, with judicious decisions, realistic goals, and a defined risk appetite, traders can navigate the market with confidence, maximizing gains while curtailing risks.